In 2015, when the Reinventing Bretton Woods Committee (RBWC) released Bretton Woods: The Next 70 Years, a number of the contributors to this commemorative volume called for reforming the global financial architecture for an increasingly multipolar world, an agenda that RBWC had already been pursuing for some time.

What was not anticipated three years ago, was the retreat of the United States, the nation that gave birth to a new global order after World War II and sketched out a grand strategy to rebuild Europe’s economy and security.[1] Should we be concerned about an inward-looking America ceding the field to other countries, and most notably to China which has recently advanced a major Belt and Road Initiative (BRI) that is all about the power of ideas to reshape the world? BRI involves China in rolling out the largest urbanization and infrastructure development scheme on the planet. Already in its fifth year, the $900 billion initiative includes new roads, shipping lanes and construction projects stretching over 65 countries. The Chinese are literally rewiring global trade across Asia, the Middle East, Africa and Europe. Chinese companies have been buying cargo terminals from the Indian Ocean to numerous strategic ports in Europe. Is it time for others to join French President Emmanuel Macron in calling for a more equitable sharing of these routes as he did recently during his visit to China?

Faced with threats ranging from climate change to hugely disruptive technological advances, the world is clearly at a crossroad. More than ever stable and able global governance is needed. And yet, due to rising inequalities, especially in the Western middle class, and legitimate frustration with the perceived failures produced by the liberal order, there is surging opposition to liberal governance – Francis Fukuyama, Edward Luce, and Jan-Werner Mueller view populist nationalism as one of the gravest threats to future stability. How can the multilateral system better harmonize national responses to new challenges with the maintenance of global stability?

The response that we are seeing today is a ‘crisis of transition’, whereby the US-led post-war Bretton Woods order is giving way to a new configuration of global power, new coalitions of states, new governance, new institutions. This situation was clearly illustrated at the World Economic Forum in Davos in 2018, where three competing versions of the future world order emerged. President Donald Trump called for economic nationalism and his country’s retreat from the current order. Chinese leaders proposed a new global economic system built around the concept of ‘a shared future for mankind’. In contrast, Canada’s Justin Trudeau and France’s Emmanuel Macron urged Western leaders to double down on the current liberal order. Along these same lines, Indian Prime Minister Narendra Modi warned leaders of the threats facing globalization: ‘The forces of protectionism are raising their heads against globalization.’ Angela Merkel stressed the importance of multilateralism and warned that we have not learned from the darkest days of history: ‘The spirit of multilateralism that rebuilt Europe and formed our international institutions in the aftermath of the Second World War is now under threat.’ If the leaders of the world’s major nations and international organizations cannot agree, how can we find a satisfactory way forward?

Can we renew a spirit of internationalism, now that we live in a world where no single country can be the guardian of globalization?

Although we may be witnessing the decline of international cooperation, China has nevertheless made strides in asserting itself in global economic policy design and governance. For one, under recent Chinese leadership the G20 has continued to shift in the positive direction of turning away from focusing solely on crisis management to instead attending to long-term global governance, thus becoming a platform for international cooperation and communication that goes well beyond macroeconomic policy coordination.

Moreover, China continues to reaffirm its desire for a more balanced system with the establishment of international economic institutions to supplement, rather than to compete with, the existing ones. In addition to the World Bank and the International Monetary Fund (IMF), new institutions have already been put in place today (i.e. BRICS New Development Bank; the BRICS foreign exchange swap arrangements; the Asian Infrastructure Investment Bank – AIIB, and the new Silk Road Fund), strongly signaling that the landscape of global economic governance is in the process of a transformation that cannot be ignored and that represents a shift toward a multipolar arrangement.

This is a positive development for the entire world, because a multipolar system should be more stable than the bipolar, or the unipolar one we have today. A positive side effect of the One Belt One Road (OBOR) initiative is the further push to greater international financial integration of China, increased outward FDIs and a wider use of the renminbi as more Chinese companies get involved in foreign trade, and investment and infrastructure contracts in the region are increasingly labeled in the Chinese currency.

The Future Reform of the Bretton Woods Monetary System

In the past six months, the paths of America and Europe have diverged on everything from climate change to trade to preserving an open, multilateral international system. Today, the European Union (EU) finds itself without a strong partner with a similar vision, who can help shoulder the responsibilities of global governance. In order to answer this question, however, one must .rst consider more fully what ‘Bretton Woods’ and the IMF, the institution established to oversee the new monetary order, were intended to achieve.

‘Bretton Woods’ has become almost synonymous with the fixed exchange rate system that prevailed from the time of the IMF’s establishment until the abandonment of fixed rates in 1973. However, the visionaries at the Bretton Woods conference had broader objectives in mind. As stated in the IMF’s Articles of Agreement, they were striving toward a system that would ‘promote international monetary cooperation’, ‘facilitate the expansion and balanced growth of international trade, and to contribute thereby to the promotion and maintenance of high levels of employment and real income’. They also aimed to ‘promote exchange stability. . . maintain orderly exchange arrangements among members and. . . avoid competitive exchange depreciation’. At the same time, they wanted to ‘assist in the establishment of a multilateral system of payments in respect of current transactions between members and in the elimination of foreign exchange restrictions which hamper the growth of world trade’. As these goals suggest, the purpose of ‘Bretton Woods’ was above all to establish a more stable and prosperous world economy, and the role of the IMF would be to help promote the preconditions for this.

The IMF is still needed to help countries resolve payments problems in an internationally responsible way, to address liquidity crises, and to act as a crisis manager. Does this mean that crisis prevention should be at the core of the IMF’s work? Should it deepen its efforts to collect and disseminate information to investors and markets, further covering indicators of financial vulnerability as well as macroeconomic fundamentals? To what extent should its resources be expanded to enable it to provide liquidity, and under what circumstances should the Fund provide backstop financing for countries?

Indeed, the environment in which the Fund operates has changed, but the instruments at its disposal have not. Can the IMF perform within its current governance structure, or does it require a change in the governance reform? Does the Fund have the internal governance and risk control mechanism to deal with capital account crises? (If the preferred creditor status should be reexamined in this new evolution, if we deal with fiscal policies difficulties and not balance of payment problems.) How can disparities in economic weight and financial contributions be reconciled with the need for more inclusive decision-making in international institutions and arrangements (for example, in IMF voting)? How can emerging economies be best represented in the international financial architecture, recognizing that improving their development prospects is a principal aim of global financial governance? Will the G20 serve as a basis, perhaps, in combination with regional forms of governance?

Another important challenge facing the global monetary system is the emergence of digital currencies. It seems that the current debate about digital currencies offers a unique opportunity to integrate monetary innovation and reform of the system. Indeed, digital currencies represent important monetary innovations and have reinvigorated interest in and debate about the notion and the very meaning of money. They promise to deliver important economic benefits and choice amid possible alternatives to unsteady national currencies, greater financial transaction efficiency and reduction of transaction costs. At the same time, they represent considerable risks and aim to disrupt and challenge existing monetary and financial arrangements. As such, digital currencies are likely to have a profound impact on the international financial architecture.

Whether digital currencies do indeed occupy a key role in the new monetary system, the fact is that, in an economic world now dominated by the rapid development of financial transactions, the absence of a credible solution to the problem of international liquidity management, and the lack of a global instrument allowing the world to adapt the level of the international reserves to its needs, presents a challenge to the global economy. As it is clearly difficult for national central banks to adjust their monetary stance to reduce the risks resulting for the rest of the world from these externalities, the need for an institution facilitating a common evaluation of the global situation and the adoption of the appropriate corrective measures is made more and more pressing. Ideally, such an institution should be equipped with the possibility to add to insufficient global liquidities, or to withdraw part of them in the opposite situation. This is what John Keynes had in mind in the early 1930s when he said: ‘The ideal system would surely be in the foundation of a supranational bank that would have similar relations with the national central banks to those that exist between each central bank and its subordinate banks.’

It might be unrealistic in the current global political environment to transform the IMF into a global ‘central bank of central banks’. But it would be also plainly unrealistic to think that the multipolar/multi-currencies world of the next decades could continue accepting a state of affairs when global liquidity is determined by the monetary policy of a country which, in full legitimacy, refuses to take into account the global implications of its economic policy decisions.

The Integration Platforms of the Global South

The mounting protectionism emanating from the US in the past month has reached a point of being one of the key risks to the sustainability of the recovery in global economic growth. But, apart from the direct effects of such protectionism on the dynamism of the world economy, there may be significant effects with respect to the evolving structure of economic alliances and global economic architecture. In particular, a further exacerbation in trade tensions is likely to undermine the effectiveness of global institutions such as the World Trade Organization (WTO) and raise the attractiveness of bilateral and regional alliances as an alternative to multilateralism in global organizations.

For developing economies, the appeal of actively pursuing regionalism is further accentuated by a number of factors. On the one hand, global institutions present a paradoxical mix of either lack of effectiveness when votes are equally distributed among countries (WTO), or notable inequality in the distribution of voting shares between developing and developed economies (IMF). On the other hand, the regional integration in the developing world is sorely lacking structure and coordination as opposed to the integration pattern in the advanced economies –suffice it to compare the patterns observed in North America vs. South America and in Europe vs. Asia.

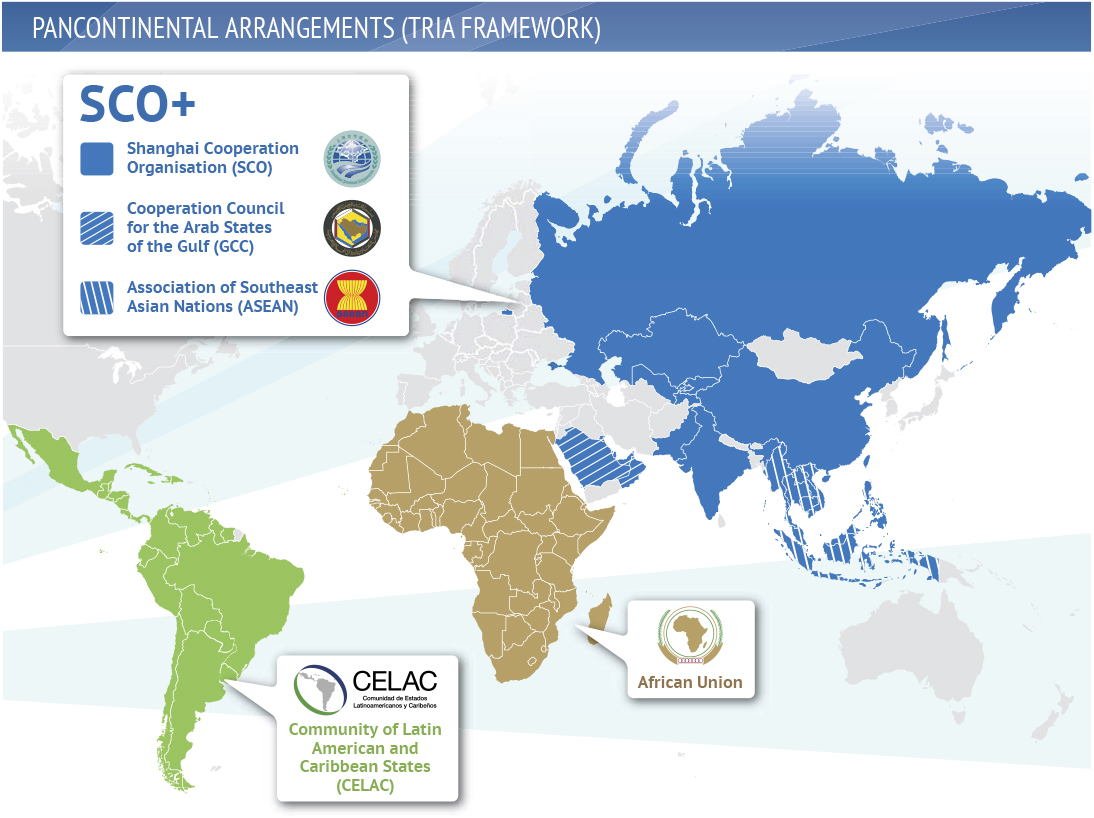

Regionalism in the South–South dimension may take on multiple forms, but perhaps the most straightforward, parsimonious and simple is a coordination framework between the pancontinental agreements/organizations for each of the continents representing the developing world, namely South America, Africa and Eurasia. Such a simplified framework has the advantage of attenuating the potentially high coordination problems associated with efforts to bring together the multitude of existing regional trade arrangements (RTA) formed by developing countries. Importantly, these pancontinental agreements already exist and may serve as a foundation for a trilateral alliance between the continental unions of developing economies. In the case of Africa it is the African Union (AU), in South America it is the Community of Latin American and Caribbean States (La Comunidad de Estados Latinoamericanos y Caribe.os, CELAC) or the Union of South American Nations (Uni.n de Naciones Suramericanas, UNASUR), while in Eurasia the most comprehensive platform for South–South cooperation is the Shanghai Cooperation Organisation (SCO).

For SCO a further extension could be an ‘SCO+ framework’ that would seek to extend the remit of the organization’s coverage to the ‘Greater Eurasia’ of the developing world. Such a SCO+ framework would need to bring together SCO countries and their partners with regional blocks in the Arab world in the west (such as the Gulf Cooperation Council, GCC) as well as the Association of Southeast Asian Nations (ASEAN) in the east. In other words, the ‘possibility set’ for the SCO+ framework could cover all of the developing countries of the Eurasian continent.

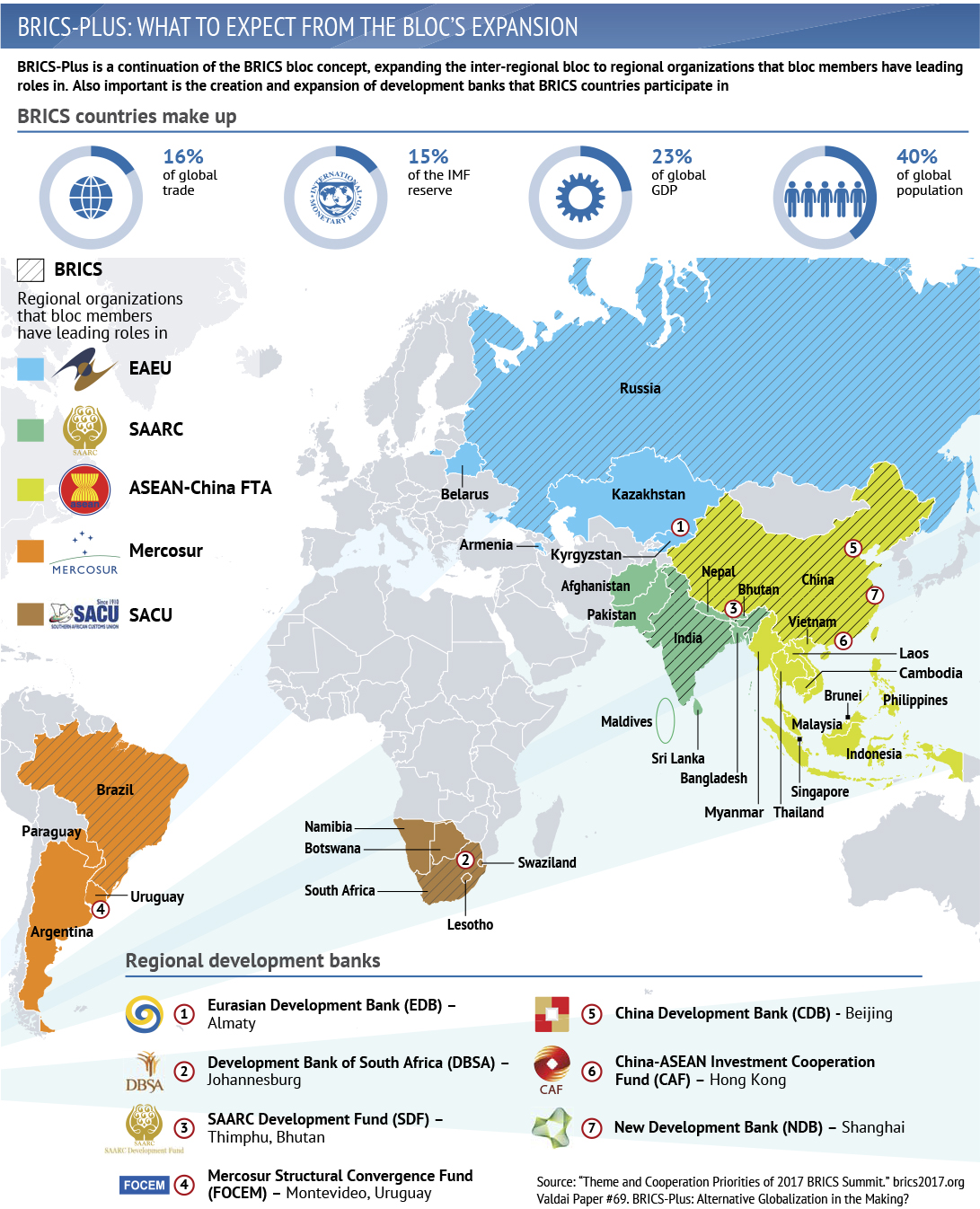

A cooperation mechanism represented by the developing economies of AU, SCO+ and CELAC (tentatively referred to here as the Trilateral Intercontinental Alliance, TRIA) could form the most extensive cross.regional platform for South–South cooperation in addition to other possible platforms such as the BRICS+ platform represented by the respective regional integration arrangements of each BRICS economy (the Southern Common Market, MERCOSUR, for Brazil, the Eurasian Economic Union, EAEU, for Russia, the South African Customs Union, SACU, for South Africa, and SCO for China and India). In fact, the TRIA framework could be viewed as an extension of the BRICS+ model that is to encompass a broader range of potential partners of BRICS economies.

In effect the TRIA circle may be viewed as a logical extension of the BRICS+ platform through the principle of regional partnership and cooperation: the RTA-based composition of the BRICS+ alliance is extended to other regional partners on the basis of continental commonality and proximity.The resulting platform of cooperation encompasses the vast majority of developing economies, which opens the possibility to extend cooperation to global issues such as security or North–South relations.

In the past several years important steps have already been undertaken by the developing countries in the direction of strengthening the cross-continental cooperation between the AU, CELAC/UNASUR and SCO. In particular, CELAC in its 2015 Declaration called for the promotion of bilateral ties with other regional groups, and particularly with the BRICS, the African Union and the League of Arab States. CELAC has also actively developed ties with China, which led to the creation of the China–CELAC Forum. As part of its regional outreach activities during the 2014 BRICS summit, Brazil invited leaders of UNASUR countries, while South Africa invited the AU to attend the 2013 BRICS summit. In 2015 Russia held a BRICS/ SCO Heads of State meeting in Ufa.

In the end, the construction of a new system of global governance is not about a quantitative increase in the number of regional integration arrangements in the Global South, but rather a rise in coordination and quality of existing regional groups, with the coordination framework enabling developing economies to exploit synergies in the various regional integration projects. Such coordination may be performed by a set of integration platforms that seek to aggregate existing regional arrangements to come up with tangible economic dividends for developing economies in trade, financial and investment spheres. Accordingly, the array of integration platforms may be composed of two groups – the regional integration platforms that are based on the cooperation between the various geographies of regional trading arrangements (RTAs) or regional investment arrangements (RIAs) and the financial institutional platforms of the developing world. The former group may be divided into three layers:

- regional integration represented by such arrangements as EAEU or MERCOSUR;

- pan-continental arrangements such as African Union, CELAC, or the proposed SCO+;

- trans-continental coordination: BRICS+ that brings together the largest regional integration groups of the developing world where BRICS countries play a leading role; or the proposed Trilateral Intercontinental Alliance (TRIA) that brings together AU, CELAC and SCO+.[2]

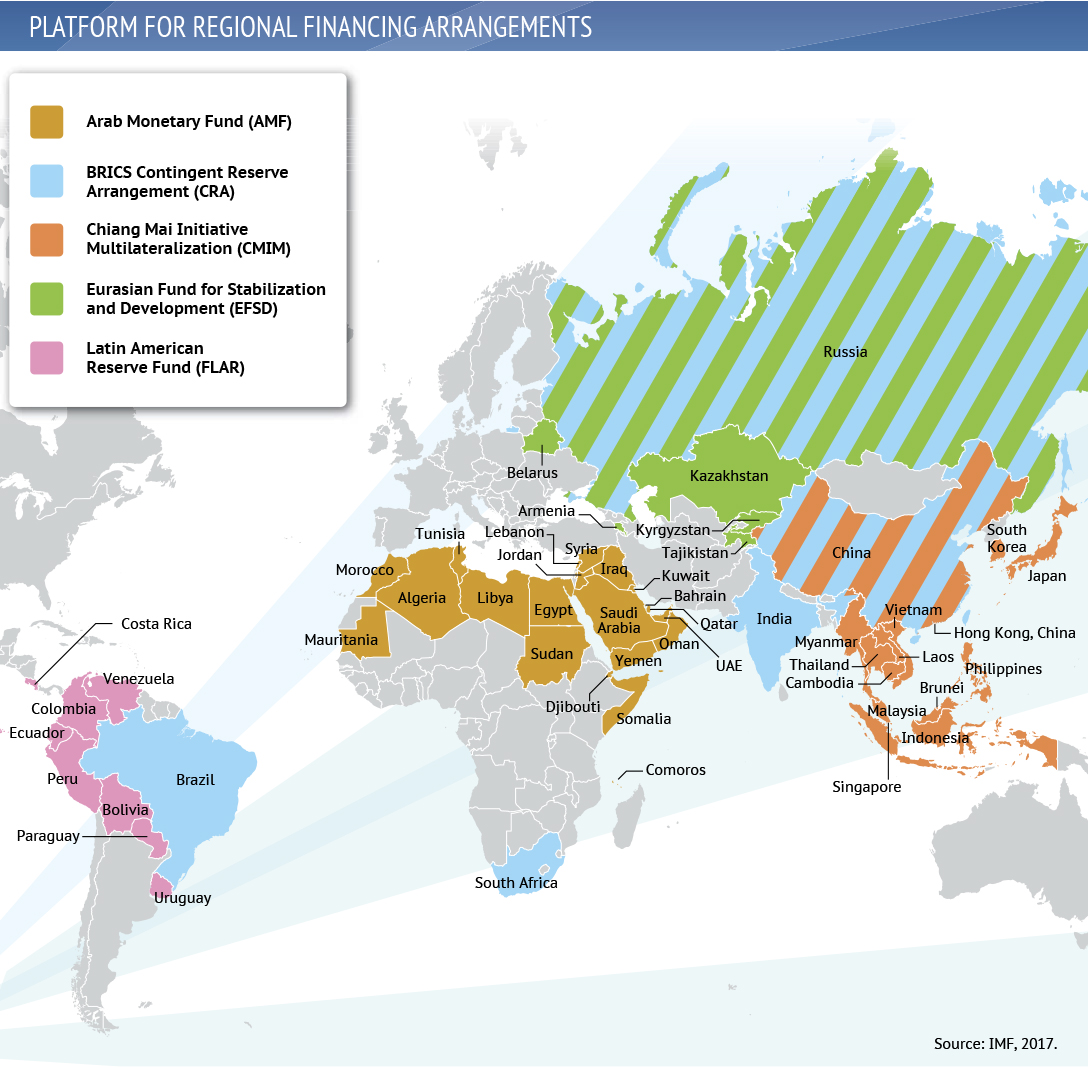

The second group, namely the financial platforms of cooperation of the Global South, could include the following:

- a platform for regional development banks and funds of developing countries such as the Eurasian Development Bank (EDB) or the SAARC Development Fund (SDF);

- a platform for regional financing arrangements (RFAs) such as the Eurasian Fund for Stabilization and Development (EFSD) or the Latin American Reserve Fund (Fondo Latinoamericano de Reservas, FLAR);

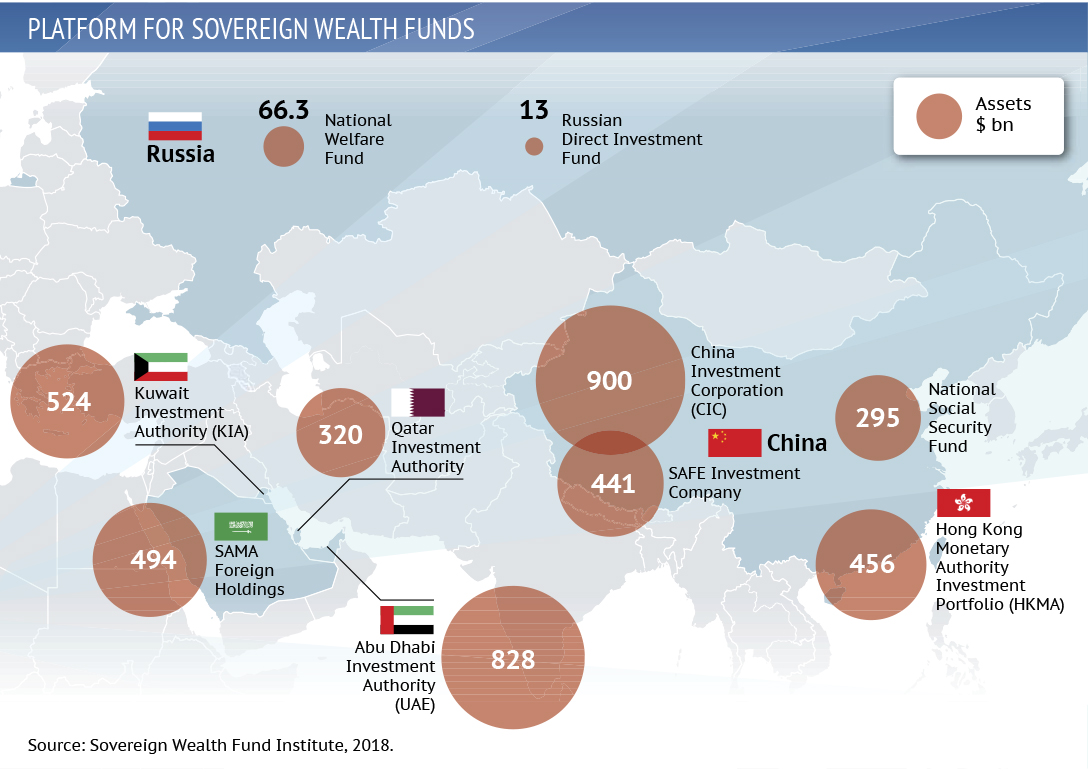

- a platform for Sovereign Wealth Funds (SWFs) such as China Investment Corporation (CIC) or Abu Dhabi Investment Authority (ADIA).

The first group of integration platforms (based on RTAs and RIAs) expands the scope for trade and investment alliances across the South–South perimeter, with each preceding level serving as a foundation for higher levels of integration. Such complementarity and mutual reinforcement is also meant to be elicited from the second group of platforms, whereby the platform covering the cooperation of the regional (and national) development banks addresses the microlevel of economic integration that concerns companies and sectors, while the RFA platform coordination improves the macroconditions for project financing. The platform of Sovereign Wealth Funds (the only one that is not of regional nature and brings together the funds from national constituencies) could also serve to improve the conditions for closer South–South cooperation, including in the regional context via co-financing joint priority/integration projects and promoting the use of national currencies with the possibility of strengthening their regional and global roles.

It is worth noting the rising importance and the share of developing countries in the total resources of RFAs and in SWFs. According to the IMF, within the Global Financial Safety Net (GFSN) ‘the Fund, the second largest component (after own reserves) before the crisis, has increased its share marginally and fallen behind the RFAs.’[3] The vast majority of RFAs come from the developing world. With respect to the SWFs, the role of developing nations is even more significant. According to the SWF Institute, in mid.2017 the share of Gulf countries in total assets of world’s SWFs accounted for 38.8%, the share of oil- and gas-related SWFs in mid-2017 stood at 56.2%, while the share of Asia, Africa and the Middle East stood at more than 80% in 2015.

Given the interdependencies among all these South–South platforms, there may be a case for some coordination to be undertaken either via the BRICS+ framework and the annual BRICS summits or via a separate forum that brings together representatives from all these platforms to discuss policy outlook and the modalities of joint cooperation. At the same time the operation of such platforms in the Global South needs to be rendered flexible, while at the same time being guided by a set of core principles and modalities that characterize regional integration, which is in line with the development goals set by the UN, WTO and other multilateral organizations:

- sustainability – integration directed at lowering imbalances and inequalities across the global economy;

- inclusiveness – possibility of participation in integration arrangements available to third parties;

- openness – bene.ts of economic integration and liberalization being made available to third parties;

- structured approach to integration – integration that avoids duplication, tensions and seeks to exploit synergies and complementarities.

The effects of the emergence of integration platforms of the Global South on the evolution of the global economy and the rebuilding of global economic architecture, could be significant. First and foremost, the array of such platforms could serve to overcome the fragmentation in the pattern of South–South regional alliances. The aggregation of existing platforms and closer cooperation among the main regional arrangements and institutions could help to boost developing countries’ position in global institutions such as the WTO and the IMF. The effects of trade and investment liberalization in the context of South–South cooperation may also be viewed as being less onerous for developing economies compared to large-scale liberalization vis-à-vis advanced economies. In the end, the aggregation of the integration platforms of South–South cooperation could provide the much-needed boost to global economic liberalization and market openness at a time when the developed world is yet to come to grips with what may well prove to be one of the most elemental waves of protectionism in the past century.

Conclusion: Towards a New Global Framework of Cooperation

The current global governance system is in flux as the centrality of global institutions is weakened and the nation states are reasserting their powers. At the same time the in-between layer of global governance (between global institutions and nation states), namely regional integration arrangements, is undergoing massive changes: apart from the formation of megaregional blocks and the sheer rise in numbers resulting in ‘disorganization’ (sometimes together with bilateral FTAs referred to as a ‘spaghetti bowl’ of alliances), the regional integration projects along the South–South axis are becoming the focal point of ‘alternative economic integration’ vis-à-vis the well-advanced integration system in the developed world. It is this intermediate layer of regionalism that may become a more prominent factor in the economic and political contradictions of the future world economy and the overall instability of the changing global governance system. There is, hence, a need to devise arrangements that may render greater stability in the global governance framework via coordination among regional institutions and integration arrangements.

In this regard in sphere of cooperation among regional development institutions there may be a case for multilateral consortia of regional development banks to promote connectivity as well as the broader development goals. In the case of the Belt and Road Initiative such a cooperative platform could bring together China’s development institutions as well as other development banks and funds from across the Eurasian continent – what may be referred to as the Silk road development consortium – that would seek to exploit the synergies in the cooperation of the existing Eurasian institutions along the Silk Road route ranging from the European Investment Bank in the West to China Development Bank and the China–ASEAN Investment Cooperation Fund in the East. The benefits could include possibilities for co-financing projects in the respective parts of Eurasia, the possibility to share expertise in infrastructure development, greater ability to develop longer-term strategies on common project pipelines, as well as enhanced possibility to complement rather than contradict or duplicate each other’s efforts in the Eurasian space.

Taking this a step further, the Eurasian connectivity projects like the BRI could be replicated in other continents – Africa or South America, where the lack of infrastructure development and regional connectivity is stifling growth. In Africa the continental consortium of development institutions could include the respective regional development banks such as the Development Bank of South Africa, the African Development Bank, etc. A similar continental platform could be created in South America to include the Inter-American Development Bank (IADB), Mercosur Structural Convergence Fund (Fondo para la Convergencia Estructural del MERCOSUR), Development Bank of Latin America (CAF) and other development institutions.

Even more broadly, there may be case for a global coordination mechanism among the largest regional integration arrangements from both the North and the South. Such a framework could operate separately on the basis of coordination among the respective regional development institutions, or it could be coordinated via the global networks and organizations such as G20 or the WTO. The G20 could be the best forum to launch discussions on such a platform and/or on broader issues of coordination among regional integration arrangements, given that it brings together the largest developing and developed economies that in turn are leading powers in their respective regions/continents, and that frequently head the formation of a regional economic block. The list of some of the largest regional integration arrangements in such a framework could include NAFTA and the EU as well as MERCOSUR, EAEU and RCEP (once it is formed to include China and ASEAN countries).

In summary, what is missing in the current system of global governance is greater coordination among regional arrangements – a system of ‘syndicated regionalism’ (Regionalism Inc.) that would .ll the voids in regional economic cooperation. The process of coordination could be institutionalized via greater cooperation among the respective development banks and other institutions, with the roadmap for greater coordination in the regional sphere spanning the likes of SCO and BRI in Eurasia as well as similar regional/continental syndicates in Africa and Latin America. It could further include a transcontinental element in global governance in the form of BRICS+ and a North–South cooperation mechanism that brings together the largest regional integration groupings.

Rebuilding global governance architecture with regional blocks may serve to strengthen the ‘supporting structures’ of the edifice of the global economy – with hardly any attention paid to coordination among regional arrangements as most of the coordination and regulation was focused on the nation state level or the level of global institutions. A globalization process that is based on integration and cooperation among regional blocks may harbor the advantage of being more sustainable and inclusive compared to the core–periphery paradigm of the preceding decades.

Most importantly, ‘syndicated regionalism’ offers the possibility of additional lines of communication, economic cooperation and crisis resolution at a time when the fragilities in the global economy are transcending national borders and taking on regional dimensions (hence, IMF’s greater focus on evaluating regional economic vulnerabilities). A coordinated approach to regionalism allows the world economy to transcend some of the country-to-country barriers to economic cooperation, exploit regional ‘economies of scale’ in advancing economic cooperation, while at the same time potentially attenuating the risks of confrontation among the competing integration projects. The latter in recent years are increasingly directed toward the formation of megaregional blocks (the race to megaregionalism) that in turn harbor ever-greater dividends as well as greater risks.

The views and opinions expressed in this paper are those of the authors and do not represent the views of the Valdai Discussion Club, unless explicitly stated otherwise.

Valdai International Discussion Club

[1] Eichengreen, B & Uzan, M, 1992, ‘The Marshall Plan’, Economic Policy, vol. 7, issue 14, April 1, pp. 13–75.

[2] Lissovolik, Y, 2018, ‘Imago Mundi: a South-South concert of continents’, Valdai Discussion Club, January 31. Available from: http://valdaiclub.com/a/highlights/imago-mundi-a-south-south-concert-of-continents/

[3] ‘Collaboration between regional financing arrangements and the IMF’, 2017, IMF Working paper, July, p. 9. Available from: https://www.imf.org/~/media/Files/Publications/PP/2017/pp073117-collaboration.between-regional-financing-arrangements-and-the-imf.ashx