In the fifteen years since the 1998 crisis, the so-called Emerging and Developing Asia has become a new engine of global economic growth. Through these years, the region has been developing under the slogan, «Asia for the world,» and the world has been looking for opportunities that it could draw out of the Asian economic miracle. Today we observe a profound transformation of the existing mod- el: almost all countries in the region are becoming more Asia-centric, and a new model is emerging, which could be called «Asia for Asia.» It seems to be a perfect time to ask, finally, what does Asia want? And does this mean that Asian economies will be able to catch up with the best standards of quality that the local growing consumerist class is looking for?

For those who are eager to find an answer, Asian countries are already being rather open about this. If earlier, the most important indicator of economic success of the region was the growth rates in and of themselves, now it is turning to criteria reflecting the quality of this growth. All medium-term regional policy documents declare such objectives as a higher level of education, inclusive growth, closer relations with neighbors and a strengthened innovative component of the economy. Economic growth per se is not a strategic objective for any country besides the poorest ones, such as Nepal, Laos or Cambodia.

Inclusive growth, on the one hand, implies a fair allocation of the benefits of growth among all citi- zens, and on the other hand, the involvement of the maximum number of citizens in the process of economic development. This formula means a better quality of urbanization, large-scale investment in human capital and a new dimension of public services. Therefore, the most obvious changes in the next decade will take place in cities. This urban Asia wants to work for Asia, not only for the golden billion. For the last 25 years, the West has considered Asia a manufacturer, the factory of the world. Meanwhile, the growth of the future will be created in Asia: consumer growth.

Asia invests the money it saves, and predictably, does so on neighboring markets. Developing coun- tries of the region, according to all forecasts, will demonstrate strong growth, outstripping the global average. So new capital flows are gradually concentrating in Asia: two out of the three leading world investors, Japan (2nd) and China (3rd), direct an increasing share of their capital investments to ASEAN and South Asian markets.

Asia wants to build new regional relationships to guarantee its consumption and growth, and increase the efficiency of local economies. This new policy of connectivity these days ranks higher on the regional agenda than intraregional political mitigation, and has been gradually cemented by large-scale infrastructure projects and a policy of economic corridors for the last twenty years.

Finally, Asia is attempting to become more independent. On the strategic level in the coming decades, consumption should result in better local products, products with higher value added, and in local innovations. All this closely relates to improved human capital and creativity. Considering the profound nature of this ongoing transformation, these “Four C’s” will have a structural impact on the policies of Asian countries, and on the global positioning of the region in the next 10-20 years. And the first C on this Asian wish-list – consumption – will be a key megatrend.

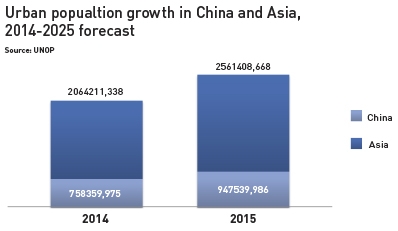

Fig. 1

Source: UNOP

Consumption

The evolution of the role of human capital is the main reason for changing the development model of Asia. Until very recently, the nearly 4 billion people inhabiting the region were regarded only as a cheap and globally competitive factor of production. Due to the economic success and revenue growth of the past fifteen years, a significant proportion of these people (especially in China) are trying on a new role: that of demanding citizens-consumers. At the same time, these people have already widened their own opportunities to produce better products.

Since 2000, the annual disposable income per capita has risen by 1,800 USD, while the region’s urban population has grown by 1.2 billion people. Continuing a trend of the 2000s, the key factor affecting Asia’s domestic consumption in the medium term will be urbanization and rising income.

Such a transformation will significantly affect the consumption of food, services and other goods. Rising prosperity will lead to increased consumption of proteins, mainly meat products subjected to technological processing, as well as fruit, and people will dine at restaurants more frequently. The consequences of the protein revolution are the most evident in China: from 2001 to 2012, the volume of China’s foreign trade in agricultural products increased fivefold, reaching 156 bln USD. Its dependence on imports doubled and net food imports in China reached the level of Paraguay`s GDP: 31 bln USD. Current trends are likely to keep going up, leading to a further shift towards proteins, increased imports of feed crops and intensification of food trade.

Demand for apparel, footwear, electronics, furniture and other consumer goods will continue to grow, with an increasing demand for high-quality and luxury goods. According to forecasts of McKinsey & Company, by 2015 one third of expensive handbags, shoes, watches and jewelry acquired worldwide will go to Chinese consumers, while Japan, Hong Kong, Singapore, Korea and Malaysia are also attractive markets. But luxury goods are representative of a general trend: in China alone, retail sales of consumer goods totaled 21 trln RMB in 2013, up 333 percent from 2003, an annual increase of 16.2 percent.

A rising demand is also observed for services. Medicine, education and social security are traditionally provided by the public sector, which is underdeveloped in most Asian countries. So we can expect an increase in the share of government spending on these services. At the same time, even in China, private institutions provide a lot of those services. Developed leaders of the region – Japan, Korea, Singapore – are on the other bank: their companies could operate in a private sector competing with Western business, with demand already very promising for any service company. But we can go beyond speaking about «fundamental» services: mostly private segments such as recreation, tourism and express delivery are also booming. Finally, transport services, provided both for individual travelers and businesses, are closely related to a general demand for connectivity, both national and intraregional.

Connectivity

Quickly improving human capital and rising salaries lead to a reallocation of production facilities towards less developed areas and countries. It influences the geography of value chains across the region; creates a demand for new infrastructure and logistics hubs; and transforms the character of Asian economic relations from a globally competitive one to a regionally complementary one. Labor-intensive production, special economic zones and techno parks are moving from China’s East to the center of the country, as well as to Vietnam. Textile factories from Vietnam are gradually being reallocated to Cambodia and Myanmar. And more high-tech production from Korea is now being produced in China. This process forms a regional demand for connectivity. In addition to national infrastructure-development programs, there are already a number of regional ones. Since the mid-1990s, this connectivity imperative was developed within a concept of economic corridors. Above all, they were aimed at providing an infrastructure link between city-hubs and particular economic areas in a region, as well as usually a special environment favorable to business.

The Asian Development Bank, traditionally close to Japan, has been playing the main institutional role in the development of economic corridors in the Asia-Pacific region for the past 20 years. Major projects are concentrated in South-East Asia: «Greater Mekong Sub-region» (the most advanced and promising), «SinJoRi» (Singapore, the Malaysian state of Johor and the Indonesian province of Riau), BIMP-EAGA (Brunei, Indonesia, Malaysia, Philippines – the East Asian Growth Area), IMT- GT (Indonesia, Malaysia, Thailand – the Growth Triangle) and a new economic corridor between India, Nepal, Bangladesh and Bhutan, the so-called «Corridor of South Asia,» is in progress. However, a rising demand for connectivity leads to the establishment of new structures, such as the Chinese Asian Infrastructure Investment Bank project, and the new BRICS development bank, headquartered in Shanghai. The New Silk Road, the String of Pearls, development of the Northern Sea Route: all these projects are also oriented towards the challenge of connectivity. Institutional frameworks aimed at achieving better connectivity are presented in all APR countries, at the ASEAN level, within APEC and even as a platform of the widely-discussed Regional Comprehensive Economic Partnership project.

Serious limitations still exist: there is a lack of interconnectivity between ports, railways and roads, and the geographical features of the area – mountainous terrain and jungles – complicate development of ground infrastructure. Finally, these projects are usually expensive, but could be developed in the event of consensus of future economic cooperation. Thus, infrastructure development anticipates capital flows.

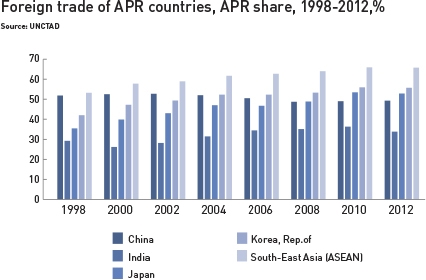

Fig. 2

Source: UNCTAD

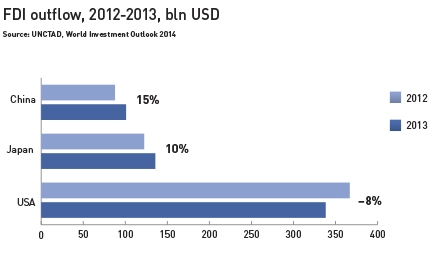

Fig. 3

Source: UNCTAD

Fig. 4

Source: UNCTAD, World Investment Outlook 2014

Source: UNCTAD, World Investment Outlook 2014Capital

Since 2012, China has become the third biggest investor in the world, while its Eastern neighbor, Japan, has remained in second place for years. At the same time, Chinese investment in 2013 increased by 15 percent, and Japanese, by 10 percent, while American investment (first place in the world) fell by 8 percent. Moreover, in 2013, for the first time in its history, Southeast Asian countries attracted more FDIs than China, mostly due to a gradual transfer of energy, water and labor-inten- sive production from more developed Chinese provinces to less developed areas of Asia. An annual growth rate of Chinese investment in ASEAN countries since 2010 accounted for about 30 percent, significantly higher than for other regions. In the medium term, we could expect that this process will become mass-scale in nature. So in investment terms, the region is becoming Asia-centric even more quickly than in trade.

In addition to economic factors (high growth rates, opportunities for capital investment), an important role is also played by the numerous Chinese diasporas, low language and cultural barriers, and active support of such investment by the governments of Southeast Asian countries. Finally, investments allow China to increase its political influence in the region without eliciting too negative a reaction from its neighbors, which are scared enough by any activities by Beijing in APR.

Meanwhile reallocation of existing business and improved connectivity alone wouldn’t be able to maintain globally competitive positions of Asian economies in the long term. Last but not least is a new, creative approach to the economy, not only in developed high-tech countries like Japan and Korea, but also in China, India and ASEAN.

Creativity

A segment of high-tech is critically important in the long-term perspective, but represents only the most vivid part of the general reorientation of Asian economies. In the Asian context, the creative component of the economy should be considered in a broad sense, almost equal to the production of goods, but with bigger value added, as the level of human capital already affords Asia the opportunity to apply its own innovations at all levels of production.

Aerospace, pharmaceuticals, high-tech and electronics provide opportunities for growth for almost all major economies of the region. These days, segmentation resides at the level of the newest technologies. Developed countries, especially Korea, Japan and Singapore, already have access to some pioneer technologies, notably in studies of energy and water efficiency, new materials, robotics etc.

It should be noted that in addition to the economic breakthrough of the last 30 years, Asian coun- tries have also been able to significantly improve the quality of their human capital. Of course, a very low level of development in the poorest countries of the region in the 20th century allowed for initial success due to basic education and simple skills training.

However, without an effective public education policy and the transfer of skills both from developed countries of the West to Asia, and from the more developed countries of Asia to countries that are lagging behind, it will be impossible to achieve sustainable improvements in human capital: the Human Development Index showed a positive trend in all countries of the region since 1980. And since 2008, Singapore has risen by 14 positions in the world ranking, China, by 10 positions, and South Korea and Sri Lanka, by five (hdr.undp.org/en/content/table-2-human-development-index-trends-1980-2013 ).

Five Asian economies (Singapore, Hong Kong, Korea, Japan and Brunei) are among the 30 countries with the highest levels of human capital. Malaysia, Sri Lanka, Thailand and China already belong to the group of countries with high human capital. In turn, Indonesia, the Philippines, Laos, Cambodia, Vietnam and India belong to the group of countries with medium levels of human capital. These rankings are closely tied to prospects of the creative economy in those countries.

The center of gravity: China’s role

Among these general trends, China, in terms of the size of its economy and its growth rate, has already become Asia’s engine of growth, partially replacing the role Japan played in the 1970s-90s. In the next two to three decades, China’s role will likely become more significant in realizing Asia’s ambition and potential along the lines of all these «Four C’s,» pending a relatively stable and con- sensual accommodation of China’s changed role within and outside of the region. More specifically, China could play the following roles: consumption hub, investment engine, facilitator of increased connectivity in greater Asia. Meanwhile the potential for China as a conduit for “creativity” is subject to higher uncertainty.

According to IMF data using purchasing-power-parity calculations to adjust for exchange-rate differences, China overtook Japan in 2010 as the world’s second largest economy. China also overtook the U.S. in 2009 as the biggest automobile market and Germany as the largest exporter. The country is now the world’s largest buyer of iron ore and copper and the second-biggest importer of crude oil. The sheer size of Chinese economy has made China a crucial player almost everywhere in the world. As of the early 2000s, China has entered a new stage of development in both its domestic and external economic relations. Recently, the active discussion of the “middle- income trap” among Chinese elites indicates their recognition that the current economic model, despite its huge success, cannot sustain itself, and requires fundamental changes: a shift away from factor-accumulation-based growth and an embrace of inclusive growth, based more on improvements in human capital and innovation and a more equitable distribution of the fruits of growth.

Internally, three main trends in China will define the structural transformation of the economy and the next round of reform: new initiatives for enhanced urbanization, an increasingly aging population (the “getting-old-before-getting-rich” phenomenon; even more so than Japan, which is at a similar income level) and upgrading of the industrial structure.

Just like in many other Asian countries, consumption in China is gradually edging out investment as the main engine of growth. Household consumption has been inching up as of late as a proportion of GDP, rising from 34.9 percent in 2010 to 36.2 percent in 2013. As China moves away from investment towards consumer-driven growth, demand is shifting from “mining to dining,” and the premium on soft commodities – dairy, red meat, fish and grains – has risen. A more urbanized population will lead to more demand for construction materials, as well as internal design, entertainment, travel, healthcare, education and given the demographic changes, social services, specifically for senior citizens. All these changes will open up opportunities for other countries in Asia, including increased tourism and manufacture exports. This rebalancing between domestic investment and consumption, and upgrading in China’s consumption-portfolio behavior has already made itself felt beyond China’s borders.

Roughly since the mid-1990s, China’s overall position in the global production chain and capitalist system has undergone fundamental changes. As Chinese wages rise, foreign companies are having more incentive to look for new investment sites that are easier and safer for their lower-end manufacturing. Meanwhile, as Chinese domestic capital faces increasing pressure for further accumulation and expansion, it has become logical for many Chinese firms to seek room overseas for further expansion, hence an official policy of “go-abroad.” The official stance was also meant to partially relieve pressure of overproduction on the domestic market.

Very soon, China’s own investments abroad will overtake inflows and will be a major theme driving flows into different countries and reshaping industrial structures there. Since withdrawal of Western capital from emerging Asia will not be accompanied by a compensatory rise in demand for Asian exports, there will be no shortage of applicants keen to tap into this new source of capital. For example, by some estimates, in urban infrastructure alone, Asia needs to invest 11 tn USD to accommodate its demographic shift.

However, whether “capitalism, Chinese style” will be able to be accommodated within the current regional regime(s) is a big question. Recent social movement against Chinese investment or China- sponsored free trade agreements in various parts of Asia (such as Taiwan and Vietnam) demonstrates such uneasiness among China’s Asian partnerships.

In terms of connectivity, the new leadership in Beijing has recently announced ambitious plans to rekindle interest in historical precedents and recreate trade routes for regional connectivity, the primary examples being campaigns for the two Silk Roads (the “New Silk Road Economic Belt” and the “Maritime Silk Road”) and the two Corridors (the Bangladesh-China-India-Myanmar economic corridor and the China-Pakistan economic corridor). Such projects, although still in their infancy, together aim to create a massive loop linking three continents, creating more capital convergence and currency integration and an extensive trade network stretching from the Western Pacific to the Baltic Sea. In many of the region’s attempts at inter-connectivity, advocated by other countries, China has also indicated great interest and willingness to be an active participant and a key conduit through which other countries in the region could jointly prosper and could even catch a “free-ride” on China’s economic growth.

With China’s overall economic power on the rise, it is totally possible to envision an integrated Asian economy reliant on the Chinese economy as its center. At least in economic modeling in East Asia, there has been a clear transformation of the “flying geese” model advocated by Japan in the mid-1980s. The model was based on vertical economic integration centered on Japan through capital flow, technological transfer and supply of manufacturing parts, and a clear regional division of labor and production networks among Japan’s neighbors. It is a key challenge for the regional economy in the coming several decades whether China, as a new regional factor, has the economic capacity and political skills to play a similar role as Japan used to play, and lead a new type of East Asian or even Asian socio-economic model. So far, despite the overall economic might of China, the specifics of such a Chinese version of regional integration are still far from clear.

Among the Four C’s, China’s ability to lead and restructure the regional provision of creativity has most often come under question. For the past three decades, China’s phenomenal economic growth has relied heavily on the export of low-skill, labor-intensive goods to developed economies, which has contributed to the image of “made in China” as a synonym for shoddy goods. In certain high- tech and high value-added sectors, upward movement along the product and technology ladders by Chinese players is evident. Huawei and ZTE in telecommunication, Sany and XCMG Group in heavy machinery manufacturing are examples. In addition, improvement in the defense sectors after the very difficult 1990s has recently shown an unexpected surge, especially in fighter jets, deep-water exploration and space technology. Technical breakthroughs in these sectors will soon trickle down to civilian sectors. However, a technical foundation similar to that of the Japanese flying-geese model is not yet in place, and China’s ability to revive and facilitate regional integration along the line of “creativity” is far from convincing.

To better implement the potential for the whole region, greater regional integration is necessary. But the exceptional diversity of both economic level and political development, and a lack of boundaries and identity, has traditionally impeded effective integration in Asia. Most existing regional mechanisms (ASEAN, APEC, six-party talks, SCO, ASEAN-plus-three, EAEC) have been mostly sub-region- al cooperation efforts based on a bottom-up approach. As a result, the diverse Asian and Asia-Pacific region has so far been served by multiple overlapping institutions that include different groups of countries, often with very different visions for future regional integration, resulting in highly uneven and fragile integration.

Partly responding to the lack of region-wide cooperation mechanisms, Chinese President Xi Jinping made the announcement at the 4th CICA summit in Shanghai that “it is for the people of Asia to run the affairs of Asia, solve the problems of Asia and uphold the security of Asia.” However, such a statement in itself doesn’t solve the problems of reaching consensus among diverse Asian countries with no clear boundaries and common identities. In other words, despite the overall high potential for further integration and cooperation, the lack of consensus when it comes to leadership and a specific model of integration could neutralize any potential.

Some positive signs are emerging. In response to huge funding gaps among middle-income Asian countries, especially in Indonesia, India and Thailand, the Asian Infrastructure Investment Bank (AIIB), proposed first by China in 2013, does offer an alternative funding source. The AIIB will mainly focus on infrastructure construction in Asia to promote regional connectivity and economic cooperation. As of September 2014, at least 21 countries in Asia and the Middle East had expressed interest in joining the AIIB, which is expected to be established by the end of the year.

It`s equally important not to ignore the fact that stable inclusive growth development remains a key national imperative for all regional actors, and only closer orientation into the region can provide it for most of them. This race for prosperity is probably a unique safeguard for such a vibrant region.

However, political ambitions and rising competition for Asian leadership between China, Japan and India could lead to asymmetric regional integration. It seems highly likely that all major players will intensively develop economic cooperation with ASEAN countries, both due to the numerous advantages they can draw from those projects and also considering cooperation as an instrument for balancing each other. As for the «India-China-Japan» triangle, two sides are quiet clear: most likely Indo-Japanese relations will strengthen both in their political and economic dimensions, while Sino- Japanese relations will continue to be a rival both in APR and worldwide. Indo-Chinese relations are now passing through deep revisions and there is a big chance that Mr. Modi and Mr. Xi could push bilateral relations to a new level at least in investments and trade. Nevertheless, neither country is confident with the other in terms of setting a new agenda, and they are hedging themselves by sup- porting closer allies: Japan, Vietnam and Nepal by India; and Pakistan and Sri Lanka by China.