In 1911, Jack London wrote ‘The Mexican,’ a story of a Mexican pugilist who dared a famous American boxer for a match on the condition that the winner would take the entire monetary prize instead of sharing the reward as usual. The emotional appeal of the story comes from the fact that, while the outraged American wanted ‘to lick the dirty little greaser’ for offending his self-esteem, the determined Mexican needed the money to buy arms for the revolution in his motherland.

Emotions aside, the concept of “Winner-Takes-All Society” is well known to the researchers, in fact, a book with this title was published in 1995 by economists Robert Frank and Philip Cook. They considered its implications and concluded that such a society “misallocates economic resources, causing grave inequalities in the distribution of income” and leads to the creeping monopolization of power in national politics.

In the context of international affairs, the Winner-Takes-All rule results in the development of a monopoly-like, unipolar world order with a single state dominating the economic, social, cultural, and military influence over the globe. In such a world, there is no room for negotiation — even when an accommodation of contestant’s claims would benefit the dominant power as well — because the latter cannot reveal its actual strength but must employ every surreptitious tool to nip any challenge in the bud. Thus, a fight ensues and the aggregate outcome will be negative no matter who — incumbent or challenger — prevails in the end, as is always the case in negative-sum games.

In my previous article, ‘The Empire Strikes Back,’ I stated that the Russian security demands, as expressed in December 2021, would eventually be accommodated. The reason for that claim was based on the observation that the relative worldwide strength of “globalists” (political, economic or financial actors whose power goes beyond national borders and who were against granting concessions to Moscow) was in decline, whereas the strength of “nationalists” (whose power lies within national borders and who did not mind accommodating demands of “foreigners” that suited them) was rising. In fact, that inference was erroneous, as a grave confrontation ensued, with a resulting “hot” war and breakdown of long-established commodity chains within Europe in 2022. Thus, it became imperative to revisit the argument and to consider what the previous analysis missed, along with a supplementary question of who specifically among the globalists happened to be keen to keep the world in the situation where the winner takes it all.

Globalists and Nationalists Revisited

The appearance of globalists as a social stratum can be traced back to the merchants who engaged in cross-border trades in medieval Europe and to the Spanish conquistadors who conquered new lands in Latin America. These two approaches led to the organization of commercial chains, through which the “civilized countries” that controlled the trade routes exchanged their home products for “colonial goods.” On the political front, the same development led to the formation of colonial empires that used military force to introduce their own “law and order” in dependent territories.

Colonialism, with its overt exploitation of colonies by the metropoles, became virtually extinct in the 20th century, (mainly due to the military deterioration of the “old” European empires) but the world has stubbornly remained unequal, even after the former colonies obtained formal independence. This observation contradicted the mainstream economic theory that predicts the eventual convergence in wellbeing between former colonies and metropoles, and suggests that global trade is still controlled by new powers, albeit in a disguise. Since the discussion of the source of the modern globalists’ power lies outside the scope of this article, it suffices to place globalists and nationalists within the framework of world-systems analysis developed by Immanuel Wallerstein in the 1970s to expose the main conflict between the two groups.

The world-system is defined by Wallerstein as “a social system, one that has boundaries, structures, member groups, rules of legitimization, and coherence” that is composed of nation-states but is larger than the sum of its constituent parts. He states that “its life is made up of the conflicting forces which hold it together by tension and tear it apart as each group seeks eternally to remold it to its advantage” (‘The Modern World-System’, 1974.) In this interpretation, global inequality becomes indispensable as it creates a force that sustains the eternal flow of goods between “rich” and “poor” countries. This inequality is cemented by the existence of “core countries” that specialize in higher-skill, capital-intensive production and “periphery countries” that are forced to focus on low-skill, labor-intensive production and extraction of raw materials.

However, for such a transition to proceed peacefully, it is also necessary to receive an approving nod from the highest level of core countries that are ready to accommodate a newcomer into their club.

The world-systems analysis appropriately models the modern world and explains why some countries succeed, (and are invited, for example, to the OECD) but is silent on what happens when a borderline, semi-periphery country, like Russia, decides to challenge the status quo instead of waiting patiently in line to be admitted to the club of core countries. To answer this question, another thought concept is required. Since this article deals with a specific challenge (Russia against the Western global order,) a concept developed in Russia is appropriate. It can be found in the article written by former Putin’s adviser and political theorist Vladislav Surkov “Where Has the Chaos Gone? Unpacking Stability” (in Russian).

Referring to the second law of thermodynamics, which states that entropy cannot decrease in isolated systems left to spontaneous evolution, Surkov claims that no sovereign nation can maintain its internal order without exporting some form of chaos (entropy) to the outside world (system environment). Thus, when a country aspiring to join the core fails to get invited by the core, it must challenge the existing global order and treat it as its “environment” to which it “exports chaos.” This argument (export of chaos) has been basically interpreted in the West as a theoretical justification for Russian expansionism; however, its intellectual appeal is finer and can complement the world-system framework by adding a driving force behind global revolutions, a slogan known for ages — Divide et Impera: nations that can be divided become weak and subject to exploitation.

Yet, while the Russian audacity can be explained by the internal demand of this nation for “greatness”, — that is, aiming to reach the status of a core nation by negating the status quo — the question of why the collective West reacted seemingly irrationally remains. Game theory tells us that “hot” wars happen because of information asymmetry: one or both of the opponents err and overestimate their net rewards. Apparently, Russia does not seem to expect to gain from the war: Russian President Vladimir Putin repeatedly said that “there will be no winners” in this conflict and that he “would avoid it if it were possible.” On the contrary, the US-led alliance may believe in a net gain from the war between Russia and the Ukraine, expecting Russia to fail. US President Joe Biden is on record saying that “Putin cannot remain in power” and seconded by US Secretary of Defense Lloyd Austin who hoped “to see Russia weakened to the degree it can’t do the kinds of things that it has done in invading Ukraine.” Thus, the political actors of the current core countries are sufficiently confident that the Russian contender will be given “a good licking.” We will further explore who among the economic and financial actors of the core countries agree with this assessment and for what reason they support it.

It’s the Economy, Stupid: Who Calls the Shots

The politicians like to believe that they rule nations and, subsequently, the world; however, looking at the process of how policies are conceived and implemented, two observations caution against such hasty generalizations. First, the demand for new policies brews unnoticed among the masses until it is picked up by a few activists or the public media, who sense its political appeal. Since monetization is a common theme in market economies, a whole industry of public affairs has developed in response to this demand, with experts sifting through potential ideas and clarifying ambiguous points through public surveys. When the discovered topics are found to be relevant to a particular cause, they are subsequently hyped out of proportion by the media, including the social media, to steer the public sentiment for or, on the contrary, against that cause. As public sentiment rises enough to pass the scrutiny of political advisers, the causes are picked up by the politicians to appear on their political agenda with subsequent debates in parliaments. After the debates are completed and new policies are designed, they move onto the second stage — implementation. This stage is also filled with multiple pitfalls since the accepted policies can either be embraced wholeheartedly or covertly sabotaged by those who oversee their implementation or are obliged to comply with them.

The industry of public affairs comprises private establishments who are not bound by rules (apart from foreign lobbyists, who are to comply with the Foreign Agents Registration Act in the US) and may work for every wealthy client. Thus, the political decision undertaken by the West to rebuff the Russian security demands of December 2021 was obviously debated and endorsed by at least some among the Western non-political elite. Who among them would benefit from the resulting strain of global chains that involved Russia and how?

The states that belong to the global core and the periphery differ in their international standing and it is logical to conclude that their economic and financial actors also have different relative power within the relevant global chains and support globalist or nationalist agendas accordingly. It is also possible that agents of a core country may support nationalist policies if their position within the chain happens to be subordinate, whereas agents of a periphery country may support globalist policies if their position within the chain becomes dominant.

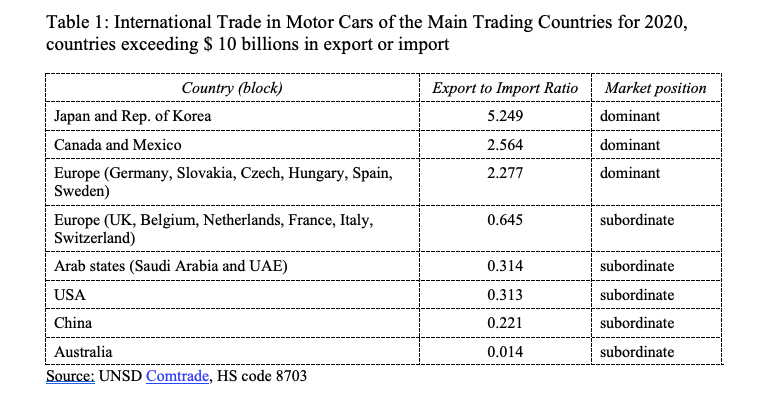

Assuming that the data from international trade statistics positively correlates with the position of national actors within the international value chains, it is possible to rank their preferences using the ratio of export to import as a proxy: the higher its value, the likelier the actors prefer globalist policies and vice versa. As an example, consider the international trade in motor cars, see Table 1.

Table 1 shows that the producers of motor cars in Japan, Korea, Canada, Mexico and the group of European countries tentatively centered around Germany assume the dominant position in the global trade. Therefore, they favor globalist policies and incur losses when the motor vehicle chains are broken. On the contrary, car producers in the USA, China and the part of Europe that includes the UK, France and Italy would see opportunities when these chains are interrupted and, hence, support nationalist policies. However, since Russia does not appear on the list, these chains are to remain mostly unaffected and the reaction of car producers to the war is mute (there are some reports of inconveniences experienced by the German producers of motor cars.) However, incidentally, the data shows a potential split of interests within the EU and NAFTA that may grow into a real issue if the popular appeal of nationalist sentiment grows stronger.

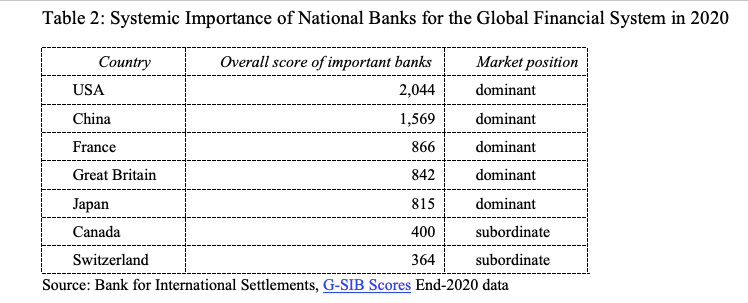

Next, consider the global financial actors who would be willing to endorse the confrontation between the West and Russia, see Table 2.

The situation with global finance is less clear-cut. Yet it is reasonable to conclude that the American and Chinese financial groups do not get along well on the basis of additional observations. First, there have been no significant mergers and acquisitions between the two groups, indicating a lack of mutual trust. Second, it appears that the UK, who probed to form a financial alliance with China, (it became a founding member of Beijing’s Asian Infrastructure Investment Bank in 2015) reversed its decision and began to oppose China falling in line with American demanded. If the American financial circles pressed hard to stop their closest ally from partnering with Chinese bankers, they likely felt threatened. Otherwise, why were they concerned?

Whatever the case, the financial actors of the US supported the sanctions against Russia, including the exclusion of Russian banks from the SWIFT system, even though such a move had resulted in the losses that were recorded within the books of major US and European banks. On the other hand, freezing the assets of the Russian central bank and other sanctioned agents gave the Western banking system access to “free” funds in the amount of circa $300 billion, which more than compensated for their losses. Still, in the long run, the financial actors would lose through the reduce trust in their ability to preserve value and, hence, their support for the sanctions is conditioned on something else.

Le Charme Discret de la Démocratie Libérale

In 1972, Spanish filmmaker Luis Buñuel directed the surrealist film “Le Charme discret de la bourgeoisie.” The film consists of five gatherings of a group of bourgeois friends who expect to have fine dinners, but they go awry every time. However, the friends never stop trying, as though it were their natural right for others to serve and pamper them.

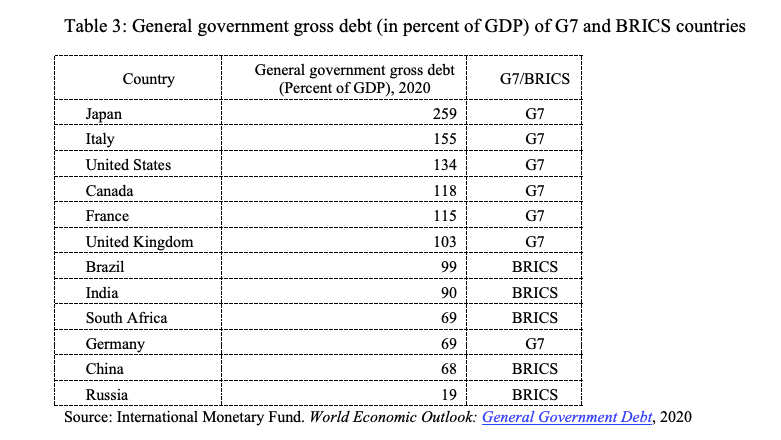

People living in liberal democracies feel the same way: they want, as the Latin saying holds, “panem et circenses” (“bread and circuses”) and, needless to say, this style of life is very expensive. The authorities of liberal democracies, — which happen to comprise the core countries, such as the G7 group, to a tee — must ensure the uninterrupted inflow of resources from the periphery countries to maintain a high standard of living required to keep their citizens content. Commonly, when authorities feel that the situation has slipped out of control and there is no more free lunch, they resort to public borrowing, with the resulting debts required — at least since the 1980s when this practice became widespread — only being serviced but not repaid. As a result, the public debt in the core countries has ballooned over time, unlike in the periphery countries. Let consider the amount of public debt of the leaders of two blocs that comprise the G7 and BRICS countries, see Table 3.

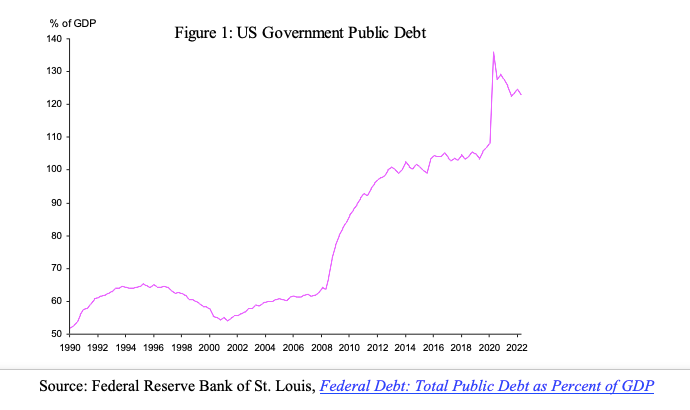

Obviously, the G7 — with the exception of Germany — have accumulated largely unsustainable amount of debt, unlike the BRICS country, especially Russia. Next, let observe how the amount of US public debt grew over time, see Figure 1.

Figure 1 reveal two curious incidences of rapid increase in debt. The first involves the period of the Great Recession 2007-9 when the debt grew from 63% of GDP (April 2008) to 100% (April 2013). That was the time when the US Federal Reserve System (the Fed) at first allowed a large banking institution, Lehman Brothers, to go bust, but then backed off from its hawkish stance and reversed its policy to quantitative easing, which involved pumping a large amount of funds into the troubled financial sector. The second case took place in March 2020 and, once again, the Fed played a major role in the drama, which saw the debt rise from 108% (January 2020) to 135% (April 2020).

The US Federal Reserve System is an interesting structure in and of itself and deserves to be elaborated upon. It is not a normal central bank, as it comprises 12 Federal Reserve Banks that are private establishments reporting to their shareholders, who happen to be local banks; however, the Fed itself is governed by the Board of Governors that is appointed by the US president and confirmed by the Senate. Essentially, it is a public-private partnership formally tasked with maintaining the balance between maximum employment and stable prices through open market operations and setting basic interest rates. But once in a while, the Fed engages in activities that go beyond its stated purpose.

For example, the quantitative easing of 2008-2014 witnessed the Fed entering the market to buy securities, typically mortgage-backed securities and US public debt (Treasuries), that is, to inject both capital and liquidity directly into the market. Thus, for the first time in its history, the Fed combined the roles of a regulator, supervisor, and participant in the economy. That created a conflict of interest as the Fed possessed the technical means to earn additional profits through operations that smacked of insider trading.

In 2020, the Fed was called to the rescue of financial markets again. This time it was an even more unorthodox type of intervention. Apart from purchasing mortgage-backed securities and Treasuries, as in 2008-13 — this time in unlimited quantity — the Fed pledged to funnel help far beyond the financial core. When I wrote “An Invisible Global Revolution” two years ago, I mentioned “recent jolts of stock indices … provoked by the interference of large institutional players,” but the identity of those players was not yet known at the time. The fact that the Fed was buying corporate debt also implied that it lent money directly to the non-financial sector by playing the role of a regular bank. But how successful would the Fed be with its unconventional policies?

When America Sneezes, the World Catches a Cold

A potential answer to this question can be found in history of the British Empire. In 1945, within a memo circulated to the British War Cabinet discussing the staggering debt that the UK government accumulated during the Second World War, the prominent economist John Maynard Keynes wrote: “By cunning and kindness, we have persuaded the outside world to lend us upwards of the prodigious total of £3,000 million. The very size of these sterling debts is itself a protection. The old saying holds. Owe your banker £1,000 and you are at his mercy; owe him £1 million and the position is reversed.” So, if £3 billion were sufficient for the UK government to keep its creditors at bay, how more efficient would be the $30 trillion borrowed by the US government to the same effect?

Yet the story did not end favourably for the British, who had to disband their empire in the aftermath of the war despite their fervent attempts to preserve it intact. Would it be a different case for the USA? The Russian challenge in the form of an open rebellion against the Ancien Régime is the first precursor, which could be followed by some kind of hostile action from China. The world enters into an unchartered territory and the unexpected can happen any time rendering futile current forecasts of the future. Yet, an interesting marker of the potential future can be found in the policies of one of the American allies.

A Canary in a Coal Mine

Until as recently as 1986, coal miners took canaries into the mines with them to detect the accumulation of carbon monoxide and other harmful gases in the atmosphere. That practice produced a saying: ‘to be a canary in a coal mine’, which describes one whose sensitivity to adverse conditions makes him or her useful early indicator of such conditions. Among the American allies, Italy seems to fit the bill. The Italians like to self-deprecatingly joke, saying ‘Gli italiani corrono sempre in soccorso del vincitore’ (‘the Italians always run to help the winner’) and for good reason. The unique historical experience of Italy being a rich medieval land incapable of protecting itself against external incursions has ingrained the local elites with acute sensitivity to oncoming changes in the power balances abroad. Thus, political processes that unwind in this country may be indicative of future political developments in the West as a whole.

Currently, Italy prepares for the general election due to be held on 25 September 2022 and it is worth explaining what is at stake. It all started in February 2021, when Mario Draghi, a former President of the European Central Bank, was tasked to form a technocratic government. Being closely associated with the financial sector, Mr. Draghi represented the Italian globalist faction and behaved accordingly. However, his position of a technocratic prime minister was always precarious. Mr. Draghi tried to increase his political weight by applying for the position of Italian President in December 2021, but his attempt was foiled by nationalists who dominated the Italian parliament.

After Russia started its military operation against the Ukraine in February 2022, Mr. Draghi sensed a chance to prove his worth. He was instrumental in the development of European sanctions against Russia, even though his country bore the brunt of the Russian countersanctions. The growing prices of energy, natural gas in particular, were especially hurting Europe and Mr. Draghi tried to show his economic acumen by calling for the introduction of a EU price cap on Russian gas (still debated within the EU) but, again, he did not succeed in impressing the parliamentarians. However, the main test of his political prowess came in May 2022, when he went on an official visit to the US, mostly to solicit American help in securing additional supplies of natural gas from sources other than Russia. By all indications, he returned empty-handed, and his failure was crucial in undermining the positions of Italian globalists.

Two months later, the part of Italian nationalists who formally supported Draghi’s government (Lega and Forza Italia) withdrew their support, prompting a snap election in which another nationalist party (Fratelli d’Italia) that stayed in firm opposition to the government is likely to prevail. If that happens, the Italian political landscape will be altered beyond recognition.

It needs to be said that the post-war Italian political system is based on an informal agreement to exclude the old, pre-war force of the fascists and the new, post-war force of the communists from taking power with appropriate checks and balances being put in place. The system has worked flawlessly up to now, but its stability will be seriously tested after the oncoming election. The party Fratelli d’Italia has a fascist background and, hence, the system should prevent it from forming a government, but will the checks and balances function as expected?

At the moment, it looks like they will not: at least, there are already attempts to whitewash the party and present it as a traditional conservative group devoid of any fascist connotations. The media highlights the professed Atlanticism of its leader, Giorgia Meloni, but her election battle cry ‘We are Ready to Revive Italy’ sounds awfully reminiscent of the slogan ‘Make America Great Again’ that shook the US not long ago. So, the globalists must think twice if Ms. Meloni will be easier to rein in than former US president Donald Trump.