The sanctions taken against Russia by EU countries are generating a major “boomerang effect,” one which could lead to a global energy crisis. The shock will probably be felt by the EU economy this winter and afterwards. It is therefore at this time that crucial political questions will arise regarding the expediency of the EU countries’ policy towards Russia.

“War is coming back to Europe” is the new mantra. However, war didn’t come back just because of Ukraine. There have been previous winters of war in Europe, linked to the bloody disaggregation of Yugoslavia. However, war in Ukraine, with all its geopolitical consequences, is a true game changer. Even if some reassuring talks are given in the EU about prospects for this winter, the fact that it is destined to be difficult, and likely cold and dark, is a naked truth. Sanctions have dramatically damaged the energy relationship between Russia and the EU. Europe will face the consequences of an energy drought, one which doesn’t just affect gas but coal and oil as well, without the ability to turn to quick alternatives (no offense to Margaret Thatcher).

To understand the extent of the issue, we have first to understand the extent to which the EU is dependent on Russian energy. This situation didn’t come at once and from nothing. Some people have been blaming leaders, like Ms. Merkel. But this is to large extent unfair. The main reason behind this dependence is the fact of cold-blooded economic computations where cheap energy from Russia has been seen by different EU countries as a possibility, and even a condition, to improve their economic competitiveness in the world. The decision to use Russian gas, oil and even coal was made in the 90’s and early in the 2000’s. This choice became critical for some countries, like Germany, as they began to feel the pressure of competition by Asian countries (China mostly) and tried hard to maintain their competitive edge. The dramatic Fukushima accident and its political legacies in Germany helped of course to freeze a political consensus on an energy mix which made the country highly dependent of Russian energy. But event without horse-trading with the Grünen this mix made sense just for economic reasons.

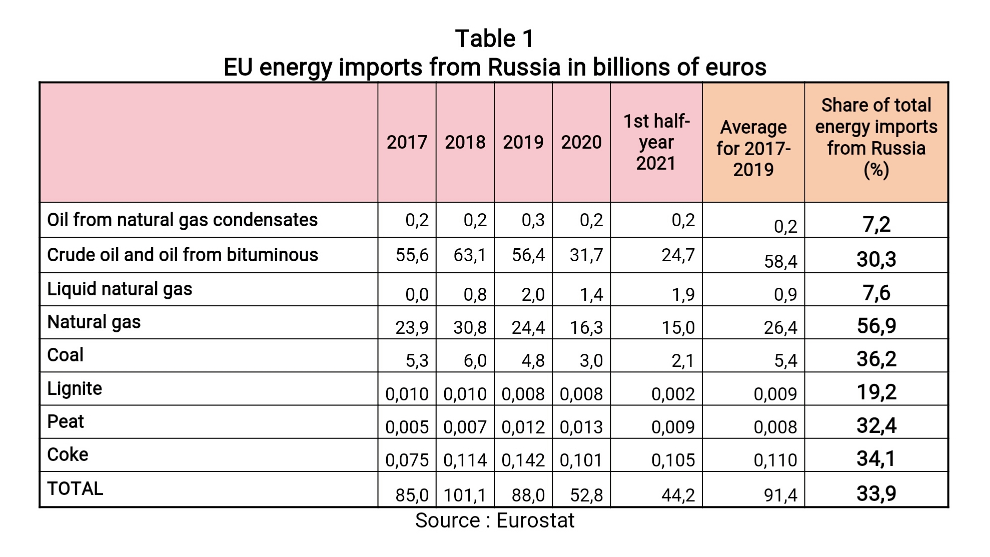

This led to a situation which can be best described using Eurostat data.

Now, with the war in Ukraine, sanctions taken by EU countries are provoking a global energy crisis. People are forgetting that supplies stopped because the EU countries introduced economic and financial sanctions and refused the solution proposed by Russia. What was forgotten too was that these sanctions didn’t change Russia’s key role as a supplier of various raw materials. Political and economic facts didn’t mix easily. This crisis has then been particularly painful in the EU countries where energy prices have risen to a considerable extent, already prompting some small and medium enterprises to stop activity (more than 1,200 in Germany alone).

Now, with the war in Ukraine, sanctions taken by EU countries are provoking a global energy crisis. People are forgetting that supplies stopped because the EU countries introduced economic and financial sanctions and refused the solution proposed by Russia. What was forgotten too was that these sanctions didn’t change Russia’s key role as a supplier of various raw materials. Political and economic facts didn’t mix easily. This crisis has then been particularly painful in the EU countries where energy prices have risen to a considerable extent, already prompting some small and medium enterprises to stop activity (more than 1,200 in Germany alone).

With Russian hydrocarbon deliveries cut, possible means of substitution have been investigated. It’s possible to replace gas with LNG. However, the volume of Russian pipeline gas had been three times that of imported LNG. In addition, regasification facilities are few in number and already working at more or less full capacity. Substituting Russian gas with LNG would involve building three times the number of existing facilities, which would take between 3 and 5 years. It would also involve the construction of a major fleet of LNG carriers; another expensive, time-consuming process. Incidentally, LNG is intrinsically more expensive than pipeline gas. Even when complete substitution is complete, EU countries will have to pay 25% to 33% more for the gas they will get. That will not improve economic competitiveness.

Dependence on oil is somewhat less pronounced and substitution theoretically easier. However, for the moment, oil market observers are skeptical, to say the least, about the willingness of the countries of the so-called OPEC+ group to significantly increase production. What’s more, the dependence is even higher if we look at refined products. Substitution is possible but will entail significant time and higher costs.

Imports of Russian coal (and coke) could too be substituted but mines in the United States, Poland and Australia are already working at full capacity. Coal imports from the United States were equivalent to 38% of imports from Russia and those from Australia to 30%. This shows the extent of the required increases in production for this substitution to be effective. This will, again, take time — between 1.5 and 2 years — and be expensive. But energy is not the only issue at stake. Oil and gas are also used as raw materials in the chemical industry. So, the global rise in costs won’t just affect households, which could in some cases reduce their energy consumption, but industry and, naturally, the economy as a whole.

A quick assessment of the situation thus reveals that, yes, substituting other sources of energy for what was delivered by Russia is possible, but the time and cost factors are unknown and are certain to be significant. Even without taking into account the investment cost – which will be high – there will be a general rise in energy costs, which will be quite detrimental to economic competitiveness. However, the most important factor is time. Even if we assume the EU countries will do everything they can to have an effective substitution by fall 2025, what will happen this winter and during the next two winters?

Another big question is: which countries are most exposed? The IMF has looked at this issue and issued a report; while it probably under-evaluates the economic impact of EU energy starvation, it is nonetheless a useful evaluation. In taking the energy imported volume as an indicator as well as the economic size of the country and of its industry, it is clear that the most exposed countries are Germany, Italy, Spain and France. Germany is clearly the most exposed country both in terms of the volume of energy imported and with respect to the types of energy. For France, the question arises mainly for liquid fuel. The global economic impact could then be a GDP contraction for 2023 of around 2%, maybe more. This would lead to more unemployment, something which coupled with inflation could lead to serious social discontent this winter and afterwards.

The sanctions taken against Russia by EU countries are generating a major “boomerang effect,” one which could lead to a global energy crisis. The shock will probably be felt by the EU economy this winter and afterwards. It is therefore at this time that crucial political questions will arise regarding the expediency of the EU countries’ policy towards Russia.