In order for the EAEU member states to achieve closer economic integration, they must overcome economic and institutional challenges at the national level as well as at the level of country-to-country macroeconomic policy coordination. The tasks involved in balancing the levels of macroeconomic development and approaches to monetary policy enshrined in interstate documents of the Union are closely intertwined with the currency sphere. De-dollarization of the Eurasian economies is the most important task at hand.

The dollarization of the economy in Eurasian countries is making domestic monetary policy less effective and restricts the central bank’s ability to regulate macroeconomic processes in the country in order to achieve monetary policy goals. The effectiveness of the monetary policy transmission mechanism is reduced, since changes in interest rates on the central bank’s transactions do not directly affect rates on foreign exchange assets and liabilities. Foreign currency loans issued by banks to unhedged borrowers (the ones that do not have foreign exchange earnings), as well as the lack of monetary instruments to regulate currency liquidity of the banking sector by the central bank, significantly increase the currency risk and the financial system’s solvency risks. In this regard, the EAEU member states, whose economies are characterized by high dollarization levels, remain exposed to significant external shocks that limits the opportunities for better coordination of the monetary policy among the countries of the union.

Dollarization of the EAEU countries: Current situation

The economic literature describes three main forms of dollarization:

- payments dollarization, which involves using foreign currency as a means of circulation and payment;

- real dollarization, which means pricing of goods and services and/or setting wages pegged to foreign currency;

- financial dollarization, when financial contracts are denominated in foreign currency.[1]

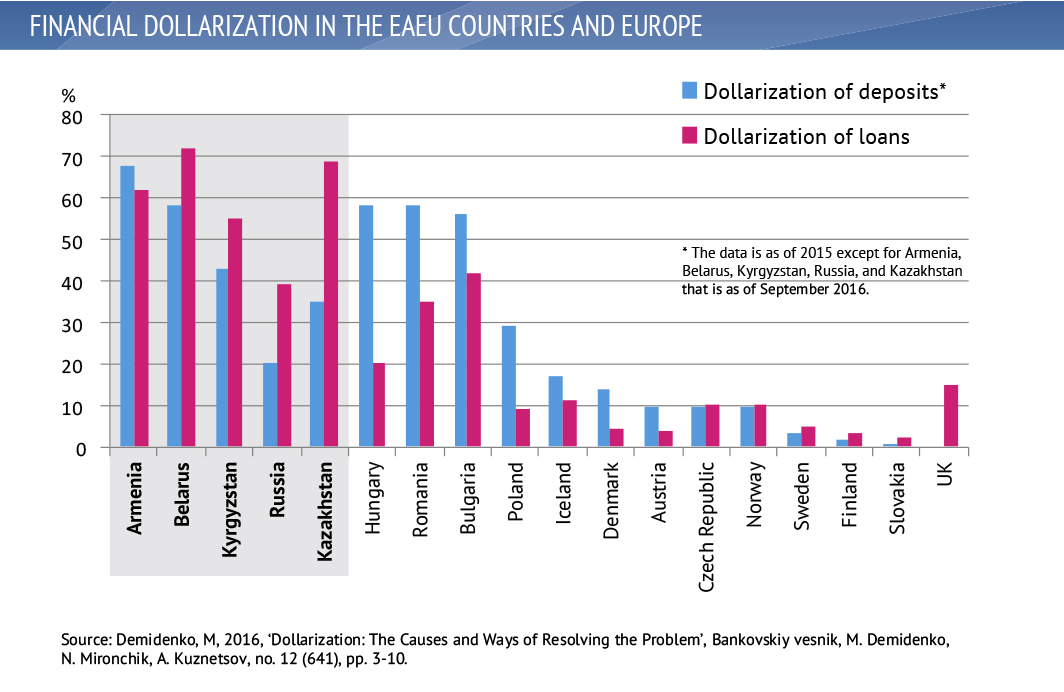

In practice, financial dollarization is the only form that can be estimated with a satisfactory degree of reliability. The level of financial dollarization in most EAEU member states is high compared with European countries.

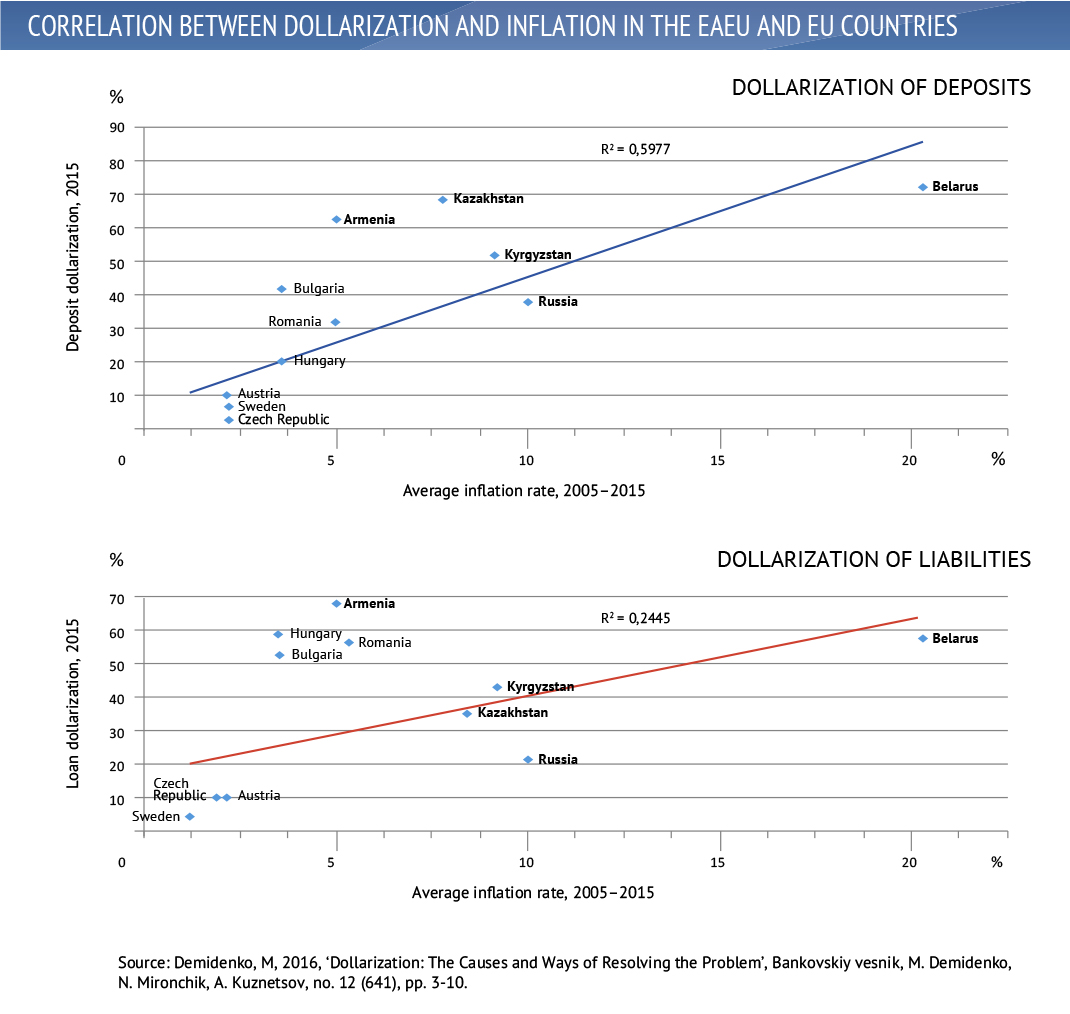

Having studied the dollarization phenomenon in some of the EAEU countries, a number of experts have concluded that the main reasons for the increased level of dollarization are as follows: high inflation and a variety of exchange rate controls (pegging, fixed rate, etc.), macroeconomic volatility, in addition to fears of floating exchange rate.[2] There is a direct correlation between inflation and the degree of financial dollarization. Armenia is the only exception with its relatively low inflation and one of the highest levels of financial dollarization in the EAEU. Probably, this situation is connected with the peculiarities of the way the inflation targeting regime is being implemented in Armenia, namely, limiting the national currency’s exchange rate fluctuations. A number of commentators have noted that when inflation is more volatile than the exchange rate, this creates prerequisites for growing dollarization of the economy.[3]

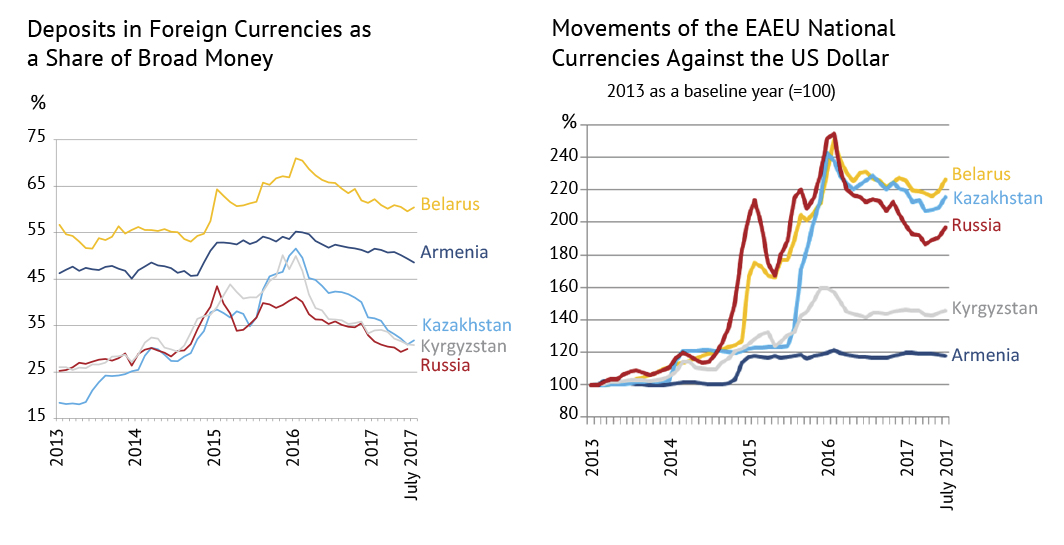

Amid rapid depreciation of national currencies under the influence of unfavourable external shocks in the period from 2014 to 2016, the countries of the region experienced growing financial dollarization: the share of foreign currency deposits in broad money significantly increased in all the EAEU countries. The maximum level of dollarization of savings in this period was recorded in the Republic of Belarus (70.5% in January 2016), and the minimum in Russia (41.1%). Notably, the increased share of foreign currency deposits was associated both with changes in the savings preferences of economic agents in favour of foreign currency-denominated instruments, and the effect of revaluation in the wake of national currencies weakening against the US dollar.

Weaker pressure on the domestic foreign exchange markets in the second half of 2016 − first half of 2017 across the EAEU economies has led to a decrease in financial dollarization. In particular, the level of dollarization in Belarus decreased from 71% in January 2016 to 60.4% in July 2017, and in Kazakhstan from 51.6% in January 2016 to 31.8% in July 2017. The decline in the level of financial dollarization was largely the result of the governments and central banks of the countries of the region implementing a set of policies to de-dollarize their economies and financial systems.

Dollarization in the EAEU countries: De-dollarization policies and key results

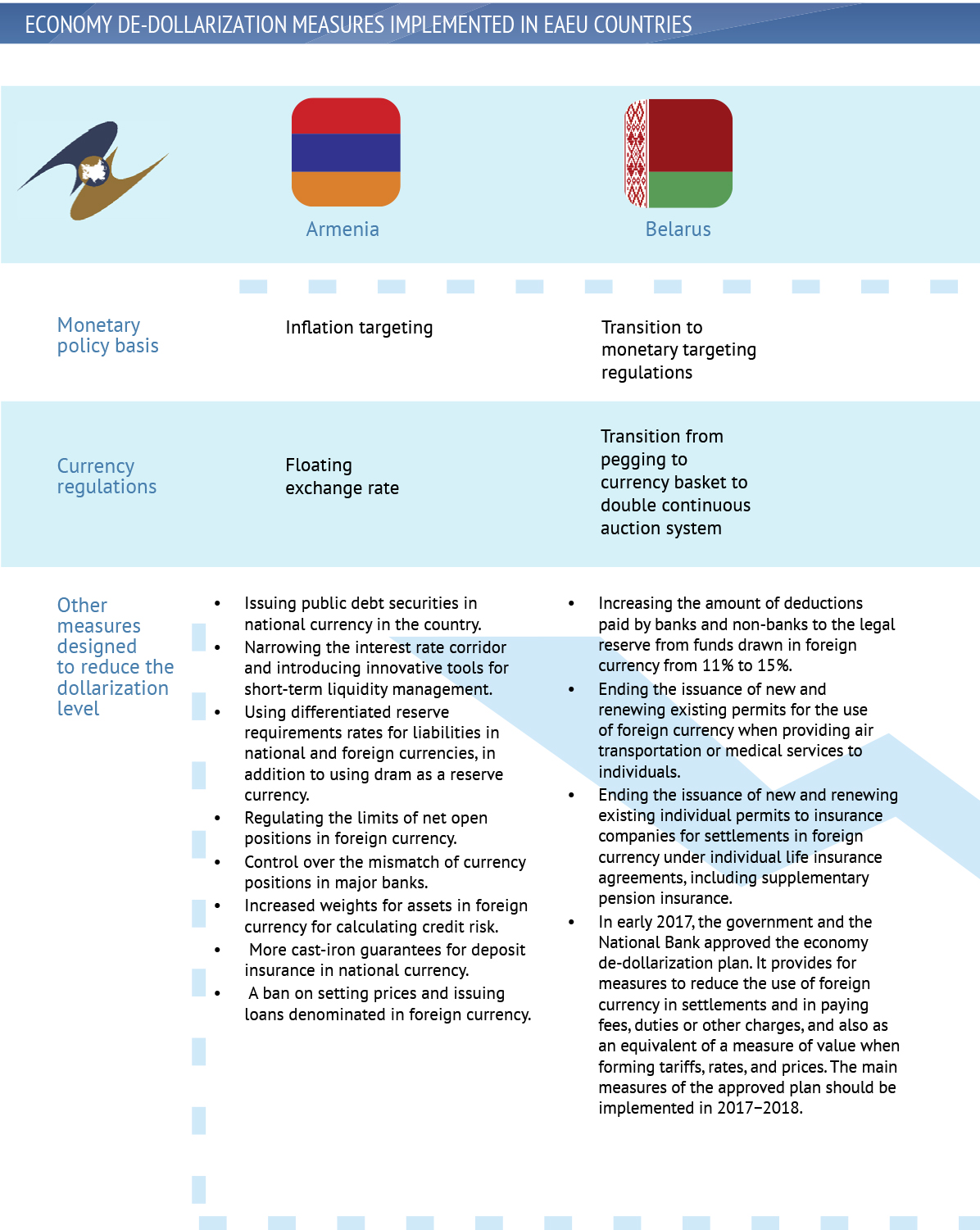

The main policies aimed to reduce the dollarization of the EAEU member countries’ economies in 2014−2017 are laid out in table below. Most of the countries under review have been widely using de-dollarization policies, which directly stimulate the use of national currency.

- Increase in reserve requirement differentiation. For instance, reserve requirements for borrowed funds of the banks in foreign currency doubled to 15% in Belarus as compared with early 2017, and were reduced by 3.5 percentage points to 4% for rouble liabilities.

- Strengthening the differentiation of prudential oversight requirements and facilitating the transfer of foreign currency requirements into national currency. Armenia and Belarus have toughened their approaches to foreign currency debt classification in calculations of a special reserve for the assets subject to credit risk. Kyrgyzstan has introduced a ban on issuing personal loans in US dollars. In Kazakhstan, a foreign currency loan may be issued to individuals only if they have income in loan currency.

- Organization of a large-scale campaign to switch to the widespread use of national currency as a means of circulation and payment. Most of the EAEU countries have introduced bans on establishing prices, tax rates, tariffs, and other payments in foreign currency, or tightened control over pricing. Belarus has stopped issuing new and renewing existing permits for the use of foreign currency when providing air transportation or medical services to individuals. Kazakhstan has introduced new e-commerce rules, where e-commerce intermediary ensures pricing for goods exclusively in national currency. Both Kyrgyzstan and Kazakhstan have introduced a ban on setting prices for goods and services in conventional units.

The passive measures adopted to form a favourable market environment, which are aimed to create conditions conducive to changing future cash flow structure, are as follows:

- Restricting policies which stimulate the use of foreign currency to the detriment of national currency: execution of state loans mainly in national currency (Armenia), transition to the use of various taxation rates for deposits in national and foreign currencies (Belarus), improvement of the deposit insurance (Armenia, Kazakhstan).

- Encouraging the development of an institution to hedge foreign currency risk (Belarus).

- Improving the infrastructure and gradual liberalization of the domestic foreign exchange market in most of the countries under review.

The above mentioned de-dollarization policies are referred to by some authors as second- or third-order policies. Their effectiveness directly depends on implementation of priority policies aimed at improving the macroeconomic environment, as well as reducing and stabilizing inflation at a low level.[4]

From the point of view of implementing first-order policies, the EAEU countries can be conventionally divided into two groups:

- countries which, along with other policies aimed at de-dollarization of the economy, have provided greater exchange rate flexibility (Belarus, Kazakhstan and Russia);

- countries which have actually limited the adjustment of nominal exchange rates (Armenia, Kyrgyzstan).

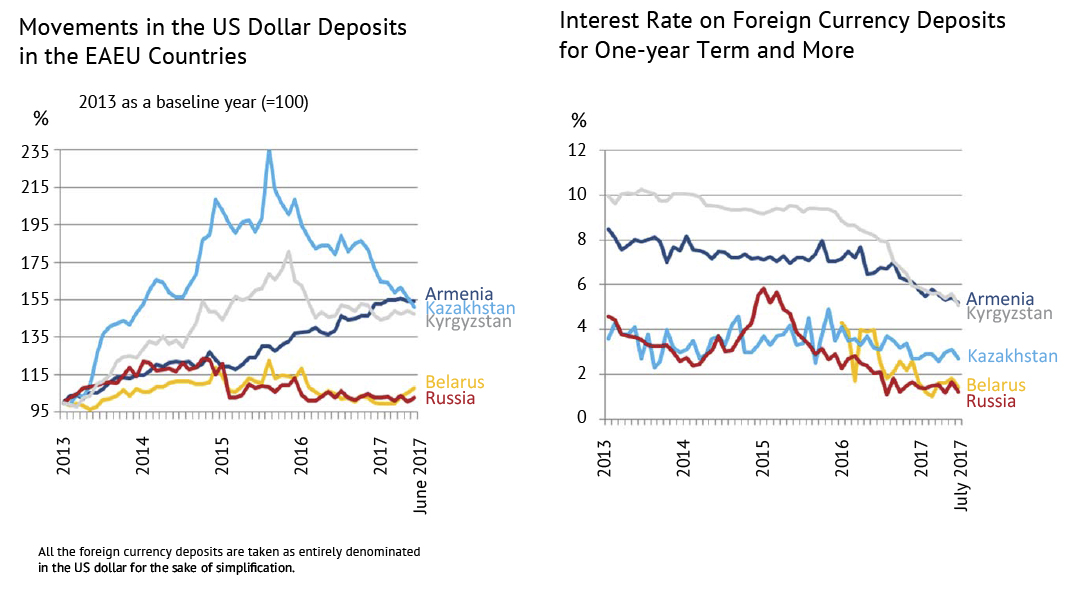

If we consider the dynamics of foreign currency deposits, it becomes clear that one group of countries have shown better progress than the second one. In Kyrgyzstan, a rapid reduction in the volume of foreign currency deposits without taking into account the exchange factor was observed in early 2016 (the first months of the national currency’s nominal strengthening), but was later replaced by stagnation. In Armenia, an increase in the number of deposits denominated in foreign currencies was observed until 2017, after which, partly influenced by higher return of the deposits in drams, the number of foreign currency deposits began to edge down.

At the same time, the decline in interest rates on foreign deposits in Russia and Kazakhstan has been somewhat limited, and the slowdown in the dollarization rate compared with the level of 2013 has become more pronounced. For example, in Kazakhstan, the decrease from the maximum interest rate (during the period from January 2013 to June 2017) amounted to 220 basis points, whereas the volume of foreign currency deposits continuously declined from August 2015. In the Republic of Belarus, a significant reduction in the volume of foreign currency deposits, primarily private deposits, was observed in 2016. This was due to both the newly adopted de-dollarization policies, and the desire of the population to maintain a certain standard of living against a noticeable reduction in real disposable income through dipping into their currency savings. In the first half of 2017, the reduction in the currency holdings of the population in the banks practically came to a halt. However, the increase in currency deposits observed in April−June 2017 is related solely to the resolution of the oil and gas conflict between Belarus and Russia: a portion of the cash that Gazprom Transgaz Belarus received from the Belarus Government as a part of the payment for the Russian gas debt was deposited by that company on foreign currency accounts with Belgazprombank.

It is premature to draw conclusions about the degree of influence exerted by structural factors on the level of dollarization in the EAEU countries, but the preliminary results of the last 18 months corroborate the thesis that facilitating the flexible exchange rate and implementing policies designed to reduce and stabilize inflation are among the fundamental factors behind reduced dollarization. Having switched to free exchange rates and making efforts to stabilize inflation, Russia and Kazakhstan have so far shown more convincing results in lowering the dollarization level. Meanwhile, the EAEU countries, which have sought to limit the volatility of the national currency exchange rate and implemented about the same set of administrative policies aimed at de- dollarization of the economy, have not been as successful in reducing the level of savings dollarization.

Further conceptual measures to reduce the dollarization level in the EAEU countries

Possible de-dollarization policies in the EAEU states, which may be adopted in the future, should be divided into three groups (corresponding to the above mentioned).

The first-order, or strategic policies, are designed to improve the macroeconomic environment, to achieve low and stable inflation and to further gradually increase exchange rate flexibility. These policies are a priority for the EAEU member countries, since the historically high-level inflation and its volatility, as well as the use of fixed exchange rates associated with periods of currency market destabilization were the main reasons for high dollarization levels in the countries. Without effective implementation of priority policies, there is a high probability that any other de-dollarization policies will not lead to the anticipated positive results.

The second-order policies include passive policies, whose purpose is to create an environment that will limit negative consequences for the economy if the set of the first-order policies are not fully implemented. The following second-order policies are important for the EAEU countries:

- encouraging of government borrowings in national currency;

- further infrastructure improvements and liberalization of domestic foreign exchange markets in order to create favourable conditions for replacing foreign borrowings with foreign direct investment;

- development of the derivatives market and the foreign currency hedge in part related to improving accounting, taxation, creating benchmarks for financial instruments profitability in national currencies, etc.;

- as the financial systems become more stable, it is advisable to limit (and eventually phase out completely) the guaranteed repayment of private deposits denominated in foreign currency;

- improving the communication strategy of central banks to better inform financial-market participants about currency risks and advantages of the transactions denominated in national currency;

- developing the secondary market for debt securities denominated in national currency to facilitate pricing for long-term credit instruments.

The third-order, or active policies, are complementary to the above mentioned policies and are designed to directly encourage the use of national currency. Without effective implementation of the first- and second-order policies, the activities under the third group will, at best, have no significant impact on the dollarization levels and, at worst, can destabilize the financial systems. It is stated that ‘third-order policies are designed, first, to protect the most vulnerable groups from currency risks, and second, to render unacceptable the banking model based on mechanical shifting of the currency risks to clients’.[5]

As noted above, active policies are being widely used in most of the EAEU

member states. The additional policies include the following:

- raising clients’ awareness about currency risks, for example, by introducing mandatory simulation of the consequences of devaluation;[6]

- subsidizing interest rates on foreign currency loans converted into national currency;[7]

- encouraging the use of de-dollarization in the intermediate stage as a basis for prices, tariffs, and rates that are traditionally pegged to foreign currency.[8]

Conclusions

The goal of bringing the monetary policies of EAEU states closer together is primarily hampered by high levels of financial dollarization in these countries. This owes its existence to the high level of inflation, prolonged use of fixed exchange rate coupled with periods of currency instability, macroeconomic volatility, and the ‘fear of floating’.

Following the increase in financial dollarization in 2014 through the first half of 2016 amid depreciating national currencies, the de-dollarization process started in most of the EAEU countries in the second half of 2016. In many respects, it is connected with the policies undertaken by governments and central banks designed to restrict settlements and pricing in foreign currency, to tighten prudential standards that directly affect foreign exchange assets and liabilities, and to improve infrastructure and to liberalize foreign exchange markets, to name a few.

In the wake of unfavourable external shocks, a number of states (Russia, Kazakhstan, and Belarus) have conducted institutional changes in their respective monetary policies aimed to increase exchange rate flexibility and transitioning to inflation targeting. The preliminary results of implementing structural policies demonstrate the impor tance of reducing and stabilizing inflation, as well as the impor tance of flexible exchange rates in reducing the level of financial dollarization of the economy.

Despite the ongoing decrease of the dollarization level in most countries of the region, further consolidation of de-dollarization policies is needed to consolidate the emerging positive trends. The most important of these are the policies aimed to further improve exchange rate flexibility, reducing inflation and inflation expectations as well as fixing them near the target levels established by the central banks.

In the long term, the de-dollarization of the global economy will have its own political ramifications. The monopoly of the developed countries, primarily the United States and Western Europe, in the sphere of payment systems and reserve currencies will decline as new global financial centres and reserve currencies become available in developing countries. The political influence in international relations is largely derived from the economic power of the countries: the loss of monopoly status in regulating international economic relations will require new resources and economic breakthroughs from the developed countries in order to maintain their political weight on the international arena.

China in the past few years has made significant progress in enhancing the role of the renminbi in international trade and investment operations, and has the best prospects for reaping economic and political dividends from the de-dollarization of the global economy. The de-dollarization process for Russia and its EAEU neighbours is, above all, about stimulating the development of their own payment systems and mutual trade and integration based on the use of national currencies. For Russia, it is also a factor of greater economic sovereignty and reduced vulnerability to sanctions and external political and economic pressure.

Finally, it should be noted that, just as de-dollarization can facilitate integration processes in the post-Soviet space, the regional scale of integration is a more suitable ground for dollarization compared with the narrower confines of individual countries. The broader regional integration context means that efforts to encourage the use of national currencies and the reduction of dollarization will be more sustainable. In addition to the EAEU, such integration platforms as China’s One Belt One Road project can provide a significant catalyst for de-dollarization processes in the global economy.

Valdai International Discussion Club

[1] Kruk, D, 2015, ‘Dollarization and De-Dollarization in Belarus: Formulation of Agenda’, BEROC, no. 23. Available from: http://w w w.beroc.by/webroot/deliver y/files/PP_23_dollarization.pdf

[2] Demidenko, M, 2016, ‘Dollarization: The Causes and Ways of Resolving the Problem’, Bankovskіy vesnіk, M. Demidenko, N. Mironchik, A . Kuznetsov, no. 12 (641), pp. 3-10; ‘Monetar y policy of the EAEU member states: Current status and prospects for coordination’, 2017, M.: EEC, St. Petersburg: EDB Center for Integration Studies, p. 148.

[3] Ibid.

[4] Demidenko, M, 2016, ‘Dollarization: The Causes and Ways of Resolving the Problem’, Bankovskіy vesnіk, M. Demidenko, N. Mironchik, A. Kuznetsov, no. 12 (641), pp. 3-10; ‘Monetar y policy of the EAEU member states: Current status and prospects for coordination’, 2017, M.: EEC, St. Petersburg: EDB Center for Integration Studies, p. 148.

[5] Demidenko, M, 2016, ‘Dollarization: The Causes and Ways of Resolving the Problem’, Bankovskіy vesnіk, M. Demidenko, N. Mironchik, A. Kuznetsov, no. 12 (641), pp. 3-10.

[6] ‘Monetar y policy of the EAEU member states: Current status and prospects for coordination’, 2017, M.: EEC, St. Petersburg: EDB Center for Integration Studies, p. 148.

[7] Demidenko, M, 2016, ‘Dollarization: The Causes and Ways of Resolving the Problem’, Bankovskіy vesnіk, M. Demidenko, N. Mironchik, A. Kuznetsov, no. 12 (641), pp. 3-10

[8] Kruk, D, 2015, ‘Dollarization and De-Dollarization in Belarus: Formulation of Agenda’, BEROC, no. 23. Available from: http://w w w.beroc.by/webroot/deliver y/files/PP_23_dollarization.pdf