The Transatlantic Partnership: General Context

The Transatlantic Trade and Investment Partnership (TTIP) – the formation of which has been the subject of active negotiations between the United States and the European Union ever since 2013 – is by far the most ambitious current project for reaching formal agreement on regional cooperation. It combines traditional measures for liberalizing mutual trade with a coherent harmonization of regulations for economic activity on the territory of its member states. If the project succeeds, it will have a deep and far-reaching impact on the future development of the world economy, as well as on the mechanisms for regulating it.

On one hand, lowering barriers to economic cooperation between partners whose mutual trade exceeds $1 trillion and whose cumulative mutual direct investment is close to $4 trillion would inevitably affect a wide range of economic players around the world: opening up new opportunities for market access to some while weakening the competitive position of others.

On the other hand, the formation of the TTIP would contribute to further changes in the architecture for managing global economic processes even as the Doha Development Round negotiations of the World Trade Organization (WTO) have essentially reached an impasse. Together with the Trans-Paci?c Partnership (TPP) – on which formal agreement was reached in February 2016 – the TTIP sets out to further expand the contractual mechanisms for economic regulation beyond the scope de?ned by WTO agreements (the “WTO+” format). It also shifts the initiative for liberalizing trade and investment away from international economic organizations with universal memberships and toward regional economic entities, thereby strengthening the position of economically developed countries, in particular the U.S., in the system of managing global economic processes.

How realistic are these prospects and what impact might they have on the economic and political interests of Russia – or more precisely, on the interests of Russia’s major economic players and its key political decision-makers? As with any major expected changes in the structure of economic regulation, finding answers to these questions requires analysis in three areas:

- the ?rst is factual, meaning that it is necessary to identify what is actually happening in connection with the creation of the TTIP;

- the second is analytical – that is, it requires an assessment of how the TTIP could in?uence the world economy and its various subsystems;

- the third is rhetorical: how is the possible establishment of the TTIP portrayed in political discussions and materials that shape public opinion.

The relationship between these three areas is often dif?cult, if not contradictory. In particular, the rhetorical arguments used by both advocates and opponents of the TTIP occasionally ignore, or worse, incorrectly interpret, the results of studies performed by leading analytical centers. This is despite the fact that the actual course of negotiations can differ greatly from what analysts imagine (such as the scale of reductions to regulatory barriers), and even more so from the way the debate is framed by lobbyists for speci?c economic interests. It is nonetheless important to consider the process at all three levels to understand the prospects of the TTIP. This is due not only to the fact that in real politics the tail often wags the dog – as in this case, rhetorical arguments of even the most far-fetched nature can in?uence the course of negotiations and whether the political elites and public opinion in the U.S. and EU accept or reject the results of those talks. No less important is the fact that in today’s world, the findings of the leading “think tanks” are widely used in preparing and adjusting the parties’ negotiating positions, thereby in?uencing the future content of any agreement on the TTIP.

The following analysis of the potential impact of the TTIP on Russian interests will focus on three groups of issues: the immediate impact the TTIP will have on Russian economic entities; opportunities for Russia to interact with its leading economic partners in the regulatory sphere following the formation of the TTIP; and the impact the TTIP will have on the formation of a new structure for managing global economic processes. It will end with conclusions concerning the relative in?uence of each of the factors studied and suggest possible strategies for the Russian response to the challenges associated with them.

The Anticipated Impact of the TTIP on the Foreign Economic Relations of Russia

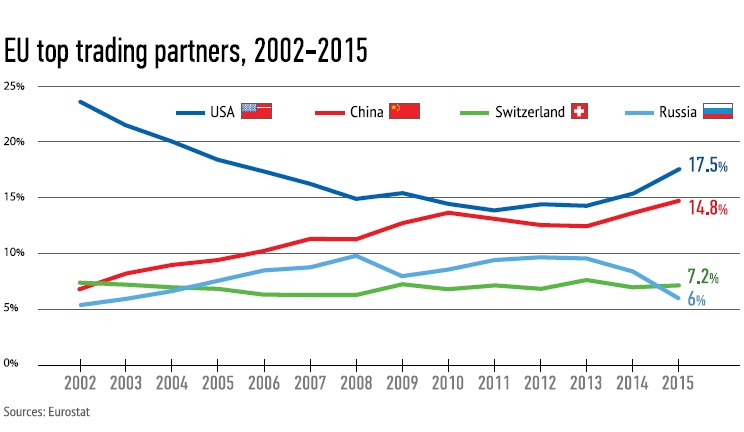

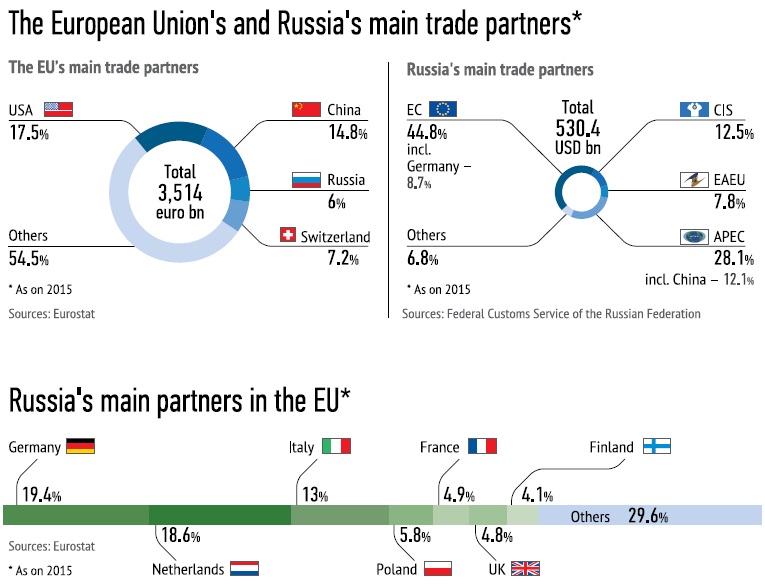

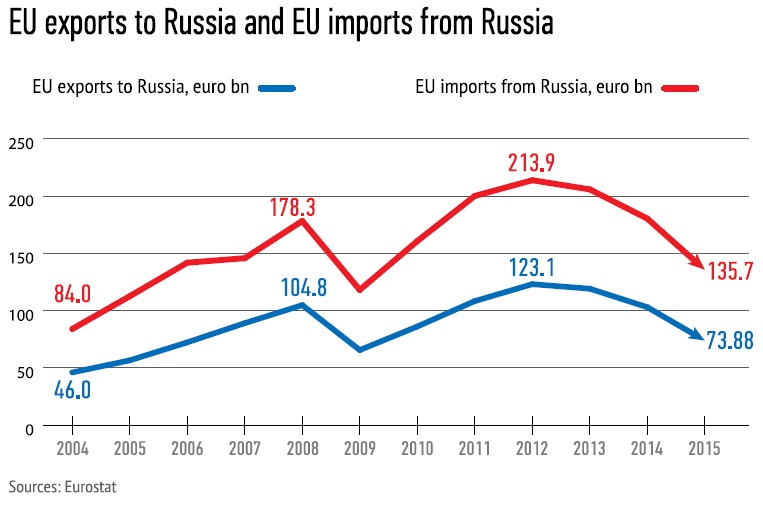

This area examines the immediate impact that the TTIP would have on Russian economic entities. The scale of that impact largely depends on three groups of factors: the effects of the reorientation and possible expansion of trade between the U.S. and EU following the conclusion of the TTIP agreement, the economic growth participating countries consequently experience, and the scale of those countries’ foreign trade with Russia. The last of these factors has a clear quantitative measurement. The EU and U.S. accounted for 49.4% and 3.3% of Russia’s total foreign trade respectively in 2013, or $417.5 billion and $27.7 billion in absolute terms. Because of the sharp deterioration in Russia’s economic relations with the EU and U.S., the decline in world energy prices, and the crisis conditions in the national economy, the share of the EU in Russia’s foreign trade fell in the first half of 2016 to 43.8%, or $91.5 billion. At the same time, the share of the U.S. rose to 4.2%, but only because the decline in Russia’s overall trade was slightly greater than its drop in trade with the U.S. – that totaled only $8.8 billion. (Russia’s trade with the U.S. in the first half of 2016 fell by 19.2% year on year, and with the EU by 26.1%, even while its overall trade volume declined by 22.2%.) Despite the drop in volumes, trade with the EU and U.S. account for 48%, or almost half of all of Russia’s foreign trade. That makes Russia especially vulnerable to any changes in the way its leading partner countries structure their trade relations.

What is the potential scale of those changes? This process is typically measured in terms of trade creation and trade diversion resulting from the implementation of preferential trade agreements, and more broadly, from trade and economic agreements. Such agreements lead to trade creation when the participating countries lower mutual trade barriers, enabling them to replace less ef?ciently produced domestic products with those purchased from a partner country at now favorable prices. Trade diversion occurs because the lowering of mutual trade barriers among participating countries enables them to purchase goods from each other at better prices than they had previously paid when purchasing those same items from third party countries where certain barriers continue to remain in place. This consequence of trade diversion generally poses the greatest risk to countries excluded from large-scale preferential agreements designed to enhance regional economic cooperation.

Most research done to date indicates that the TTIP could result in major trade diversion and consequent negative effects to third party countries. This is due to three key factors. First, despite the fact that trade barriers are low overall, averaging just over 2% for U.S. imports to the EU and slightly more than 3% for EU imports to the U.S, average import tariffs exceed 10% in a range of sensitive goods categories such as food, beverages, textile products and clothing. (In 2012, the cost equivalent of import tariffs on milk products to the EU exceeded 50%, and almost 20% to the U.S., and nearly 20% on beverage and tobacco products to the EU and 14% to the U.S.) The elimination of those barriers through implementation of the TTIP could significantly boost bilateral trade of those products, and correspondingly diminish the competitive positions of countries lacking such preferential agreements with the EU and U.S.

Second, the fundamental feature of TTIP is its focus on reducing non-tariff barriers to trade and economic cooperation, including through mutual coordination of regulatory rules in force in the U.S. and EU respectively. In this way, it is estimated that the parties could achieve a potential 30%-70% increase in the mutual export of goods and services, as compared to a baseline scenario in which the TTIP negotiations fail. The greatest improvement in terms of mutual access to markets is expected in the automaking, chemical products, food, and metals industries. Considering that the chemical and metallurgical products industries occupy an important place in Russian exports – accounting for approximately 13% of commodities supplies to the EU in 2015 – the effects of trade diversion in those industries could have a signi?cant impact on Russian interests.

Third, the focus on further improving conditions for mutual investment means that trade diversion could also affect the larger investment environment. Given that at least one-third of all mutual trade between the EU and U.S. consists of deliveries between subsidiaries of European and U.S. companies located on each other’s territories, investment diversion resulting from the TTIP could give added impetus to trade diversion. This would primarily compromise the interests of countries that actively invest on EU and U.S. territory, but that have no preferential agreements with them. (This applies primarily to China, for example, but also to Japan, although the effect on the latter is mitigated by Tokyo’s participation in the TPP.) Russia might feel those effects less than would more economically developed countries and a number of major emerging markets whose domestic companies would consequently scale back their investments in the EU and U.S. economies. However, in the long term (especially as regards easing geopolitical tensions), the TTIP could play a moderating role in the development of mutual investment relations and the implementation of projects involving technology cooperation and the creation of cross-border added value chains.

Theoretically, the negative effects of a reorientation of trade and investment flows could be mitigated as accelerated economic growth among signatories to the preferential agreement leads to increased GDP and disposable incomes, in turn creating greater demand for imported goods and services. However, signi?cant gains in this area are unlikely. All available estimates of the expected results of the TTIP predict an extremely low boost – less than 1% – to GDP and real incomes for both the EU and U.S. One commentator offered the sarcastic observation that, even under a best-case scenario, the TTIP would increase incomes only enough to enable the average European to buy one extra cup of coffee per week. Despite the subjectivity of all such assessments, it is undeniable that not one of them offers any reason to expect that compensating factors would at least partially offset the effects of the trade and investment reorientation resulting from the TTIP.

But how signi?cant could these effects be for Russia? A report published in 2015 that assesses the potential impact of the TTIP on the BRICS economies found that, even if the EU and U.S. removed all of their mutual trade barriers, Russian exports would fall below the baseline by a cumulative total of only 1.7% (including a 4.3% decline in exports to the U.S. and a 1.4% decline with the EU). By comparison, Russian exports to the U.S. and EU fell in the first half of 2016 by 11.8% and 33.9% respectively. The negative impact of the TTIP on the economic growth rate promises to be even less pronounced. The expected cumulative decline of Russia’s GDP could reach a mere 0.1% of GDP, about the same as India would experience (0.09%) and slightly less than China (0.12%). It is important to note that these figures represent not annual rates of decline in GDP, but the total effect of the TTIP’s implementation through 2027. And although, as mentioned above, the negative effect might be more pronounced for speci?c industries, current analyses clearly give no reason to expect any disastrous economic fallout from the implementation of the TTIP.

Regulatory Implications

It is more dif?cult to determine the long-term effects to the Russian economy resulting from changes to the trade and economic regulatory regime between the EU and U.S., and how those changes might in?uence the relationship between participating countries and the outside world. On one hand, the lack of a standard methodology for quantifying such effects leaves scope for a wide range of theories – including the most far-fetched – concerning the possible economic consequences to the U.S. and EU if they adopt the TTIP. (For example, some anticipate a hypothetical increase in EU imports of genetically modi?ed food products from third party countries if Brussels bends to U.S. pressure to lift its ban on GMO products.) On the other hand, a bilateral agreement between the U.S. and EU could affect the interests of third party countries through complex, at times a priori and subtle channels that would require extensive analysis to identify.

The common perception is that if the EU and U.S. form a single regulatory space, Russia risks losing maneuvering room in bilateral negotiations with participating countries due to the imposition on it of unsatisfactory regulatory norms deriving from the TTIP. These include technical standards, supranational mechanisms for protecting the interests of investors, an expanded approach to safeguarding intellectual property rights, liberalization of access to public procurement markets, and so on. Although formally the norms adopted in preferential agreements apply exclusively to relations between signatory countries, previous experience in negotiating with the United States, and especially with the EU, shows that their representatives have a strong tendency to apply their “own” regulatory norms to relations with other partner states. In this sense, there is an even more pronounced risk of “regulatory imperialism” resulting from the provisions of the TTIP than there is from the TTP agreement.

This problem might find resolution, first, by developing optimal negotiating strategies for each of the issues involved in Russia’ future regulatory cooperation with the EU and U.S., and second, by searching for suitable frameworks for reaching agreements with them. Although it is possible that only a skilled prognosticator could predict how those goals might be achieved with regard to the U.S., there is a very real possibility that, over the long term (10-15 years), Russia and the EU could return to the idea of agreeing on a system for lowering trade and investment barriers. Paradoxically, the substance of current TTIP negotiations suggests that the final agreement could actually make it easier for Russia to conclude a new agreement with the EU on favorable terms. A number of other factors also exist indicating that regulatory changes associated with the TTIP could indirectly contribute to advancing Russia’s interests in its relations with the EU, and to a lesser extent, with the U.S. What are these factors?

First, in their efforts to remove trade barriers, the U.S. and EU are more likely to develop mechanisms for officially recognizing each other’s technical, sanitary, phytosanitary and other standards than they are to harmonize, much less unify those standards. Their ability of the two sides to create mechanisms for determining the conformity of assessment procedures, certification, monitoring, and so on could set an important precedent while serving as a model for others. It is well known that one of the main “stumbling blocks” in discussions on creating a “single economic space from Lisbon to Vladivostok” has been differences over approaches to coordinating regulatory practices. The EU sees it as a process by which Russia accepts European technical standards, while Russia expects the mutual recognition of EU and Eurasian Economic Union standards. The Russian position openly contradicted the decades-old European belief in the exclusivity of EU standards in its relations with foreign partners. However, if the TTIP includes the principle of mutual recognition of standards, it will deal a significant blow to that exclusivity and the ingrained belief in it.

Second, TTIP negotiations have threatened another “sacred cow” of the EU – the so-called “precautionary principle” by which those who develop and employ technologies must prove that they are safe for consumers and the environment. The problem is that the U.S. applies the opposite principle and requires those who are opposed to the use of specific technologies must provide proof that they are harmful. The sharp clash between these opposing approaches blocks further progress in negotiations on a wide range of issues – from trade in food and chemical products to the development of shale deposits of hydrocarbons. And although the EU is unlikely to make concessions in such sensitive areas as the production of, and market access for GMOs, it is quite possible it will be more flexible in other areas. One example is the infamous Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) policy the EU adopted in 2006, and that has since caused signi?cant problems for Russian exporters of chemical products. One can only wish good luck to U.S. chemical industry lobbyists who have pushed in recent years for a revision to REACH provisions as part of negotiations on the TTIP agreement. If their efforts prove successful, Brussels will have little chance of retaining so odious a protectionist tool, one that was borne of the joint “creative” efforts of European chemical companies and the ideologically motivated “green lobby.”

Third, the TTIP might result in limits to the scope of agricultural subsidies in the EU and U.S. That prospect has sparked active debate between agricultural lobbyists who are predictably critical of such a prospect, and the expert community that views it as beneficial to consumers. With regard to Russia’s interests, the limiting of subsidies would reduce the artificial competitive advantage enjoyed by EU and U.S. food products. That could lend additional economic justi?cation to the policy of import substitution and enable Russian agricultural producers to expand their presence in foreign markets.

Finally, TTIP regulatory reform could also have a positive impact on specific Russian economic interests. Take, for example, the possibility that Europe might ease its standards – once again, under U.S. pressure – for controlling products based on their region of origin. The producers of Russian champagne, Moscow region parmesan cheese, and Kizlyar cognac would clearly stand to gain from such a scenario.

It is also important to note that all of the above-mentioned regulatory changes could one day find a place in the formulation of universal agreements concerning trade and investment regulation – particularly within the framework of the WTO negotiating process. The other side of that coin is that the aspects of the “WTO+” regime of the TTIP that are least appealing for Russia could become incorporated into multilateral international agreements. Moreover, many observers question whether the WTO will become a “super?uous” organization in the face of the growing regulatory might of the TTIP and TPP. How will events develop further? That is an important issue worthy of special consideration.

The TTIP, Geopolitics, and Prospects for Managing Global Economic Processes

The impact that the TTIP would have on the international architecture of economic regulation remains one of the most hotly debated questions today. There is a wide range of views on the subject – from the belief that the TTIP and TPP will sound the “death knell” for the WTO, to the conviction that the TTIP and TPP are strictly based on WTO norms and that the innovations they introduce could serve as a model for new initiatives aimed at reviving the stalled Doha Round of WTO negotiations. Regarding the first view – in which the multilateral system of foreign trade regulation is replaced by a U.S.-centric system of regional trade and investment blocs – former U.S. Secretary of State Hillary Clinton aptly described it as an “economic NATO,” and U.S. President Barack Obama famously remarked that the TPP would enable the U.S., and not China, to play the role of global trade leader. At the same time, the latter interpretation is not without merit.

Ever since the 1990s, agreements akin to traditional free-trade areas (FTAs) – with their elimination of mutual barriers to trade and services, and reduction of investment barriers according to differences in national regulatory standards – have come to dominate regional economic cooperation. They outnumber regional associations based on deeper cooperation and integration involving the creation of Customs Unions, common markets, and economic and monetary unions. The new formats, commonly referred to as “FTA+,” proved to be ideal for agreements between countries with different levels of economic development and/or that take different approaches to regulating various aspects of economic life. In both cases, differing economic interests make it impossible to adopt the uni?ed economic regulation norms characteristic of more fundamental forms of integration, yet do not prevent the countries from eliminating barriers to cooperation in those areas where they share the greatest common interest and/or from exchanging concessions to their mutual advantage. In matters governed by WTO rules, the parties to such agreements traditionally adhere to the relevant norms, building on them with their own strategies for achieving highly liberalized mutual economic relations. At the same time, in areas where WTO norms do not apply, they independently formulate their won regulatory standards for cooperation – according to the principle of the “WTO+.” Although the TTIP and TPP have taken that approach to an unprecedented level of regulatory scope, the basic approach remains unchanged: wherever possible, “the WTO takes precedence” in matters concerning the liberalization of trade, while participants simultaneously develop their own norms and rules in areas outside the competence of the WTO.

Could this process lead to the “decline and disappearance” of the WTO? That prospect seems unrealistic at present. This is first because, as mentioned above, agreements in the “FTA+” format are themselves based on WTO norms. Second, even if WTO mechanisms are unable to provide for the further incremental liberalization of international trade, they are still crucial for maintaining the level of liberalization already achieved and for resolving trade disputes. Thus, it is too early to write off the WTO.

It is also of no small importance that the TTIP affects only a modest share of global trade. In fact, published assessments stating that the TTIP will have regulatory consequences for more than 30% of world trade in goods and more than 40% of the trade in services is based on a purely mechanical and groundless calculation of the value of trade between EU countries.

Trade between the U.S. and EU, on the other hand, is signi?cantly more modest in scope. According to WTO statistics, EU exports to the U.S. represented just 2.3% of the global export of goods in 2015. Exports from the U.S. to the EU that year were even less – only 1.5% of global exports. Their share of the global exports of services was only slightly higher – just 3.1% and 4.1% respectively. These are clearly not indicators on which to build a global international trade regime without the support of an effective structure of global regulation – a function that the WTO currently performs.

In this connection, it is necessary to consider an important paradox. To the extent that the U.S. intends to use the WTO to promote the TTIP and TPP regulatory norms more widely, Washington might be doing itself a disservice by employing geopolitical rhetoric intended for domestic voters. Under current conditions, con?dently presenting the TTIP and TPP as projects for cementing U.S. leadership to the detriment of other participants in the global system could raise concerns that Washington is creating a “sel?sh hegemony” – not only among countries left on the sidelines of the TTIP and TPP, but also among a number of actual and potential participants in those agreements, including the EU political elite. If that happens, any hopes for including TTIP and TPP norms in the system of WTO agreements would prove futile.

On the other hand, if the U.S. plans to extend the scope of the TTIP and TPP regulatory norms “without the WTO” – that is, by inviting new countries to sign those agreements and by imposing those norms on other partners by use of bilateral trade and investment agreements – that strategy will inevitably leave signi?cant niches untouched in which bilateral trade and investment relations will be carried out beyond the regulatory purview of the TTIP and TPP. And because the economy, like nature, abhors a vacuum, it is very likely that those niches will be ? lled with regional projects initiated by countries that are not very enthusiastic about the prospect of a U.S. hegemony in global economic regulation. Under such conditions, the WTO would serve as linchpin keeping the global trade regime from slipping into a bitter rivalry between alternative regional projects.

Possible strategies for responding to the challenges

Every time a new challenge arises in the global economy that stems from the behavior of players on which a given country cannot exert any effective in?uence, that country must choose between fighting the problem and adapting to it. The nature of the final choice often depends on who is making it, with members of the political elite usually preferring to fight the challenge, and the economic elite preferring to adapt to it. Russia’s strategy for combating the negative effects of the TTIP calls first for intensifying efforts to implement its own regional projects – primarily deepening integration of the Eurasian Economic Union and speeding up negotiations on preferential agreements with countries that remain outside the orbit of the TTIP and TPP. As a future element of that strategy, Russia might actively use WTO mechanisms to challenge the actions of the EU and U.S. that are aimed at applying norms and regulations of the TTIP to Russia that run counter to its interests.

The strategy of adaptation, on the other hand, involves evaluating the future TTIP agreement and considering ways its provisions could be used to improve the regulatory regime in Russia, to further liberalize trade and investment relations among EAEU and friendly CIS countries, and in the long term, within the framework of negotiations for a new agreement on economic cooperation with the EU. As shown above, a number of issues addressed during the formulation of the TTIP could lead to approaches that would strengthen Russia’s negotiating position in its interactions with the EU. Because overall direct economic loss to Russia from the implementation of the TTIP would probably be minimal, it is most important to search for ways to compensate speci?c sectors that might suffer the greatest losses from the effects of trade diversion. In particular, in a best-case scenario, Europe would reconsider its REACH regulations, thus minimizing losses to Russian producers of chemical products, and the U.S. and EU would reduce the scope of their agricultural subsidies, thereby strengthening the position of Russian producers of food products and agricultural raw materials.

The best reaction to the challenges associated with the formation of the TTIP would include a combination of the two strategies described here. The form that combination takes will largely depend on the outcome of negotiations on the TTIP. In fact, the U.S. and EU still hold fundamental differences over food safety, technical standards, agricultural subsidies, environmental protections, investment, and intellectual property, casting a significant degree of uncertainty over not only the substance of the TTIP agreement, but also the prospects for its ?nal adoption – and especially its rati?cation. The situation is complicated further by the institutional crisis in the EU that has erupted with renewed force with the possibility of Great Britain leaving the EU and the imminent departures of the U.S. and German leaders who, in recent years, have served as the main standard-bearers of the TTIP ideas. The only absolute certainty is that the implementation of the TTIP carries with it no disastrous consequences for Russia, and that if and when it is ever signed, Russia will have suf?cient time to mount the best possible response.

Valdai International Discussion Club