The 2007-2008 global financial crisis marked a milestone in redefining the international balance of power. The black-and-white picture of the world taken at Bretton Woods in 1944, which had only been marginally retouched in the following decades, started to rapidly fade as the world slipped into the “Great Recession”. The Bretton Woods system, which appeared to have emerged victorious from the momentous changes of the Nineties, suddenly came to be perceived as both economically unsustainable and politically unacceptable.

Emboldened by extraordinary economic growth rates, some emerging economies have become increasingly vocal in their request for an overhaul of the Bretton Woods institutions, in the direction of a reform of their governance system that would mirror the new balance of power at the global level and account for their new policy preferences. After the crisis, some of their political requests were met swiftly: by late 2008, the main forum to discuss global economic matters switched from the G7 to the G20. Following G20 inputs in 2008, the spotlight was put on the reform of countries’ voting power in the IMF. However, impetus towards reforms was to prove short-lived, and today institutional reforms seem to have come to a halt.

In this paper, we argue that the deadlock in reforms should not be regarded as a “free for all” on political commitments at a global level. There is still much that countries can do, not least because national contributions to “global public goods” could set the example and reignite the stall ed reform process itself. For Russia, in particular, the current period is crucial to adjust the role that the country is set to play at the international level, by defending and re-launching the provision of global public goods in the years to come.

The quest to prioritize “global public goods”

In the decades before the crisis, global economic governance had become ever less representative of the international balance of economic power, in terms both of policy coordination and international regulation, as most decisions were increasingly taken by small networks outside formal global governance institutions [1].

In recent years, the balance of global economic power, both in terms of GDP and in ternational trade, has become ever more dispersed, and multilateral institutions that had been created in a different era – and, to some extent, for different purposes – have been increasingly requested to acknowledge these changes in order to function effectively. This rebalancing in economic and political power originates an urgent need to identify the nature of “global public goods” that countries expect the global financial and monetary system to pursue, uphold and defend.

From G20 declarations, it is clear that the main objective recognized by all participants is the protection of a strong, stable and balanced economic growth, from which every country can benefit. However, in order to achieve the “growth goal” a number of ancillary tasks has consistentl y appeared in in G20 declarations between 2008 and 2014. These are:

- A stable international financial system;

- Responsible use of monetary policy (responsive to domestic conditions, but avoiding to destabilize capital flows at the international level);

- Fiscal sustainability in the long-term, without refraining from stimulating depressed economies in the short-term;

- Preservation of an open global economy, preventing protectionist moves or addressing them at an early stage;

- Reform of the Bretton Woods institutions [2].

In declarations, however, such tasks appear to be listed without a clear -cut and consistent ranking. In fact, IMF reforms seem to have preceded most of the abovementioned steps as far as the actions of political leaders are concerned. Moreover, tasks are set by national governments and are “country — owned” only, meaning there is no enforcement mechanism at an international level that can monitor, let alone enforce, such measures.

Our argument is that G20 leaders should reach an agreement about the priority to give to each of these important objectives and interpret them, at least to some extent, as “ global public goods”. If all the listed objectives are conceived as subservient to the overarching goal of ensuring that the global economy grows, and does so, as much as possible, in an equitable manner and keeping risks to a minimum, it is urgent that they are pursued with a coherent strategy, a clear timetable, and an effective monitoring mechanism. Ultimately, the reform of the Bretton Woods institutions should be consistent with each country’s current and prospective contribution to global growth, seen as the most important global public good.

Contributing to global public goods: priorities and tools

a) Monetary policy

At the 2008 Washington summit, G20 leaders traced back the roots of the crisis to “inconsistent and insufficiently coordinated macroeconomic policies” [3]. Given that fiscal policies coordination is not in sight, at least in the near future, the question then arises: is global coordination of monetary policies feasible, or even desirable?

A way to address this question is to consider how rapidly the conventional wisdom about monetary matters has evolved since the beginning of the global financial and economic crisis. Until 2007, central banks tended to treat bubbles with benign neglect: they were hard to detect and harder to deflate, so better to leave them alone; the mess could be mopped up after they burst [4]. Today, no central bank would admit to such benign neglect any longer.

A related debate has to do with the effectiveness of monetary policy and its role in the crisis. Two starkly different views, stemming from very different theoretical traditions, seem to be defending the very same argument, i.e. that monetary policy is largely ineffective in the face of looming macroeconomic imbalances of a global scale [5]. This is just one of many unresolved tensions over the utility and the scope of monetary policy in the current post-crisis scenario [6].

These still-open debates in the scholarly community frequently spill over to the policymaking community as well. International leaders find themselves at cross-purposes over the conduct of monetary policy, and it is not infrequent that they accuse each other about whether to take a certain decision or do nothing. In short, G20 leaders should commit to further studying monetary issues in order to clarify what objectives of monetary policy should be pursued, by which countries, how, and when.

b) Exchange rate policy and the role of currencies

On issues regarding the role of exchange rates and currencies, the debate seems to be somewhat more settled, and more focused on the role currencies can and should play at the global level than over which exchange rate regime is preferable in order to stabilize countries and the aggregate world growth potential [7].

G20 countries have been debating at length the role some national currencies play in the current international monetary system, which sets them apart from the rest because they can a ct as global reserve currencies (the dollar) or as potential competitors (the euro or, more recently for some, the yuan). Supporters of the reduction of global imbalances have long advocated for selected currencies to play a more dynamic role – e.g. acting as potential reserve currencies – thus switching from a dollar-dominated world to a “multipolar reserve currency system” [8]. This call is usually complemented with the request to improve the role of the IMF’s Special Drawing Rights (SDRs) as a reserve currency in the international monetary system. This is an important case in point in our argument for pairing reforms in Bretton Woods institutions to each country’s contribution to the supply of “global public goods”.

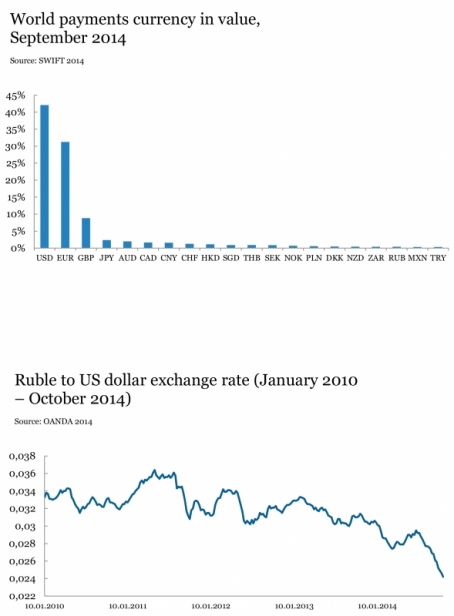

The current IMF criterion for including currencies in the SDR basket and the weight to give to each of them is “the relative importance of currencies in the world’s trading and financial systems” [9]. According to the global financial transactions system, SWIFT, by September 2014 the dollar was still the first currency used to settle international payments worldwide, while the euro was a strong second. As a comparison, the yuan was 7th, while the ruble was 18th (see Fig. 1). Since there are more than 150 currencies in the world, the ruble’s 18th place is anything but negligible, but the recent rise of the yuan begs the question of the future role – and weight – of the ruble in the international monetary system. It seems that the ruble does not aspire to be seen as an international reserve currency per se. In this regard, it would be wise to distinguish between a currency’s international role in settling world payments, and its role as a “followed” currency in a specific regional monetary system.

In the latter case, the ruble seems to be an important benchmark for most Post -Soviet countries in Eastern Europe, Central Asia, and the Caucasus. The recent slide in the ruble’s value (see Fig. 2) is having a significant impact on many countries that depend on Moscow for remittances or imports, especially in Central Asia [10]. The role of the Russian ruble as a potential regional reserve currency has attracted a lot of interest as of late, and deserves further analysis [11].

Stalled IMF reforms and the rise of alternative institutions

If global coordination of monetary policies seems to be far off in the horizon, a collective contribution to the stability of currency markets appears feasible and desirable. Our proposal is that the more countries agree to take up a role on global currency markets, contributing to its reform and stability, the more they should be ‘rewarded’ in terms of their place in global economic governance institutions.

In the meantime, even recent IMF reforms may turn out to be insufficient if compared to the shift in economic power that has occurred in the last two decades. At a first glance, the proposed 2010 Seoul package of IMF quota and governance reforms appears quite impressive. The package includes:

- The doubling of IMF quotas (from SDR 238 to SDR 476 billion, at the moment equivalent to $730 billion) and a reallocation of quota and voting shares. Under the agreement, for example, China would move from 6th to 3rd place in IMF quotas and voting rights. Russia, on the other hand, would see its role restored: after losing out in the 2008 reform package, which saw Russia’s quota shares decrease from 2.73% to 2.49%, the most recent reform would bring its quotas back again to 2.71%;

- Amending the IMF Articles of Agreement to establish an all-elected executive board. Currently, the 5 IMF members with the largest quotas (US, Japan, Germany, France, UK) are entitled to appoint an executive director. The voting power of Russia, China, and Saudi Arabia is already sufficient to allow each of them to elect their own executive director. The remaining 16 seats are formally contested, but the outcome is normally pre-negotiated;

- A political agreement that the “advanced” European countries would reduce their representation on the 24-person executive board from the actual 8/9 seats by 2 seats.

At closer inspection, however, the current reforms imply just a 5.6% global realignment in terms of quotas, and an even slimmer 5.4% realignment in voting shares. Advanced economies would lose some ground, but would still retain 57.6% of quota shares (and 55.2% of the votes) [12].

Moreover, at Seoul it was agreed that IMF reforms should be in place by November 2012. But, as of November 2014, they still have to be ratified by the US Congress, which repeatedly failed to do so – most recently last March [13]. The still-pending US Congress ratification is also delaying the start of the next round of IMF reforms, which has currently been put on hold.

The current deadlock is comprehensibly frustrating, especially for BRICS countries. On 15 July this year, BRICS countries launched the New Development Bank (with a ca pital of $50 billion) paired with a Contingent Reserve Arrangement (with a capital of $100 billion). Unlike the IMF and World Bank, the New Development Bank assigns one vote to each country irrespective of its quota share, with no country holding veto power.

Although the BRICS are a heterogeneous group of countries, and some of them are wary of the possibility that China would come to financially dominate the group, the mere fact that BRICS countries managed to agree upon alternative institutions to the WB and the IMF is of legitimate concern for those interested in assessing the state of global governance institutions [14].

Global economic governance: room for change

Expanding on the line of reasoning advanced in the previous paragraphs, what follows is a brief proposal aimed at returning the G20 to its crucial role in the current global economic governance system, coupled with some policy implications for Russia:

- G20 leaders should prioritize objectives and act upon the recognition that their main mission is to increase the growth potential of the world economy, while at the same time guaranteeing its sustainability in the long run;

- G20 leaders should recognize that the scholarly and political consensus over how to address monetary and currency issues is consolidated in some areas, whilst lacking in othe rs. Consequently, leaders should strive to agree upon a least common denominator over which to establish what policies are best suited to reach a strong and stable economic growth;

- On the basis of a clear understanding of the main objectives of G20 summits and of the tools at the disposal of officials, G20 leaders should reach a political agreement/compromise over country — or group-specific priorities, clear timetables should be agreed upon, and a monitoring mechanism should be put in place;

- The reform of Bretton Woods institutions, and chiefly the IMF, should be directly and strictly linked to the achievement of country-specific priorities, as also confirmed by independent officials from the monitoring mechanism. The rationale is that the more a country contributes to global public goods, the more it should benefit from voice and representation in the institutions presiding over international economic governance;

- Within said timetable of country-specific priorities, European Union countries will have to consider the option of speaking with a single voice in the IMF, and consent to the progressive reduction of their relative quotas (and, therefore, voting power);

- At G20 meetings, the Russian government may further stress the role the ruble serves as a regional currency, and work to have that role acknowledged. The ruble acts as a facilitator of currency flows among Post-Soviet states, and therefore plays an important role in safeguarding growth in Central Asia, the Caucasus, and Eastern Europe;

- By establishing alternative institutions to the World Bank and the IMF, an effort should be made by BRICS countries, including Russia, to design such institutions as regional complements, not as direct competitors in matters concerning global issues. These count ries should recognize the fact that the best way to go beyond the current formal balance of power within the Bretton Woods institutions is to push harder for their reform, not for their replacement.

These recommendations are ambitious and their implementation may prove anything but easy. However, a key concern of G20 leaders should be to escape the fate of a paralysis of international institutions and, at the same time, prevent a ‘spaghetti bowl’ effect. These results may be, in the long run, beneficial to no one. By contributing to avoid them, Russia could see its role as a partner in reforming and upholding international institutions strengthened and, as a positive ‘side -effect’, this may also ease the current political tensions over the Ukraine affair.

Valdai International Discussion Club

[1] We approach the problem of coordination in international monetary governance from an international political economy point of view, as we believe that, contrary to efforts that aim at depoliticizing the management of money, monetary phenomena are for all intents and purposes political, see Walter (1991), World Power and World Money: The Role of Hegemony and International Monetary Order, St. Martin’s Press, New York.

[2] G20 (2008), “Declaration of the Summit on Financial Markets and the World Economy”, 15 November 2008, Washington D.C.; Saint Petersburg; G20 (2014), “G20 Leaders’ Communiqué” and “Brisbane Action Plan”, 16 November 2014, Brisbane.

[3] G20, “Declaration of the Summit on Financial Markets and the World Economy”, 15 November 2008, Washington D.C.

[4] The Economist, “Monetary policy and asset prices”, 21 June 2014.

[5] On the one hand, see Alan Greenspan, Financial Crisis Inquiry Commission, Testimony of Alan Greenspan, 7 April 2010, available at: http://fcic-static.law.stanford.edu/cdn_media/fcic-testimony/2010-0407-Greenspan.pdf. On the other, see the debate over the so-called Triffin dilemma: Padoa Schioppa (2010), “The Ghost of Bancor: The Economic Crisis and Global Monetary Disorder”, Triffin Lecture, Louvain-la-Neuve, 25 February 2010; Bini Smaghi (2011), “The Triffin Dilemma Revisited”, Speech at the Conference “The International Monetary System: Sustainability and Reform Proposals”, Triffin International Foundation, Brussels, 3 October 2011.

[6] On the focus between output and inflation, see Blanchard, Romer, Spence, Stiglitz (2012), In the Wake of the Crisis: Leading Economists Reassess Economic Policy, MIT Press, Cambridge; De Grauwe (2011), “Animal spirits and monetary policy”, Economic Theory, Vol. 47, n.2-3, pp. 423-457. On the spillover effects of national monetary policies, especially of monetary policy choices in advanced countries and their impact over developing countries, see Burns, Kida, Lim, Mohapatra, Stocker (2014), “Unconventional Monetary Policy Normalization in High-Income Countries: Implications for Emerging Market Capital Flows and Crisis Risks”, World Bank, Policy Research Working Paper 6830.

[7] Exchange rate arrangements are not treated here, but a large literature on “dirty float” and mixed regimes suggests that the debate over the optimal mix between fluctuation and fixed exchange rate is still far from being settled, see e.g. Gagnon (2011), Flexible Exchange Rates for a Stable World Economy, Peterson Institute for International Economics, p. 9

[8] Zandonini (2013), “Multiple Currencies for a Multipolar World: All Change… Or Not?”, Chatham House; Dailami, Masson (2009), “The New Multi-polar International Monetary System”, World Bank Research Working Paper, n. 5147.

[9] IMF (2014), “Factsheet – Special Drawing Rights”, 25 March 2014

[10] D. Trilling, T. Toktonaliev (2014), “Central Asia pays the price for Russia’s tumbling ruble”, The Guardian, 29 October 2014.

[11] S. Narkevich, P. Trunin (2013), “Prospects of the Russian Ruble as a Regional Reserve Currency: Theoretical Approach”, Working Paper, SSRN

[12] IMF (2012), “Quota and Voting Shares Before and After the Implementation of Reforms Agreed in 2008 and 2010”, p. 1.

[13] With 17.7% of the quotas, the US is by far the largest shareholder of the Fund, retaining veto power in the most important issues (i.e. those requiring 85% of total votes to pass, as the US detains 16.75% of voting shares).