For citation, please use:

Dubinin, S.K., 2022. Russia’s Financial System under Sanctions: Logic of Confrontation. Russia in Global Affairs, 20(4), pp. 82-102. DOI: 10.31278/1810-6374-2022-20-4-82-102

At the beginning of the second decade of the 21st century, the Russian economy is facing a series of emergencies and challenges. Both internal and external conditions for the country’s development have worsened drammatically. In 2020-2021, the COVID-19 pandemic necessitated national sanitary restrictions of an unprecedented scale. In 2022, the special military operation in Ukraine has also created a new situation on the European continent, unexpected for most economic practitioners and theoretical experts. However, oddly enough, some consequences of these dramatic events have certain common features. Firstly, there has been an economic slowdown over the past several years, to be followed by a recession or zero GDP growth. According to the World Bank’s projections for 2022, the post-crisis GDP recovery rate in developed countries is expected to drop to 2.6% and decline further in 2023 (World Bank, 2022). Currently, it is accompanied by a sharp acceleration of inflation. Secondly, ESG standards and the concept of sustainable development have been put on hold. Priorities are changing in the system of international economic and political relations. Emerging markets, such as the BRICS group, are seeking the role of independent centers of economic growth, which creates new contradictions and tensions with the old leaders. Therefore, thirdly, the world order established over the past decades is heading for chaos. Universal international organizations, primarily UN institutions, are losing influence. Unilateral actions of ambitious states or their coalitions are inevitably taking center stage.

ECONOMIC SANCTIONS AS A FOREIGN POLICY TOOL

The use of economic sanctions for political purposes has become a striking manifestation and an important tool of foreign policy voluntarism. At the same time, it is political tasks that have the highest priority. Russian and foreign experts use more or less the same approaches and characteristics in their analyses. For example, RIAC Program Director Ivan Timofeev and his colleages, referring to Western scholars (namely, Hufbauer, Schott and Elliott, 2007), write: “Economic sanctions imply that the initiator country creates conditions under which economic damage, lost profit, and their consequences for society and the political system make it unbeneficial to go on with the political course and make the target country give in to the initator country” (RIAC, 2020, p. 13). Richard Nephew (2017) “provides a useful guide for designing effective sanctions, including: (1) clearly identify the objective; (2) understand the target’s vulnerabilities and its ability to absorb pain; (3) develop a strategy for focusing pain and weakening the target’s resolve; (4) continuously refine the strategy; and (5) clearly state the conditions for removing sanctions” (cited by Berner et al., 2022).

The sanctions imposed on Russia in 2022 pursue several political goals: (1) short-term: a ceasefire in the special military operation in Ukraine and the creation of negotiation positions that would be as favorable for Ukraine as possible; (2) long-term: forcing Russia to give up its confrontation with NATO. U.S. Secretary of Defense Lloyd Austin said at a news conference in Poland: “We want to see Russia weakened to the degree that it can’t do the kinds of things that it has done in invading Ukraine. It has already lost a lot of military capability and a lot of its troops, quite frankly, and we want to see them not have the capability to very quickly reproduce that capability” (Washington Post, 2022).

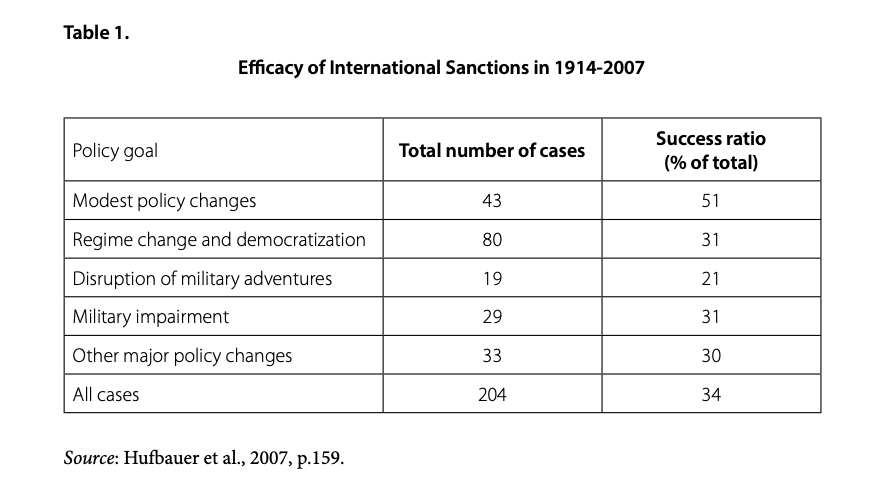

Achieving all or even most of these goals is unlikely. The practical experience of imposing economic sanctions proves their low effectiveness in attaining foreign policy goals. A team of authors who wrote a well-known book on this topic, led by Gary Hufbauer and his colleges, proposed a way to assess the economic sanctions imposed in 1914-2007, focusing on their political side (Hufbauer et al., 2007, p. 159).

The minimal result in stopping hostilities was achieved only in one-fifth of all cases. In practice, two other tasks are much more important: one is a foreign policy one, that is, to send a signal to the opponent about the firm position of the coalition of countries that initiated the sanctions; and the other task is a domestic political one, namely, to consolidate society “around the flag” and ensure mass support for the leadership of the initiating countries.

Under three U.S. administrations over the past two decades, the imposition and manipulation of sanctions has become one of the main foreign policy tools in America. There is a bipartisan consensus that the American government needs to single out a group of rival countries and use sanctions against them. This approach was enshrined in the U.S. National Security Strategy 2017. It listed China, Russia, Iran, and North Korea among such countries (White House, 2017).

This policy was further elaborated in the NATO Strategic Concept (NATO 2022 Strategic Concept), adopted at the alliance’s summit in Madrid on June 28-30, 2022. “The Russian Federation is the most significant and direct threat to Allies’ security and to peace and stability in the Euro-Atlantic area,” the document says (Strategic Concept, 2022). China’s foreign policy was also given a hostile interpretation (Gamza, 2022).

In the United States, unilateral sanctions can be imposed either by legislators (a bill passed by Congress and signed into law by the President), or by an executive order of the President. Responsible for enforcing sanctions is the U.S. Treasury Department, and specificially its Office of Foreign Assets Control (OFAC). There is yet another unit within the Treasury Department—Terrorism and Financial Intelligence (TFI)—whose task in regard to Russia is to coordinate the sanctions policy.

The general framework for sanctions was created immediately after the reincorporation of Crimea and Sevastopol into Russia. In March 2014, U.S. President Barack Obama signed a series of Executive Orders (13660; 13661, and 13662), which introduced restrictive measures against individuals and legal entities related to the situation in Ukraine, and which also imposed sectoral restrictions and blocked property (OFR, 2014). On their basis, SDN and other lists of enterprises and individuals subject to sanctions were drawn up. On December 19, 2014, President Obama signed Executive Order 13685 “Blocking Property of Certain Persons and Prohibiting Certain Transactions With Respect to the Crimea Region of Ukraine” (OFR, 2014).

In 2017, Russia was accused of interfering in the presidential elections in the United States, which led to the adoption of the Counteracting America’s Adversaries Through Sanctions Act (CAATSA PL115-44), signed into law by President Trump. It equated Russia with North Korea and Iran, and widened the grounds for applying sanctions, making them long-term.

The gradual imposition by the collective West of an unprecedented number of sanctions against Russia in response to the start of its special military operation in Ukraine demonstrates an escalation of confrontation during an international conflict. Its participants are increasing mutual pressure, seeking to undermine each other’s combat readiness and morale. Priority is given to short-term goals, which prevail over strategic long-term consequences. The purpose of this tactic is to maximize immediate damage to the adversary.

FINANCIAL SANCTIONS

Financial sanctions play a particularly important role among unilateral measures designed to influence the target state. “The leading sanctions are financial. At the top of the list are the effective freezing of assets held abroad by Russia’s central bank and selected Russian commercial banks, and the exclusion of most Russian intermediaries from the SWIFT messaging system” (Berner et al., 2022).

Tracking financial flows in international and national markets by specialized government institutions—regulators—is a well-established practice in the modern world. Therefore, control over compliance with financial restrictions imposed on companies, banks, politicians, and businesses appears to be a pretty much feasible task. In addition, sanctions on certain payments and settlements automatically limit the business activity of economic agents and households in all sectors and spheres of life. Restrictions on international payments are an effective way to exert sanctions pressure on both imports and exports. Financial sanctions affect the movement of capital across national borders to an even greater extent.

As of February 25, 2022, Russia’s international reserves stood at $629.4 billion. According to experts, the Russian Central Bank’s assets worth about $300 billion were frozen. The Bank of Russia explained its position regading changes in the structure of international reserves before the conflict. It had taken into account two possible types of crisis: a traditional financial crisis and a geopolitical one. In the former case “…We need to keep reserves in the currencies of the countries with which Russia actively trades and in whose currencies the debts of companies, banks, and the state are denominated. These currencies are predominantly U.S. dollars and euros.” In the latter case, “In order to counter a geopolitical crisis, we will need reserves that cannot be affected by Western sanctions.” This is why the Bank of Russia had increased the share of gold and the Chinese yuan in its reserves, bringing them to almost half of the total (Abalakin, 2022). Also, after the freezing of Russia’s reserves in dollars and euros, Russia adopted retaliatory measures, imposing restrictions on the movement of capital, banned the sale of securities by foreign investors, and prohibited the withdrawal of funds from the Russian financial system. Corporate and government payments to debt holders from unfriendly countries will only be made with the permission of the relevant government commission. Foreign investments in Russia are currently being offered by their owners to Russian residents at minimum prices or are subject to external Russian management. Russian investments abroad in some cases have been frozen and threatened to be seized.

The sustainability of financial institutions should guarantee not only the potential for economic development, but also the very preservation of the social organism of a country. The first measures taken by the Russian Central Bank after the start of the special military operation in Ukraine and the announcement of financial sanctions by the United States and European countries were predetermined by the need to prevent a panic reaction to these events among people. A number of credit institutions faced the risk of a chain reaction of bankruptcies, which could have crippled the entire banking sector. It was necessary to convince bank clients to keep their savings in banks and to prevent a massive transfer of foreign currency abroad. By raising the key rate to 20% and introducing currency control measures, the Bank of Russia solved these priority tasks.

The use of foreign currency was limited both by the decisions of the Russian government and the Central Bank (the export of capital abroad needs to be authorized by a special commission) and by the countries that imposed the sanctions and blocked correspondent accounts of Russian banks. With the current balance of payments, when export revenue exceeds imports by 50%, the foreign exchange market cannot be balanced on the basis of the market price (official exchange rate). The Central Bank’s decisions de facto terminated the free exchange of the ruble.

In the following months, these restrictions were eased. The Bank of Russia quickly lowered the key rate to 9.5% (resolution of the Board of Directors of June 10, 2022) and loosened restrictions on the foreign currency transfer by individuals to foreign banks abroad. In practical terms, there are now multiple exchange rates of the ruble for different transactions. The official exchange rate of the ruble has grown too much, but remains fluctuating. However government officials insist it needs to be lowered.

The exclusion of Russia from the world capital market has affected the development of the national financial market. In 2021, foreign investors (non-residents) controlled 20% of Russia’s federal loan bonds market and about a half of its stock market. The Central Bank’s analytical report reviewing the financial market in 2021 said: “The average share of individuals in stock trading in recent years has been about 40%, and that of non-residents is about 50%” (Bank of Russia, 2022d., p. 44).

As a result of the restrictions and the falling capitalization of the securities market, the work of the Moscow Exchange has become an imitation of the stock market. According to the Bank of Russia, after a break in the work of the Moscow Exchange and the subsequent trade resumption at the end of March 2022, individual investors “assumed a predominantly wait-and-see attitude, keeping their investments in Russian assets (net sales amounted to only five billion rubles).” Retail investors purchased about 50 billion rubles’ worth of shares daily on the Moscow Exchange before the start of the special military operation in February, but this amount dropped to less than ten billion rubles in April 2022 (Bank of Russia, 2022е, p. 26).

Russian corporate equities were sold en masse by non-residents in the depositary receipt markets on the London Stock Exchange. “As a result, depreciated shares began to be massively excluded from the leading international stock indices, which practically meant an indirect ban on investment in them by major foreign institutional investors” (Russian Economy, 2022, p. 95).

Russia’s external debt at the beginning of 2022 stood at $59.7 billion, including $39.1 billion in bond loans, versus $56.7 billion and $38.2 billion, respectively, a year earlier (Russian Economy, 2022, p. 63). After Russia had paid the holders of sovereign dollar bonds, these securities traded on the world market with a 40% yield to maturity.

On May 25, 2022, the U.S. Treasury Department’s General License 9C, which allowed the holders of Russian sovereign bonds to receive interest and maturity payments, expired. The U.S. Treasury decided against renewing it. A week earlier, on May 18, 2022, U.S. Treasury Secretary Janet Yellen said: “If Russia is unable to find a way to make these payments, and they technically default on their debt, I don’t think that really represents a significant change in Russia’s situation. They’re already cut off from global capital markets” (CNN Business, 2022). In turn, Russian Finance Minister Anton Siluanov said that in order to receive payments on the national debt in the original currency, an investor would need to open a foreign exchange and a ruble accounts in a Russian bank and issue orders for the sale of foreign currency… This will make it possible to establish direct interaction with the foreign holders of our securities inside the country (Russia) (Grinkevich, 2022).

The problem of settlement and payment transactions by both Russian importers and exporters has not been resolved so far. When servicing their clients, Russian banks use multi-stage transactions with partner banks that are not under sanctions. The Russian leadership’s attempts to expand the use of the Russian ruble and the national currencies of friendly countries in external trade have proved helpful primarily within the EAEU. On July 20, 2022, Eurasian Economic Commission Official Respresentative Iya Malkina said that payments in the national currencies of the EAEU member states in mutual settlements had reached 73.5%. “According to expert estimates, it can grow to 80% this year,” she added (Prime Press, 2022).

The People’s Bank of China is working to promote the digital yuan in international settlements, which can be viewed as a step towards making it a global reserve currency. The IMF has included the Chinese yuan in the basket of key currencies. As of the beginning of 2022, the share of the U.S. dollar in the international reserves of central banks was estimated at 58.8%; the share of the yuan was 2.8% (Aleinikova, 2022). On June 22, 2022, Russian President Vladimir Putin said work was underway to create an international reserve currency based on a basket of the BRICS countries’ national currencies. Russia’s trade turnover with the grouping’s member-states in the first quarter of 2022 grew by 38% to $45 billion (Gereykhanova, 2022).

SANCTIONS PRESSURE ON THE BANKING SECTOR

The Russian financial system remains stable. However, there is a number of threats and challenges, a response to which is not obvious. There is a real risk of gradual contraction and breakdown of financial institutions and markets. Mutual distrust and lack of confidence in the ability of counterparties and business partners to fulfil their obligations have become a serious problem for all sectors of the economy.

It should be borne in mind that it is the banking sector that plays a leading role in financial and market mediation in Russia. At the end of 2021, the top ten banks accounted for 74% of the banking sector’s assets. These banks and their subsidiaries make up ten leading banking groups (financial conglomerates) in Russia, five of which are present in all segments of the financial market (Bank of Russia, 2022d, p. 54). These groups have begun creating a business model of financial ecosystems based on information platform technologies.

In the face of tough international sanctions, the Central Bank, as a mega-regulator of the Russian credit and securities markets, has focused on regulating systemic risks in the banking sector. Identifying challenges and threats to the sustainability of the banking sector is necessary as the first step towards developing banking regulatory and oversight measures.

There are several key factors vital for preventing a systemic banking crisis:

- Macroeconomic consequences of sanctions for the Russian economy.

- Ability of borrowers, corporate clients, and households to adapt to the crisis and stay solvent.

- Direct impact of primary and secondary sanctions on the banking system.

- Ability of banking institutions to support a progressive business model using fintech tools, information platforms, and banking ecosystems.

- Determining the direction and methods of regulatory influence on the financial system, primarily by the Bank of Russia and the Ministry of Finance.

Let us take a closer look at the sanctions mechanisms that are used by the initiating countries to exert pressure on the Russian banking sector.

Individuals and legal entities subject to sanctions are put by the U.S. administration on three different lists:

1) CAPTA Sanctions List—The Correspondent Account of Payable Through Account Sanctions List.

2) SDN List—Specially Designated Nations and Blocked Persons List.

3) SSI List—Sectoral Sanctions Identifications List.

In 2014, U.S. and EU sectoral sanctions against Russian financial institutions directly affected two groups of banks:

- Bank Rossiya, SMP-Bank, Sobinbank, IC Bank, and others were included in the SDN List and subjected to the most stringent sanctions

- Sberbank, VTB, Gazprombank, Bank of Moscow, Rosselkhozbank, and VEB were included in the SSI List (Sectoral Sanctions Identifications).

In 2015, international rating agencies lowered the sovereign rating of government debts and securities of all Russian issuers and all Russian borrowers to below the investment grade.

Following the sanctions imposed in 2014 and several sanctions packages adopted in the first half of 2022, sixteen banks have been put on the SDN List: Sberbank, VTB, Alfa-Bank; FC Otkritie, Promsvyazbank, Sovcombank, Novikombank, Moscow Industrial Bank, Transcapital Bank (TKB Bank), Investtorgbank, Setelecom Bank, Rosgosstrakh Bank (RGS Bank), Vietnam-Russia Joint Venture Bank (VRB); Bank Rossiya, SMP-Bank, and Rosselkhozbank.

In addition, another nine banks are on the CAPTA Sanctions List: Moscow Credit Bank (MCB Bank), Ural Bank for Reconstruction and Development, RNCB Bank, Genbank, Black Sea Bank of Development and Reconstruction, Industrial Savings Bank, Eximbank of Russia, Gazprombank, and the Russian Regional Development Bank.

Eight of the largest Russian banks have not been sanctioned. These are Raiffeisen Bank, Rosbank, Tinkoff Bank, UniCredit Bank, DOM.RF Bank, Bank Saint Petersburg, Citibank, and Post Bank.

The situation changed dramatically when the SDN List was expanded. As a result, correspondent accounts of banks from this list in U.S. banks and correspondent accounts in euros in the eurozone countries were frozen. Similar measures were also taken by the central banks of a large group of “unfriendly countries of the collective West.” The Visa and Mastercard payment systems decided to stop all transactions outside of Russia which involved relevant cards issued by all Russian banks, thus sort of imposing sanctions at the initiative of the private financial sector.

In addition, a number of Russian banks were disconnected from the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system: Sberbank, VTB, FC Otkritie, Promsvyazbank, Sovcombank, Novikombank, Bank Rossiya, and VEB.

Secondary sanctions are an important instrument of pressure on Russian financial institutions. They are imposed on American and foreign banks or companies by the U.S. government at the initiative of the U.S. Treasury. “The American administrative vocabulary… uses the concept of enforcement actions against both Americans and foreigners” (Timofeev, 2020).

Secondary sanctions are used against violators of bans on transactions with sanctioned entities. These sanctions entail monetary penalties or a ban on transactions with such violators. This is fraught with financial and reputational damage to banks-violators. Over the past ten years, there have been about 200 such cases, with the average penalties imposed on European banks amounting to $3.4 million for “non-egregious” violations and to $303 million for “egregious” ones (RIAC, 2020, p. 394).

CREDIT RISK ASSESSMENT: SOLUTIONS

On April 20, 2022, the Faculty of Economics of Moscow State University hosted Lomonosov Readings, which included a roundtable titled “Crisis Management. Relevant Skills and Solutions.” Attending managers from several leading banks unanimously agreed that priority should be given to the assessment of their corporate clients’ business models and prospects. A bank traditionally approves a loan and the interest on it by assessing non-repayment risks. And although such an assessment is no longer relevant, banks are willing to provide support to their borrowers. No doubt, it will be selective, but banks need to test the viability of the customer’s business model. To this end, banks are developing internal rating (indicators) procedures to assess business viability and stress-test prospective borrowers’ business models under various scenarios.

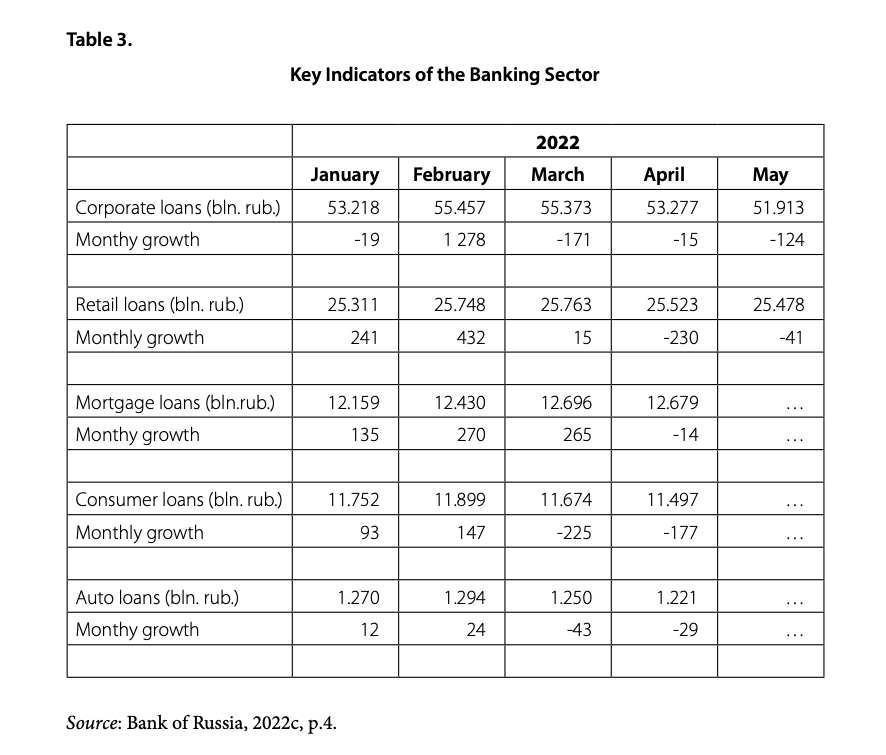

Some results of the adaptation of the banking sector and its activities to the sanctions are reflected in the official statistics released by the Bank of Russia. Table 3 below shows a noticeable decline in bank lending to both the corporate sector and households.

During the COVID-19 epidemic, the corporate sector received a number of credit-related benefits. Large companies benefitted the most. The same financial measures were used again to combat the “sanctions-induced recession.” These include restructuring of liabilities; lending for payroll funding at a reduced interest rate, with the difference to be covered from government guarantees; extension of accumulated debt; and direct budget subsidies. Given the ongoing special military operation, the government has imposed a moratorium on bankruptcy (Decree No. 497 of the Government of the Russian Federation of March 28, 2022). A separate problem is the assessment of the financial stability of small and medium-sized businesses (SMBs).

The retail banking sector dealing with consumer lending is going through an equally difficult period. Unsecured consumer lending (UCL) has declined over the past several months of 2022. Forty percent of loans are provided to borrowers with a high debt burden, that is, when the ratio of loan payments to household monthly income exceeds 70%. The accumulated debt with a debt burden of 80% accounts for 32% of all UCLs (Kozhekina and Saraev, 2022). Given this, the debt burden on household incomes will inevitably continue to grow.

MACROECONOMIC CHALLENGES TO FINANCIAL STABILITY

Russia has been forced to restructure its economy. The Bank of Russia’s monetary policy report says that the first stage of this structural transformation has already begun and the entire process may be completed within one and a half to two years. During the second stage, the economy will stabilize, reaching a new equilibrium (Bank of Russia, 2022b, p. 5). It will see the rise of enterprises focused on domestic demand and working without cooperation with external suppliers when value production chains are disrupted. This can push prices up due to higher unit costs. Inflation in 2022 has increased to 17.5%, year-on-year. Potentially, price hikes can lead to stagflation.

In the summer of 2022, a sharp decrease in industrial activity was registered. The structure of industry gravitates towards simplification and return to outdated products. In a commentary for EADaily, S.V. Tsukhlo, Head of the Laboratory of Market Surveys at the Gaidar Institute for Economic Policy, said, “In our June questionnaire, we invited enterprises to assess the supply of Russian and imported components separately… The supply of Russian components logically turned out to be better, with 71% of industrial enterprises assessing it as normal at the end of the second quarter of 2022, against 31% in the case of imported components” (Tsukhlo, 2022).

Expert assessments indicate that in 2022, the Russian economy may fall by about 10% of GDP (in the range from 15.7% (Bloomberg) to 8.5% (IMF)). The downturn is likely to surpass the slump registered during the global crisis of 2008-2009. A macroeconomic survey conducted by the Bank of Russia on April 13-19 among professional forecasters stated that Russia’s GDP may shrink by 9.2% this year, stay unchanged in 2023, and grow by 1.7% in 2024. Long-term growth in 2025-2029 was estimated at 1.4% per year. So according to independent economists, by the end of 2024, Russia’s GDP will be 7.7% below the 2021 indicator, and may recover to that level by 2030 (Kokurkin, 2022).

Studies anlyzing the impact of economic sanctions on Russia’s GDP after 2014 have proved controversial. S.A. Afontsev cites the following data: According to the Research Institute of IMEMO RAS, sanctions reduced Russia’s GDP growth rate in 2017-2020 by 0.1% in annual terms. In 2014-2016, the cumulative effect of sanctions was estimated at about 2.4-2.8% due to recession and a slowdown in GDP growth (RIAC, 2020, pp. 47, 50). At the same time, I.A. Nikolaev claimed earlier that every year Russian GDP was losing from 1 to 1.5% due to the sanctions (Bashkatova, 2017). However, it is obvious that the scale of the sanctions imposed against the Russian economy can increase its losses immensely. For example, estimates made by an expert group (Pestova et al, 2022) show that industrial production will decrease by 21-27%; the GDP will drop in the range of 12.5-16.5%; private consumption may contract by 11-15%; and investments in general will fall by 30-40% (Pestova et al., 2022).

Russian oil supplied to Europe in 2022 has made up 54.5% of the total oil export. Russian crude accounts for 40% of Europe’s imports. After the approval of the sixth package of EU sanctions in May 2022, the President of the European Council, Charles Michel, said the current ban would affect two-thirds of oil imports from Russia, and by the end of 2022, the EU was planning to cut oil purchases from Russia by 90% (Larina, 2022; Khaneneva, 2022).

A deferral has been granted to some countries, including Hungary and the Czech Republic, until the end of 2023. These countries receive oil through the Druzhba pipeline, and their dependence on these supplies ranges from 58% for Hungary to 86% for Czech Republic, and 96% for Slovakia (Starostina, 2022). In the future, the EU plans to supplement or replace this ban with an import tariff on oil and oil products in order to reduce the proceeds of Russian hydrocarbon exporters.

Shrinking Russian oil and gas exports to European countries will inevitably reduce foreign exchange earnings and push the ruble’s exchange rate down, thus jeopardizing the stability of the federal budget in 2022-2023. According to the Ministry of Finance, oil and gas accounted for 36% of federal budget revenue in 2021 (nine trillion of 25.3 trillion rubles), and the adopted budget for 2022 projected it to grow to 38.1%. According to the Ministry of Finance, federal budget revenue in the first four months of 2022 amounted to 10,034.2 billion rubles, or 40.1% of the projected annual level, including 4,787 billion rubles in oil and gas revenues (47.7% of the total), and 5,248 billion rubles (52.3%) in non-oil and gas revenues. The bulk of the budget’s oil and gas revenues comes from oil. For example, in March 2022, they made up 80.3% of the total. Expenditures amounted to 8,993 billion rubles, or 38% of the projected annual amount. So the federal budget ran a surplus of 1 trillion 41.2 billion rubles (Regnum, 2022).

However, the situation is unstable. On April 29, 2022, Finance Minister A. Siluanov voiced the opinion that the federal budget would show a deficit of about one percent of GDP this year (RIA Novosti, 2022). According to the business daily Vedomosti (Romanova, 2022), the Ministry of Finance plans to optimize federal budget expenditures in order to “ensure a balance.” Overall budget spending is expected to be cut by 1.6 trillion rubles in 2023-2025.

* * *

In the current dire situation, long-term issues are coming to the fore, primarily the need to ensure the stability of the Russian financial system and its key components: the budget (the public sector) and the banking system (the leading part of the market sector). Addressing them is a strategic goal of the government and the Central Bank.

The need for continuous budget revenue streams poses a difficult task for the fiscal authorities and all government agencies that need to develop such a flexible policy that would preserve the main sources of income: earnings from the export of hydrocarbons, and taxes on individuals and legal entities amid declining economic activity and shrinking personal incomes. It will also be necessary to ensure the inflow of savings for the purchase of government loan bonds.

Risks in the Russian banking sector have grown significantly. The amount of bad debts held by banks is increasing. Uncertainty regarding business prospects of bank customers and their debt portfolios poses a difficult problem for lending institutions that have to find a balance between risks and capital adequacy. On the one hand, banks are less and less inclined to take risks as the efficiency of the banking industry decreases. On the other hand, borrowers are not ready to take out loans as they are not sure they can service them. As a result, investments shrink since it is impossible to predict demand for goods and services.

The current task of the Bank of Russia and the economic block of the government is to ensure the stable operation of the national banking sector despite the growing sanctions pressure. Since the top ten banks accounted for 74% of banking assets as of the end of 2021 (Bank of Russia, 2022a), a priority issue is to ensure the financial stability of leading banking institutions by providing federal budget guarantees for transactions that serve priority economic interests, including structural transformation. If the quality of the loan portfolio worsens, it may become necessary for the government to increase its participation in the capital of some banks, and develop a M&A program for intercomplementary credit institutions. At the same time, it will also be vitally necessary to keep the other almost four hundred credit institutions running because many of them act as payment and settlement agents of Russian banks and corporations in transactions with foreign partners.

Abalakin, T., 2022. TsB ob’yasnil khranenie rezervov za granitsei [The Central Bank Has Explained Keeping Reserves Abroad]. Frank RG, 25 March [online]. Available at: https:// frankrg.com/63838 [Accessed 13 July 2022].

Aleinikova, V., 2022. Igra protiv dollara. Globalnye finansy [Playing Against the Dollar. Global Finance]. Kommersant, 16 June [online]. Available at: https://www.kommersant.ru/doc/5407043 [Accessed 23 July 2022].

Bank of Russia, 2022a. Bazy dannykh. Mezhdunarodnye rezervy Rossiiskoi Federatsii [Database. International Reserves of the Russian Federation]. Bank of Russia. Available at: https://cbr.ru/hd_base/mrrf/mrrf_7d/ [Accessed 13 July 2022].

Bank of Russia, 2022b. Doklad o denezhno-kreditnoi politike [Monetary Policy Report]. Bank of Russia, May. Available at: https://cbr.ru/Collection/Collection/File/40972/2022_02_ddcp.pdf [Accessed 18 June 2022].

Bank of Russia, 2022c. O razvitii bankovskogo sektora Rossiiskoi Federatsii v mae 2022 g [On the Development of the Banking Sector of the Russian Federation in May 2022]. Bank of Russia. Available at: https://cbr.ru/Collection/Collection/File/42114/razv_bs_22_05.pdf [Accessed 28 June 2022].

Bank of Russia, 2022d. Obzor rossiiskogo finansovogo sektora i finansovykh instrumentov. 2021 god [Review of the Russian Financial Sector and Financial Instruments. 2021]. Bank of Russia. Available at: https://www.cbr.ru/Collection/Collection/File/40903/overview_2021.pdf [Accessed 11 July 2022].

Bank of Russia, 2022e. Obzor finansovoi stabilnosti. IV kvartal 2021–I kvartal 2022 goda. [Financial Stability Review. Q4 2021 – Q1 2022]. Bank of Russia. Available at: https://www.cbr.ru/Collection/Collection/File/41033/4q_2021_1q_2022.pdf [Accessed 11 July 2022].

Bashkatova, A., 2017. Sanktsii prodolzhayut bit’ po VVP [Sanctions Continue to Hit GDP]. Nezavisimaya gazeta, 6 March [online]. Available at: https://www.ng.ru/economics/2017-03-06/1_6942_vvp.html [Accessed 4 June 2022].

BCS Express, 2022. TsB raskryl sostav rezervov na nachalo 2022 goda [The Central Bank Discloses the Composition of Reserves as of the Beginning of 2022]. BCS Express, 11 April [online]. Available at: https://bcs-express.ru/novosti-i-analitika/tsb-raskryl-sostav-rezervov-na-nachalo-2022?from=feed [Accessed 13 July 2022].

Berner, A. R., Cecchetti, S., Schoenholtz, K., 2022. Russian Sanctions: Some Questions and Answers. VoxEU, 21 March [online]. Available at: https://voxeu.org/article/russian-sanctions-some-questions-and-answers [Accessed 27 May 2022].

CNN Business, 2022. Matt Egan. US Treasury Says It Could Block Russian Debt Payments Starting Next Week. CNN Business, 18 May [online]. Available at: https://edition.cnn.com/2022/05/18/investing/russia-debt-payments/index.html [Accessed 29 August 2022].

Gamza, L.A., 2022. Kitai v novoi strategii NATO [China in NATO’s New Strategy]. IMEMO RAN News, 4 June [online]. Available at: https://www.imemo.ru/news/events/text/china-in-the-new-nato-strategy [Accessed 11 July 2022].

Gereykhanova, A., 2022. Vladimir Putin rasskazal ob ekonomicheskikh planakh Rossii i BRIKS [Vladimir Putin Talks about the Economic Plans of Russia and BRICS]. Rossiyskaya gazeta, 22 June [online]. Available at: https://rg.ru/2022/06/22/kurs-na-piaterku.html?from=feed [Accessed 23 July 2022].

Grinkevich, D., 2022. Rossiya budet ispolzovat’ skhemu platezhei za gaz v rublyakh dlya raschetov po gosdolgu [Russia Will Use the Scheme of Payments for Gas in Rubles for Public Debt Payments]. Vedomosti, 29 May [online]. Available at: https://www.vedomosti.ru/economics/articles/2022/05/29/924132-rossiya-zaplatit-inostrantsam-gosdolgu [Accessed 18 June 2022].

Hufbauer G., Schott J. and Elliott K., 2007. Economic Sanctions Reconsidered. 3nd Edition. Washington: Peterson Institute for International Economics.

Khaneneva, V., 2022. Glava Evrosoveta: ES soglasoval ogranichenie postavok nefti iz Rossii [Head of the European Council: The EU Has Agreed on Limiting Russian Oil Supplies]. Gazeta.ru, 31 May 31 [online]. Available at: https://www.gazeta.ru/politics/news/2022/05/31/17838176.shtml [Accessed 18 June 2022].

Kokurkin, V., 2022. Bank Rossii prognoziruet bystruyu transformatsiyu rossiiskoi ekonomiki [The Bank of Russia Predicts a Rapid Transformation of the Russian Economy]. Rossijskaya gazeta, 12 May [online]. Available at: https://rg.ru/2022/05/12/bank-rossii-prognoziruet-bystruiu-transformaciiu-rossijskoj-ekonomiki.html?from=feed [Accessed 18 June 2022].

Kozhekina, L. and Saraev, A., 2022. Prognoz bankovskogo sektora na 2022 god: peredyshka posle rekordov [Banking Sector Forecast for 2022: Respite after Records]. RA Expert, 26 January [online]. Available at: https://raexpert.ru/researches/banks/bank_forecast_2022/ [Accessed 23 April 2022].

Larina, A., 2022. Strany ES odobrili chastichny zapret importa nefti iz RF [EU Countries Have Approved a Partial Ban on Oil Imports from Russia]. Kommersant, 31 May [online]. Available at: https://www.kommersant.ru/doc/5380379 [Accessed 18 June 2022].

OFR, 2014. Office of the Federal Registers (OFR). 2014 Executive Orders Signed by Barack Obama. National Archives [online]. Available at: https://www.archives.gov/federal-register/executive-orders/2014.html [Accessed 29 August 2022].

Strategic Concept, 2022. NATO 2022 Strategic Concept. Adopted by Heads of State and Government at the NATO Summit in Madrid, 29 June 2022 [pdf]. Available at: https://www.nato.int/nato_static_fl2014/assets/pdf/2022/6/pdf/290622-strategic-concept.pdf [Accessed 29 August 2022].

Nephew, R., 2017. The Art of Sanctions: A View from the Field. New York: Columbia University Press. Available at: https://ipwna.ir/wp-content/uploads/2018/05/The_Art_of_Sanctions-irpublicpolicy.pdf [Accessed 17 June 2022].

Pestova, А., Mamonov, M. and Ongenda, S., 2022. The Price of the War: Macroeconomic Effects of the 2022 Sanctions on Russia. VoxEU, 15 April [online]. Available at: https://voxeu.org/article/macroeconomic-effects-2022-sanctions-russia [Accessed 27 May 2022].

Prime Press, 2022. Dolya raschetov v natsvalyutakh v EAES v 2022 godu mozhet dostich 80% — Malkina [The Share of Settlements in National Currencies in the EAEU May Reach 80% in 2022 — Malkina]. Prime Press, 20 June [online]. Available at: https://primepress.by/news/ekonomika/dolya_raschetov_v_natsvalyutakh_v_eaes_v_2022_g_mozhet_dostich_80_malkina-44870/ [Accessed 23 July 2022].

Regnum, 2022. Minfin otsenil ispolnenie byudzheta RF za yanvar’–aprel 2022 goda [The Ministry of Finance Has Assessed the Execution of the Russian Budget for January-April 2022]. Regnum, 17 May [online]. Available at: https://regnum.ru/news/3593494.html [Accessed 18 June 2022].

RIA Novosti, 2022. Siluanov: “Defitsit byudzheta Rossii v 2022 godu sostavit okolo protsenta VVP” [Siluanov: “Russia’s Budget Deficit in 2022 Will Be about One Percent of GDP]. RIA Novosti, 29 April [online]. Available at: https://ria.ru/20220429/defitsit-1786115707.html [Accessed 18 June 2022].

RIAC, 2020. Politika sanktsiy: Tseli, strategii, instrumenty [The Policy of Sanctions: Goals, Strategies, Tools]. Moscow: NP RIAC. Available at: https://russiancouncil.ru/upload/iblock/692/sanctions_policy_2020.pdf [Accessed 18 June 2022].

Romanova, L., 2022. Minfin predlozhil otkazat’sya ot 1,6 trln rublei raskhodov po gosprogrammam v 2023–2025 godakh [The Ministry of Finance Proposes to Dump 1.6 trillion rubles of Spending on State Programs in 2023–2025]. Vedomosti, 3 July [online]. Available at: https://www.vedomosti.ru/economics/articles/2022/07/03/929624-minfin-otkazatsya-gosprogrammam [Accessed 11 July 2022].

Russian Economy, 2022. Rossiikaya ekonomika v 2021. Tendentsii i perspektivy. Vypusk 43. [Russian Economy in 2021. Trends and Prospects]. Issue 43. Gaidar Institute [pdf]. Available at: www.iep.ru/files/text/trends/2021/book.pdf [Accessed 18 June 2022].

Starostina, Y., 2022. Neftyanoe embargo ES: skol’ko poteryaet Rossiya, vozmozhen li “razvorot na Vostok” i chto budet s byudzhetom [The EU Oil Embargo: How Much Will Russia Lose, Is It Possible to “Turn to the East” and What Will Happen to the Budget?]. TheBell, 7 May [online]. Available at: https://thebell.io/neftyanoe-embargo-es-skolko-poteryaet-rossiya-vozmozhen-li-razvorot-na-vostok-i-chto-budet-s-byudzhetom [Accessed 18 June 2022].

Timofeev, I.N., 2020. “Sanctions for Violating Sanctions”: U.S. Treasury Department Enforcement Measures against Financial Sector Companies. Polis. Political Studies, 6. Available at: doi.org/10.17976/jpps/2020.06.06 [Accessed 11 July 2022].

Tsukhlo, S., 2022. Rossiiskaya promyshlennost’ razocharovana i korrektiruet plany vypuska [Russian Industry Is Disappointed and Is Adjusting Production Plans]. Gaidar Institute News, 2 June [online]. Available at: www.iep.ru/ru/kommentarii/sergey-tsukhlo-rossiyskaya-promyshlennost-razocharovana-i-korrektiruet-plany-vypuska.htm [Accessed 11 July 2022].

Washington Post, 2022. Missy Ryan and Annabelle Timsit. “U.S. wants Russian Military ‘Weakened’ from Ukraine Invasion,” Austin says. Washington Post, 25 April [online]. Available at: https://www.washingtonpost.com/world/2022/04/25/russia-weakened-lloyd-austin-ukraine-visit/ [Accessed 28 August 2022].

White House, 2017. National Security Strategy of the United States of America. White House Government: Official Website, December [online]. Available at: https://trumpwhitehouse.archives.gov/wp-content/uploads/2017/12/NSS-Final-12-18-2017-0905.pdf [Accessed 18 June 2022].

World Bank, 2022. World Bank Group Flagship Report. Global Economic Prospects, June 2022 [online]. Available at: https://openknowledge.worldbank.org/bitstream/handle/10986/37224/9781464818431.pdf [Accessed 11 July 2022].