For citation, please use:

Timofeev, I.N., Arapova, E.Y. and Nikitina, Yu.A., 2024. The Illusion of “Smart” Sanctions: The Russian Case. Russia in Global Affairs, 22(2), pp. 156–178. DOI: 10.31278/1810-6374-2024-22-2-156-178

Targeted Sanctions. What’s in a Name?

Targeted sanctions have become a major instrument of economic coercion in contemporary international relations. Conventional wisdom links such a prominent shift with two drivers (Drezner, 2015, pp. 757-758). The first is the humanitarian price of untargeted sanctions, which includes drastic human suffering, a rise in corruption, and the criminalization of the economy. In contrast, targeted sanctions, directed exclusively at governments, elites, and state-related banks and corporations, should not affect the general population or cause any humanitarian disasters (Portela, 2014). Second, disrupting the entire economy does not necessarily harm the political regime itself, while injuring companies or sectors crucial to the political regime may have a better chance of forcing concessions from it.

Targeted, or “smart,” sanctions, considered to have greater effectiveness and to entail lesser humanitarian costs, include arms embargoes, financial sanctions, and travel sanctions (Tostensen and Bull, 2002).

Conceptual change came with institutional and practical change. Today, all UN Security Council sanctions are targeted (Beirsteker et al., 2016, p. 11). Usually, they freeze assets, ban financial or economic transactions, and restrict the travel of designated individuals and entities. Initiators of unilateral sanctions follow the same route. The EU’s “Basic Principles on the Use of Restrictive Measures” explicitly state that sanctions should target those whose behavior the EU wants to affect, while minimizing possible humanitarian effects (Council of the EU, 2004).

The U.S. has emerged as the most powerful initiator of targeted sanctions. In the 20th century, the U.S. imposed more economic restrictions than all other states and international organizations combined (Hufbauer et al., 2009). U.S. global financial leadership in the post-Cold-War era enhanced American economic statecraft. The role of the U.S. dollar in international trade and foreign reserves has provided the U.S. government with paramount opportunity to monitor and control financial transactions globally.

Washington relies mainly on ‘blocking sanctions,’ managed by the U.S. Department of the Treasury (DoT). These freeze assets and ban financial and economic transactions with designated persons, cutting the targets off from the vast U.S. market and related financial services. Sectoral sanctions are also on the rise. One recent trend is to combine them with blocking sanctions, by authorizing the DoT to block individuals and legal entities that belong to a particular economic sector.

However, some blanket sanctions, such as prohibitions on U.S. financial institutions buying the government debt of a target state, are inherited from earlier legislation.

More importantly, the U.S. possesses outstanding capability and experience in enforcing penalties. Civil and criminal penalties are regularly imposed as punishment for violation. Thus, targeted sanctions affect not just those who have been “blacklisted,” but also anyone dealing with them.

Other sanctions initiators that use targeted sanctions are the EU, the UK, Canada, Australia, Switzerland, and Japan. China and Russia are adopting targeted sanctions too. With its new legislation, China is shifting from predominantly informal sanctions to more Western-style targeted sanctions (Kashin et al., 2020). Russia combines trade sanctions, such as agricultural import bans against the EU, with targeted visa sanctions and financial blocking sanctions. And all major sanctions initiators use import and export controls, which may target specific companies (e.g., those on the U.S. Department of Commerce’s Entity List) or specific goods (e.g., military and dual-use products).

Empirical studies of targeted sanctions are limited, due to their novelty and the difficulty of disentangling their impact from that of the comprehensive sanctions that are frequently imposed alongside them.

Some experts believe that smart sanctions are more effective in changing government policy (Tostensen and Bull, 2002; Shagabutdinova and Berejikian, 2007) or increasing the level of democracy in autocratic target countries (Von Soest and Wahman, 2015), doing minimal harm to human rights or the general population. Ahn and Ludema (2017) argue that “smart” sanctions hit their intended targets with relatively minimal collateral damage. Some studies find that targeted sanctions by the UN are more effective than comprehensive ones (Biersteker et al., 2016). Dizaji and Murshed (2020) write that restricting arms purchases by a target country may cause it to reallocate resources to social welfare programs.

However, most of the existing literature point to collateral and humanitarian damage from targeted sanctions, along with the attendant ethical dilemmas (Gordon, 2011; Cortright and Lopez, 2002; Lopez, 2012). The UN Human Rights Council’s annual reports state that sanctions affect the human rights of wider populations that are not supposed to be targeted (Douhan, 2020). Elliott (2002) wrote about the “disappointing” results of “smart” sanctions. Tierney (2005) summarized arms embargos as an “irrelevance and malevolence,” while Brzoska (2008) proved the decreasing effectiveness of arms embargoes in altering the behavior of targets.

The cost-benefit rationale of financial sanctions also remains questionable. Steil and Litan (2006) wrote that all targeted entities were able to find alternative sources of financing. At the same time, sanctions may undermine financial stability, and do well-documented harm to economic growth, political stability, and humanitarian situations (Hatipoglu and Peksen, 2018). Designations may also significantly harm third parties like oil companies, banks, shipping lines, etc. (Gordon, 2019; Servettaz, 2014). U.S. enforcement measures affect companies of different sectors and cover various jurisdictions, but banks are especially vulnerable, bearing significant losses (Guerello et al., 2019). The cases of various major banks are illustrative (Rosenzweig, 2013; O’Brien, 2014; Hardouin, 2017; Scott, 2019).

Some research indicates a weak spillover effect of sanctions and penalties against one financial institution upon the behavior of non-sanctioned ones (Hundt and Horsch, 2018). However, other writings find such an effect to be significant (Caiazza et al., 2018). Major banks and other multinational corporations tend to comply with a foreign initiator’s legal demands to avoid financial and reputational losses, but smaller companies tend to be late in responding to sanctions and the threat of enforcement (Gabbi et al., 2011). Most companies under U.S. investigation cooperate and improve their compliance instruments, which may diminish the risk of further enforcement (Delis and Staikouras, 2011). In-depth interviews demonstrate that the fear of enforcement drives businesses and NGOs to abstain even from humanitarian transactions (Walker, 2017).

Do they only affect targets? What kind of spillover effects may they cause, especially when restrictions are imposed upon major banks, critical infrastructure companies, or other stakeholders? What is the ratio of “real” targeted sanctions to those causing collateral damage?

Spillover Effects of Smart Sanctions

When considering the spillover effects and humanitarian costs of targeted sanctions, direct effects should be distinguished from systemic effects. Direct effects are the consequences for the operations and financial sustainability of a company (or a set of companies in an economic sector) that are caused by the limiting of access to imports, technologies, international financing, etc. Systemic effects include exchange rate or asset price fluctuations triggered by current events, a deteriorating investment climate, etc.

By their nature, the spillover effects of targeted sanctions can be: (1) economic, (2) political, (3) legal, and (4) psychological (reputational).

Targeted sanctions can affect enterprises (including small and medium ones) and the general population and the economy by various mechanisms: the system of social payments, employment in the public sector, taxation, etc.

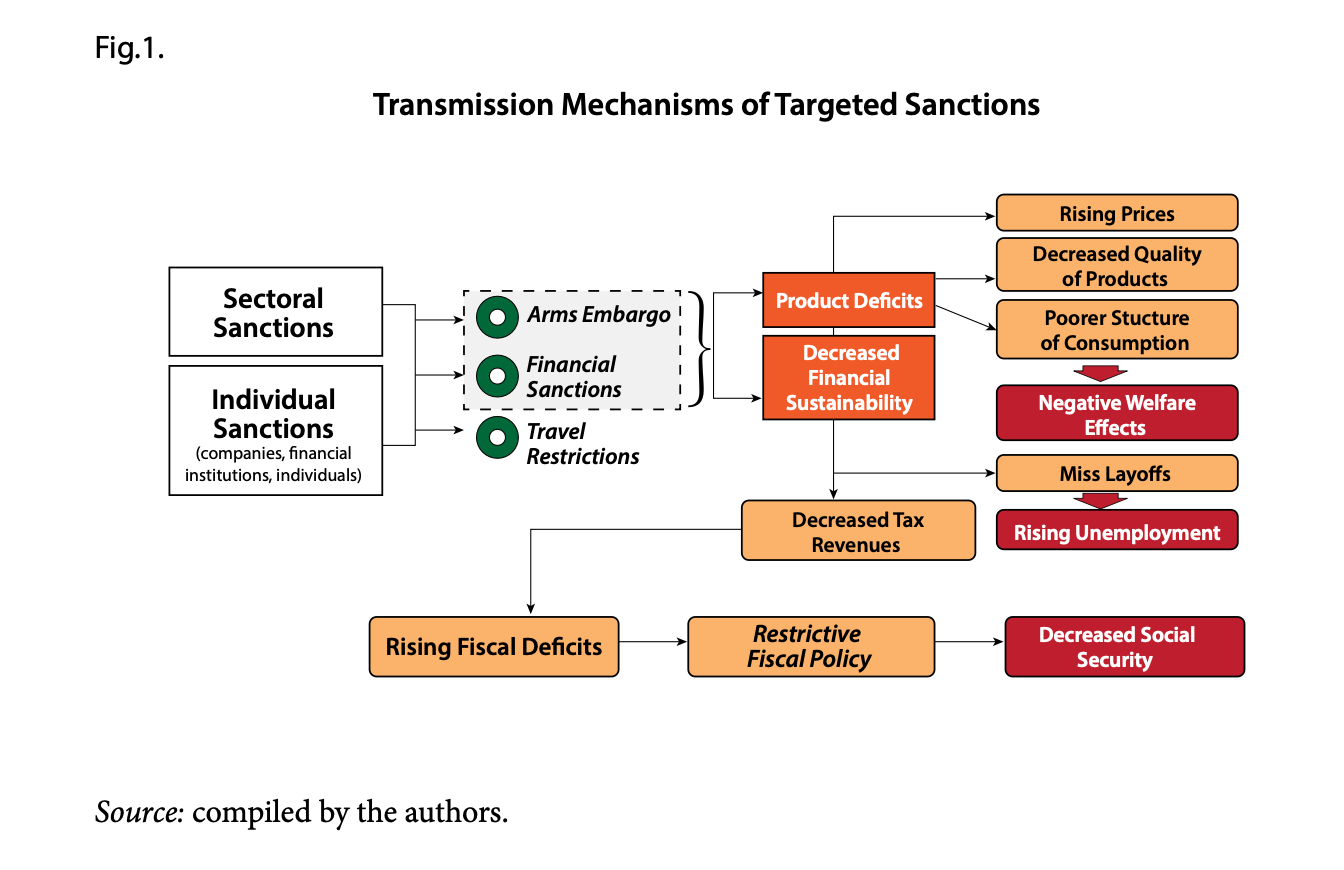

Among targeted sanctions, travel restrictions are the only type that affects exclusively the target without spillover effects. The other types of sectoral sanctions inevitably spill over onto the public by damaging the finances of companies (leading to mass layoffs and a reduction in salary and bonus payments) and reducing government tax revenues (leading to welfare cuts (see Fig. 1)).

General economic spillover effects of the “smart” sanctions and hardship inflicted on the civilian population depend significantly on several factors.

Firstly, they depend on the structure of the target country’s economy. The higher the contribution of the sanctioned sector/entities to the country’s GDP, employment, and regional/federal budgets, the worse the spillover effects.

In non-democratic countries, the share of the public sector (which is usually under sanctions pressure) can be very high. So negative effects on income, investment or consumption can be much higher, and there are no compensation mechanisms. Meanwhile, according to Drezner (2011), the so-called non-democratic regimes account for 78% of all sanctioned countries.

The consolidation of the sector and the size of entities under sanctions also matter. In cases of monopolistic or oligopolistic markets with a high share of sanctioned entities, the detrimental effects are significantly higher than in a high-competition market.

Cross-sectoral complementarity between targeted industries and other sectors may also determine the spillover effects of smart sanctions. Sanctions addressing dual-use items may affect a wide range of sectors. For example, given the high dependence of aircraft construction, shipbuilding, and other types of high-tech civilian engineering on the defense industry, sanctions may provoke a comprehensive decline in production beyond the targeted sectors.

The effects also depend on the position of sanctioned individuals in business. Sanctions against politicians may not cause significant damage to a country’s economic development. However, sanctions against the top management of large backbone enterprises are equivalent to targeted sanctions against the entire company, its subsidiaries, and affiliated structures.

Lastly, a company’s/industry’s dependence upon imports and exports should be taken into account. High dependence on foreign equipment, components, technologies, or credits can make for vulnerability to spillover effects from targeted trade restrictions or from exclusion from the international capital market. In cases of import restrictions, export-oriented enterprises may suffer the most.

Political effects may include an aggravation of relations between the initiator and the target country, potentially up to the rupture or suspension of diplomatic relations and the closure of diplomatic missions and consulates. At the same time, sanctions may damage relations between the initiators and third countries that are closely connected to the target.

Additionally, the spread of sanctions regimes may encourage political rapprochement between target countries (especially non-democratic ones) by harmonizing their positions in international organizations and forming new strategic alliances (Gabuev, 2015; Stent, 2020). Such “soft alliances” are the reaction of target countries to the increasingly uncertain future of Western integration groupings and to the basic nature of Western states’ trade policy (Spartak, 2017).

Legal effects include the development of sanctions legislation in the initiating country and, in response, in the target country. In the medium and long term, the inertial development of reciprocal sanctions legislation may go far beyond a response to the initial legal act and may produce a fully-fledged system of sanctions or reciprocal sanctions legislation. On the other hand, as the initiators’ sanctions and legislation multiply, the resolution of sanctions and trade disputes may shift from the global level to the jurisdictions of the initiating countries. Appealing to their national courts is perceived as the most effective way to suspend sanctions regimes. National courts are gradually becoming the forums of last resort in sanctions disputes, replacing the system of global regulation (in particular, the Dispute Settlement Body of the World Trade Organization).

Psychological (or reputational) effects of targeted sanctions are primarily associated with the phenomenon of secondary sanctions and the spread of “sanctions bubbles.”

Secondary sanctions affect entities which are affiliated and/or maintain commercial links with the targets of primary sanctions (Meyer, 2014). Secondary sanctions aim to coerce not only targeted states, but also third states, limiting their sovereignty to freely conduct their external economic relations (Ruys and Ryngaert, 2020).

Spillover effects for counterparties of sanctioned companies include the cost of sanctions compliance and of searching for new partners. Secondary sanctions make foreign entities reluctant to process transactions with entities from the targeted countries, even when they fall outside the scope of sanctions (Erästö, 2020), leading to a steep overall decline in transactions with businesses from the sanctioned state (Johnston, 2015).

Contemporary sanctions against Russia are one of the most significant cases of targeted sanctions and spillover effects. The case emerged in 2012 with modest and extremely targeted restrictions, but subsequently evolved into a wider range of restrictions with more visible effects. After February 2022, it turned into a “sanctions tsunami,” in which the cumulative amount of targeted sanctions generated fundamental political, legal and economic effects.

Sanctions Against Russia Before 24 February 2022

Human Rights and Corruption

The Sergei Magnitsky Rule of Law Accountability Act of 2012 was the first case of targeted sanctions against Russia since the end of the Cold War (U.S. Congress, 2012). At first glance, the implementation of the Magnitsky Act hardly had any spillover effect. Designations of Russian officials had no visible effect on Russian markets. However, Russia retaliated quickly with the Dima Yakovlev Act (Federal Law 272-FZ, 2012). It banned adoption of Russian children by Americans (the title of the law referred to the Russian infant Dima Yakovlev, who had died due to the negligence of his new family in the U.S.). However, the Dima Yakovlev Act introduced an important sanctions-related innovation, directing the Russian Foreign Ministry to maintain a list of U.S. citizens who have violated human rights or committed other crimes. Designated persons face visa bans and asset freezes. Subsequent laws introduced the concept of “foreign agent”—an NGO, media organization, or individual who receives foreign financial support for political activity in Russia. In other words, the Russian reaction went far beyond targeted sanctions vis-a-vis specific persons and ultimately had much more fundamental consequences. “Foreign agents” legislation has hardly any direct relation to the Magnitsky Act, but it emerged from legislation responding to that Act, illustrating just how far a spillover can go.

Further development of the Magnitsky Act in the U.S. also demonstrates this. In 2016, the U.S. Congress passed the Global Magnitsky Human Rights Accountability Act or GLOMAG (U.S. Congress, 2016). It provided the President with the power to impose asset blocking and visa bans against foreigners involved in human rights violations or corruption. Once again, the direct economic impact of targeting Russian nationals was close to zero. However, the U.S. Congress often refers to GLOMAG as a tool to deal with human rights violations, corruption, gender inequality, and even climate change across the globe, including in China, Iran, Vietnam, Iraq, and Mexico. GLOMAG became a benchmark for analogous legislation in Canada, the EU, the UK, and others.

Ukraine- and Crimea-Related Sanctions

The crisis in and around Ukraine caused a tremendous increase in sanctions against Russia. The number of blocked entities sharply increased, to around 200 by 2021. The designations specified in the Specially Designated Nationals List, especially of officials, rarely had a visible economic impact. But the designation of industries did. Even defense corporations, focused mostly on the domestic market, might suffer losses from the ban on foreign transactions. Global Russian companies appeared to be even more vulnerable. On April 6, 2018, the DoT notoriously blocked a number of large ventures, including Rusal, En+, Eurosibenergo, Bazel, Gaz Group, Renova Group, and a number of others. One of the problems for the markets was the vastness of EO 13661 designation criteria (see Executive Order, 2014). Section 1 of the Order mandates blocking sanctions against those acting on behalf of the various officials targeted by the Order (U.S. President, 2014). Since prominent Russian businessmen are inevitably and legally connected to governmental officials and agencies, the Order could theoretically cover almost every major stakeholder in the Russian economy, depending on the political preferences of the White House, the DoT, or the DoS. The lawsuit of Russian businessman Oleg Deripaska against the DoT, submitted to the U.S. District Court for the District of Columbia, revealed that even indirect connections or media speculations may give grounds for a designation (U.S. District Court, 2019). This generated a hardly measurable psychological spillover effect, damaging the reputation of Russian business and making it toxic for international partners.

Another problem was the Russia Sanctions Review Act of 2017, which empowered Congress to block delistings from the SDN list (U.S. Congress, 2017). Despite the opposition of some Congressmen (U.S. Congress, 2019), a number of companies from the 6 April 2018 case managed to get delisted. However, they had to restructure property and faced a painful administrative procedure. Others failed to do this.

The EU also designated around 200 Russian individuals and entities in response to the crisis in Ukraine in 2014-2021. However, these designations did not have an effect similar to that of the U.S. designations. The EU refrained from blocking large ventures as the U.S. had in the 6 April 2018 case, and it was less assertive in enforcement, lacking secondary sanctions.

The U.S. and the EU imposed restrictions against the defense, energy, and financial sectors. However, the essence and effects of these sanctions varied. Defense sectoral sanctions overlap partly with blocking sanctions, which cover a number of Russian defense companies. It is difficult to assess the real impact of these sanctions due to lack of public statistics. It is apparent that Moscow managed to find domestic substitutions for some previously imported goods. However, sanctions affected the civilian branches of defense companies and delayed a number of high-tech projects, including the MC-21 jet airliner and the Glonass space navigation system (Luzin, 2020). In some cases, foreign companies avoided transactions with civilian companies due to the supposed dual use of their products. For instance, Swedish Quintus Technologies refused to supply maintenance services to Gazgroup in 2020 because the latter may produce dual-use goods (Kommersant, 2020).

In addition to defense sectoral sanctions, Sec. 235 of the Countering American Adversaries Through Sanctions Act (CAATSA) also offers “menu-based sanctions” against foreign natural and legal persons that transact with anyone who is placed on the List of Specified Persons, maintained by the DoS per Sec. 231, for ties to the Russian intelligence or defense sectors (U.S Congress, 2017). While blocking sanctions were deployed against Chinese Equipment Development Department and its chief for acquisition of Russian weapons, “menu-based sanctions” were deployed against Turkey’s Presidency of Defense Industries for the purchase of Russian S-400 anti-aircraft systems (U.S. DoT, 2018, 2020). (However, these measures did not deter China or Turkey from defense cooperation with Russia.)

Sectoral sanctions on the financial sector included bans on new debt transactions. Their immediate effect was painful due to the cumulative effect of the oil-price slump and overall market turbulence. However, the Central Bank and the Government managed to stabilize the situation and, by 2016, the financial sector had managed to even improve its performance (Pekhtereva, 2016).

Sectoral sanctions on energy included restrictions on supplies for Russian shale and Arctic projects as well as bans on certain transactions. This did not bring an immediate shock for the industry, but it may reduce production beyond 2030, once existing fields have been exhausted and new ones have been barely explored (Mitrova et al., 2018).

Sanctions against Russian pipeline projects constituted another line of Ukraine-related restrictions with quite a sophisticated spillover effect. The Trump Administration was a champion of their implementation. A direct impact of these sanctions was withdrawal from the project by All Seas, a Swiss provider of pipe-laying vessels, and by other companies. The Biden Administration continued designating Russian vessels involved in Nord Stream, and their owners. However, one of the byproducts was a deterioration of relations between the U.S. and the EU over this particular issue.

Crimea sanctions constitute another line of restrictions. They largely ban any economic transactions with the region, with tiny humanitarian exemptions. Western initiators also used targeted blocking and visa sanctions against individuals and entities involved in Crimean elections, Crimean infrastructure projects, incidents in the Strait of Kerch, etc. At the same time, Russian federal programs promoted the region’s economic growth (Ostovskaya and Smirnova, 2019). A massive Western blockade spurred extensive Russian investments and generated a reverse effect for the regional economy.

Russia’s retaliation and adaptation measures proved to be an important variable with its own spillover effects. One of the major steps was a ban on food imports from most of the initiator states. Combined with the EU sanctions themselves, Russian retaliation brought about a $34.7 billion loss for EU exports in 2014-2016 (Fritz et al., 2017). However, the EU-Russia trade turnover recovered in 2017-2018, although it fell again in 2019-2020 due to COVID-19 (Economic Ministry of Russia, 2021). Thus, both EU and Russian sanctions caused damage to bilateral trade, but it was not long-term. The costs for the U.S. were much lower, due to the low level of trade preceding the sanctions (Moret et al., 2017).

In terms of adaptation, Russia has upgraded its existing unilateral sanctions legislation and created more. Novel mechanisms, including blocking sanctions, emerged, although blocking has not been used against foreign companies other than Ukrainian ones. Other effects were important for Russia itself. For example, Western sanctions galvanized the national payment system and fostered the security of internal financial transactions.

Cyber and Election Interference Sanctions, Non-Proliferation Sanctions

IT emerged in the sanctions sphere after the notorious U.S. election interference scandal of 2016. Currently, the SDN list contains at least 90 designations, including Russian private nationals and entities, as well as governmental agencies, such as the FSB and GRU, designated for cyber-criminal activity or election interference. These designations seem to have caused little harm to the Russian economy, but three spillover effects are worth mentioning.

First, the reputational and market losses of global Russian IT companies. For instance, the U.S. Department of Homeland Security denied Kaspersky access to U.S. governmental customers, partly out of concern about “the ties between certain Kaspersky officials and Russian Intelligence and other governmental agencies…”. (U.S. DHS, 2017). Ironically, Kaspersky itself is a global champion against cybercrime. Though Kaspersky has never been designated as a blocked entity, the whole interference issue cast a shadow over the Russian tech giant.

Second, the towering sanctions risk for the Russian IT sector due to combination of U.S. blocking and sectoral sanctions. EO 14024 vested in the DoT, in consultation with the DoS and the Attorney General, the power to block companies “operating in the technology or the defense and related materiel sector of the Russian Federation economy” (Executive Order, 2021). Pursuant to the Order, the DoT designated several Russian IT security companies, which might be service providers for Russian government agencies, but were not necessarily involved in malign activities. This caused risks similar to those generated by EO 13661, when the DoT designated Russian ventures that had connections to the government but were unconnected to the crisis in and around Ukraine.

Third, the inclusion of a number of Russian IT companies in the Military End-Users List and Entity List (U.S. DoC, 2020). These restrictions imply additional export control procedures for the export of U.S. components to the designated companies.

The EU and British cybersecurity sanctions are far more restrained in comparison with the those of the U.S. The EU has designated eight individuals, of which six are Russians, one is Chinese, and one is North Korean. Brussels alleges that the Russians participated in cyberattacks against the German Bundestag and the Organization for the Prohibition of Chemical Weapons. The EU has also designated four entities, of which two are Russian intelligence agencies. The UK list is similar to the EU’s. The economic damage of these designations is close to zero, given the natural absence of international commercial transactions by the targeted entities.

Following Executive Order 13757, the U.S. expelled 35 Russian diplomats and blocked access to certain diplomatic property. Russia retaliated in 2017 by expelling 755 U.S. diplomats, thereby equalizing the number of the U.S. and Russian diplomatic staff, and by blocking access to a selected property of the U.S. Embassy. The U.S., in turn, closed the Russian Consulate in San-Francisco and two consulate points in Washington DC and New York. In 2021, in line with the abovementioned EO 14024, Washington expelled 10 more diplomats. Moscow did the same and prohibited the employment of Russian staff by U.S. diplomatic missions (Kommersant, 2021). The key spillover effect was a collapse of U.S. consular services in Russia and complications in the everyday functioning of both states’ diplomatic missions.

Diplomatic sanctions were a direct result of another aggravation of Russia-West tensions that emerged after the UK, joined by the U.S. and 28 other countries, had expelled a number of Russian diplomats after the poisoning of Sergei and Yulia Skripal in Salisbury, allegedly by Russian special services. Moscow retaliated proportionally. The Skripal case contributed to the U.S.-Russia “diplomatic war” that had been sparked by the election-interference issue. But other states did not face the same crisis in consular services that the U.S. did. The U.S. sanctions response to the Skripal case was tough, even in comparison with that of the UK, but its effect was still limited. The U.S. responded in this case, and to the alleged poisoning of Alexei Navalny, with nonproliferation sanctions per the CBW Act of 1991, though in a very cautious manner.

The “Sanctions Tsunami” After 24 February 2022

Russia’s Special Military Operation in Ukraine and consequent inflammation of Russia-West relations, marked a fundamental shift from targeted to wide-ranging sanctions. While many of the deployed sanctions are individually targeted, their cumulative use by far exceeds the effect on nominal targets. Unlike in 2012-2022, current sanctions are a matter of high consolidation among around 50 Western allies.

Blocking sanctions are still the primary instrument. As of early 2024, the U.S., the EU, the UK, and others have blocked more than 2,000 Russian natural and legal persons, plus hundreds of subsidiaries that are functionally blocked under the “50% rule.” New restrictions cover large Russian banks, leading industrial and technological companies, governmental media, and even some universities and research centers. Hundreds of businessmen, political figures, and their families appeared on the lists of blocked persons. Blocking sanctions were accompanied by new financial sectoral sanctions, bans on financial communication services for some major banks, prohibitions on dealing with Russian sovereign bonds, restrictions on providing Russian banks with correspondent accounts, etc. A wide range of investments into Russia are either limited or prohibited.

Trade sanctions have been fundamental as well. Export controls now encompass high-tech and industrial goods necessary for Russian modernization, including electronics, lasers, sensors, etc., as well as luxury goods, legal advice, financial consulting, etc. Import restrictions block Russian oil and oil products, coal, metals, timber, gold, and other items. All formerly Ukrainian territories are under a full trade blockade by the West. The oil price cap is a new instrument to reduce Russia’s revenue from trade with third countries, prohibiting transportation of Russian seaborn oil and oil products if the price exceeds the established price cap. The majority of Western countries have abandoned normal trade relations with Russia. Massive transportation sanctions aggravate trade restrictions. Access to ports, airports, and airspace is blocked. Some initiators, like the EU, deny Russian companies access to roads. The U.S. and the EU have harmonized their positions against the use of Nord Stream-2 (Timofeev, 2022).

Another major shift is an intention to confiscate Russian assets. Frozen Russian sovereign reserves account for more than $300 billion, while the assets of blocked persons may add several dozen billion more. So far, only Canada has established a mechanism for confiscating and transferring the assets to Ukraine, but others have declared such an intention. The U.S. has threatened extensive secondary sanctions and enforcement measures against those violating the sanctions regime. For instance, following a statement by the U.S. DoT of its intent to block those dealing with Russia’s MIR payment system, a considerable number of banks, including in states allied to Russia, suspended operations with MIR cards. The EU has also established a mechanism of secondary sanctions, even though it was critical of them before February 2022, and is trying to harmonize its member-states’ enforcement legislation. Some Western states, like New Zealand, have established sanctions legislation from scratch. Aside from formal sanctions, extraordinary informal boycotts have been implemented by hundreds of Western companies that left Russia.

Sanctions had a negative effect on the Russian economy, but the damage turned to be less than expected. The Russian economy lost around 2-3% of GDP in 2022, while 8-10% percent had been expected in spring 2022. The damage of sanctions was limited by extensive government measures, including a ban on capital outflows. Russian business has been in a rush to change markets, establish new means of financial transactions, find new logistics routes, etc.

In sum, the “sanctions tsunami” of 2022-2023 had a fundamental spillover effect. It harmed the Russian economy and Western economies, especially in the EU. Due to the size of Russia’s domestic market and resource potential, global spillover effects turned out to be unprecedentedly high. The 21st-century globalization has thus increased the economic costs of sanctioning large, highly integrated economies (Mulder, 2022).

Sanctions have transformed global supply chains and logistics, increased commodity volatility, and inflated food and energy prices. They have put pressure on the emerging net-commodity-importing markets, threatening balance-of-payments crises.

Sanctions have also had legal effects in the West, plunging the market principles of global economic development into crisis. A crisis of private property rights, due to asset freezes and confiscation. A crisis of market pricing, due to the oil price cap scheme. A crisis in intellectual property, due to EU, U.S., and UK legislation that deprives sanctioned entities of the ability to use or profit from their IP assets. And a crisis of trust in the international financial system, due to the exploitation of financial and trade interdependency for political purposes.

* * *

The case of anti-Russian sanctions provides several insights into targeted sanctions and their spillover effects, and into the very theory of sanctions.

The concept of targeted sanctions was relevant to Russia before 2022. In many cases, targeted sanctions were actually targeted. Blocking sanctions against government officials and state agencies were precise and had minimal effect on the broader economy and society. The blocking of small and medium-sized companies, or of larger ones servicing the internal market, did not cause collateral damage either. But sanctions against other large companies, integrated into global supply chains, brought losses to shareholders and caused market fluctuations. Targeted sanctions could also have political, normative, and psychological spillover effects.

However, a key methodological problem remains the lack of instruments to measure targeted sanctions’ spillover effects. It is possible to determine enforcement costs, market losses, or changes in trade, but it is much harder to assess reputational losses and to distinguish the effects of sanctions from those of other factors. More in-depth qualitative research is needed to fill this gap.

Russia’s Special Military Operation in Ukraine has dramatically changed global sanctions policy and rhetoric. “Smart” sanctions have not only failed, but actually disappeared from official discourse. In the pursuit of global dominance and the unipolar world order, Western sanctions now aim to inflict maximum damage to the Russian economy, regardless of the ever-greater humanitarian and civilian sacrifices that are borne by Russia, by third countries, and by the populations of the initiators themselves. The price that the global population is forced to pay is no longer up for debate. Humanitarian values and basic rights and freedoms lose their importance as the ideological, economic, and technological confrontation grows. Instead of changing behavior—the original intent of Western sanctions—commercial damage is now the aim of asset confiscation, and it is irreversible regardless of the target’s future behavior. Historically, sanctions have often been a precursor of military escalation. The boundary between sanctions and the use of force is a crucial issue in Russia-West relations, and its erosion is a major challenge for the future.

Ahn, D.P. and Ludema, R., 2017. Measuring Smartness: Understanding the Economic Impact of Targeted Sanctions. The Office of the Chief Economist (OCE) Working Paper, 1, pp. 1-33.

Beirsteker, S.E., Tourinho, M. and Eckert, S. (eds.), 2016. Targeted Sanctions. The Impacts and Effectiveness of United Nations Action. New York: Cambridge University Press.

Brzoska, M., 2008. Measuring the Effectiveness of Arms Embargoes. Peace Economics, Peace Science and Public Policy, 14(2), pp. 1–34.

Caiazza, S., Cotugno, M., Fiordelisi, F. and Stefanelli, V., 2018. The Spillover Effect of Enforcement Actions on Bank Risk-Taking. Journal of Banking and Finance, 91, pp. 146-159.

Cortright, D. and Lopez, G.A. (eds.), 2002. Smart Sanctions: Targeting Economic Statecraft. Lanham, Md.: Rowman and Littlefield.

Council of the EU, 2004. Basic Principles on the Use of Restrictive Measures (Sanctions). Item Note. Council of the EU, 7 June. Available at: https://data.consilium.europa.eu/doc/document/ST-10198-2004-REV-1/en/pdf [Accessed 12 February 2024].

Delis, M. and Staikouras, P., 2011. Supervisory Effectiveness and Bank Risk. Review of Finance, 15(3), pp. 511-543.

Dizaji, S.F. and Murshed, S.M., 2020. The Impact of External Arms Restrictions on Democracy and Conflict in Developing Countries. Working Paper 661. International Institute of Social Studies of Erasmus University Rotterdam.

Douhan, A., 2020. Negative Impact of Unilateral Coercive Measures: Priorities and Road Map. U.N. General Assembly Human Rights Council, 21 July. Available at: https://undocs.org/en/A/HRC/45/7 [Accessed 12 February 2024].

Drezner, D., 2011. Sanctions Sometimes Smart: Targeted Sanctions in Theory and Practice. International Studies Review, 13(1), pp. 96-108.

Drezner, D., 2015. Targeted Sanctions in a World of Global Finance. International Interactions, 41, pp. 755-764.

Early, B. and Preble, K., 2018. Enforcing Economic Sanctions: Analyzing How OFAC Punishes Violators of U.S. Sanctions. SSRN, 1 December. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3306653 [Accessed 12 February 2024].

Economic Ministry of Russia, 2021. Torgovo-ekonomicheskoye i investitsionnoye sotrudnichestvo Rossiya-ES v maye 2021 g. [Russia-the EU Cooperation in Trade and Investment in May 2021]. Available at: https://www.economy.gov.ru/material/file/99663f4ac8c7b40b03888bc8f10036a4/TEC_EU_May_2021.pdf [Accessed 12 February 2024].

Elliott, K., 2002. Analyzing the Effects of Targeted Sanctions. In: Cortright, D. and Lopez, G. (eds.) Smart Sanctions. New York: Rowman and Littlefield.

Erästö, T., 2020. European Nonproliferation Diplomacy in the Shadow of Secondary Sanctions. SIPRI Policy Brief. [pdf]. Available at: https://www.sipri.org/sites/default/files/2020-08/pb_2008_instex.pdf [Accessed 12 February 2024].

Executive Order, 2014. Executive Order 13661. Blocking Property of Additional Persons Contributing to the Situation in Ukraine. Federal Register, 16 March. [pdf]. Available at: https://ofac.treasury.gov/media/5956/download?inline [Accessed 12 February 2024].

Executive Order, 2021. Executive Order 14024. Blocking Property with Respect to Specified Harmful Foreign Activities of the Government of the Russian Federation. U.S. Government Publishing Office, 15 April. Available at: https://ofac.treasury.gov/media/57936/download?inline [Accessed 12 February 2024].

Federal Law 272-FZ, 2012. Federal Law 272-FZ on Measures to Affect Persons, Responsible for Basic Human Rights and Freedoms Violation and Russian Citizens’ Rights and Freedoms Violation. Consultant.ru, 28 December. Available at: http://www.consultant.ru/document/cons_doc_LAW_139994/ [Accessed 12 February 2024].

Fritz, O., Christen, E., Sinabell, F., and Hinz, J., 2017. Russia’s and the EU’s Sanctions: Economic and Trade Effects, Compliance and the Way Forward. Brussels: Directorate-General for External Policies.

Gabbi, G., Tanzi, P.M., and Nadotti, L., 2011. Firms Size and Compliance Costs Asymmetries in the Investment Services. Journal of Financial Regulation and Compliance, 19(1), pp. 58-74.

Gabuev, A., 2015. A “Soft Alliance”? Russia-China Relations after the Ukraine Crisis. Brief 126. European Council on Foreign Relations Policy [pdf]. Available at: http://www.jstor.org/stable/resrep21546 [Accessed 12 February 2024].

Gordon, J., 2011. Smart Sanctions Revisited. Ethics and International Affairs, 25(3), pp. 315-335.

Gordon, J., 2019. The Not So Targeted Instrument of Asset Freezes. Ethics and International Affairs, 33(3), pp. 303-314.

Guerello, C., Mure, P., Rovo, N., and Spallone, M., 2019. On the Informative Content of Sanctions. North American Journal of Economics and Finance, 48, pp. 591-612.

Hardouin, P., 2017. Too Big to Fail, Too Big to Jail: Restoring Liability a Lesson from HSBC Case. Journal of Financial Crime, 24(4), pp. 513-519.

Hatipoglu, E. and Peksen, D., 2018. Economic Sanctions and Banking Crises in Target Economies. Defense and Peace Economics, 29(2), pp. 171-189.

Hufbauer, G., Shott, J., Elliott, K., and Oegg, B., 2009. Economic Sanctions Reconsidered. Third Edition. Washington: Peterson Institute for International Economics.

Hundt, S. and Horsch, A., 2018. The Effects of Sanctions on the Lending Policy and the Value on International Banks: The Case of Iran. Review of Middle East Economics and Finance, 14(3), pp. 1-13.

Johnston, C., 2015. Sanctions Against Russia. Evasion, Compensation and Overcompliance. European Union Institute for Security Studies [pdf]. Available at: https://www.iss.europa.eu/sites/default/files/EUISSFiles/Brief_13_Russia_sanctions.pdf [Accessed 12 February 2024].

Kashin, V., Pyatachkova, A., and Krasheninnikova, L., 2020. Chinese Economic Sanctions Policy: Theory and Practice. Comparative Politics Russia, 11(2), pp. 123-138.

Kommersant, 2020. “Gazel” popala pod press [“Gazel” Now under Pressure]. Kommersant, 6 October. Available at: https://www.kommersant.ru/gallery/4520096 [Accessed 14 February 2024].

Kommersant, 2021. Diplomaticheskaya voina SShA i Rossii [Russia-U.S. Diplomatic War]. Kommersant, 3 August. Available at: https://www.kommersant.ru/doc/4928289 [Accessed 14 February 2024].

Lopez, G., 2012. In Defense of Smart Sanctions: A Response to Joy Gordon. Ethics and International Affairs, 26(1), pp. 135-146.

Mitrova, T., Grushevenko, E., and Malov, A., 2018. The Future of Oil Production in Russia: Life under Sanctions. [pdf]. Moscow: Skolkovo. Available at: https://energy.skolkovo.ru/downloads/documents/SEneC/research04-en.pdf [Accessed 11 February 2024].

Moret, E., Giumelli, F., and Bastiat-Jarosz, D., 2017. Sanctions on Russia: Impacts and Economic Costs on the U.S. Geneva International Sanctions Network. [pdf]. Available at: https://repository.graduateinstitute.ch/record/295176/files/Russian-Sanctions-Report.pdf [Accessed 2 October 2021].

Mulder, N., 2022. The Sanctions Weapon. IMF. Available at: https://www.imf.org/ru/Publications/fandd/issues/2022/06/the-sanctions-weapon-mulder [Accessed 2 October 2021].

O’Brien, J., 2014. Disputatious Allies or Political Rivals? Intergovernmental Relations in Financial Regulation in the Aftermath of the Standard Chartered Settlement. Law and Financial Markets Review, 8(1), pp. 13-19.

Ostovskaya, A. and Smirnova, E., 2019. Socio-Economic Development of the Republic of Crimea: Current State. Services in Russia and Abroad, 13(5), pp. 158-171. Available at: https://sciup.org/socialno-jekonomicheskoe-razvitie-respubliki-krymsovremennoe-sostojanie-140244485-en [Accessed 11 February 2024].

Portela, C., 2014. The EU’s Use of “Targeted” Sanctions Evaluating Effectiveness. Working Document 391. CEPS.

Rosenzweig, K., 2013. Regulation of Foreign Banks Operating in the United States: A State Regulator’s Controversial Pursuit of a London-Based Bank. Fordham Journal of Corporate and Financial Law, 18(4), pp. 1021-1048.

Ruys, T. and Ryngaert, C., 2020. Secondary Sanctions: A Weapon out of Control? The International Legality of, and European Responses to, US Secondary Sanctions. British Yearbook of International Law. Oxford: Oxford University Press.

Scott, A.B., 2019. OFAC Sanctions Compliance: Insights from Recent Enforcement Actions. Journal of Financial Compliance, 3(3), pp. 247-254.

Servettaz, E., 2014. A Sanctions Primer. World Affairs, 177(2), pp. 82-89.

Shagabutdinova, E. and Berejikian, J., 2007. Deploying Sanctions while Protecting Human Rights: Are Humanitarian “Smart” Sanctions Effective? Journal of Human Rights, 6(1), pp. 59-74.

Spartak, A.N., 2017. Metamorphoses of the Regionalization Process: Regional Trade Agreements to Mega-Regional Projects. Contours of Global Transformations: Politics, Economics, Law, 10(4), pp. 13-17.

Steil, B. and Litan, R.E., 2006. Financial Statecraft. The Role of Financial Markets in American Foreign Policy. New Haven: Yale University Press.

Stent, A., 2020. Russia and China: Axis of Revisionists? Brookings Institution. Available at: https://www.brookings.edu/articles/russia-and-china-axis-of-revisionists/ [Accessed 11 February 2024].

Tierney, D., 2005. Irrelevant or Malevolent? UN Arms Embargoes in Civil Wars. Review of International Studies, 31(4), pp. 645-664.

Timofeev, I., 2022. Sanctions on Russia: A New Chapter. Russia in Global Affairs, 20(4), pp. 103-119.

Tostensen, A. and Bull, B., 2002. Are Smart Sanctions Feasible? World Politics, 54(3), pp. 373–403.

U.S. Congress, 2012. Public Law 112–208. Russia and Moldova Jackson-Vanik Repeal and Sergei Magnitsky Rule of Law Accountability Act of 2012. Congress.gov, 14 December. Available at: https://www.congress.gov/bill/112th-congress/house-bill/6156/text [Accessed 12 February 2024].

U.S. Congress, 2016. Public Law 114328. Global Human Rights Accountability Act of 2016. Congress.gov, 23 December. [pdf]. Available at: https://www.congress.gov/114/plaws/publ328/PLAW-114publ328.pdf [Accessed 12 October 2021].

U.S. Congress, 2017. Public Law 115–44. Countering America’s Adversaries Through Sanctions Act. Congress.gov, 2 August. Available at: https://www.congress.gov/bill/115th-congress/house-bill/3364/text [Accessed 15 February 2024].

U.S. Congress, 2019. House Joint Resolution 30. Disapproving the President’s Proposal to Take an Action relating to the Application of Certain Sanctions with Respect to Russian Federation. Congress.gov, 17 January. Available at: https://www.congress.gov/bill/116th-congress/house-joint-resolution/30/text?q=%7B%22search%22%3A%5B%22sanctions%22%5D%7D&r=573&s=10 [Accessed 13 February 2024].

U.S. District Court, District of Columbia, 2019. Deripaska v. United States Department of the Treasury (1:19-cv-00727). CourtListener, 15 March. Available at: https://www.courtlistener.com/docket/14718645/deripaska-v-united-states-department-of-the-treasury/ [Accessed 13 February 2024].

U.S. DHS, 2017. DHS Statement on the Issuance of Binding Operational Directive 17-01. 13 September. Available at: https://www.dhs.gov/news/2017/09/13/dhs-statement-issuance-binding-operational-directive-17-01

U.S. DoC, 2020. Addition of “Military End User” (MEU) List to the Export Administration Regulations and Addition of Entities to the MEU List. Federal Register. Available at: https://www.federalregister.gov/documents/2020/12/23/2020-28052/addition-of-military-end-user-meu-list-to-the-export-administration-regulations-and-addition-of [Accessed 12 February 2024].

U.S. DoT, 2018. CAATSA-Russia Related Designations. Specially Designated Nationals List Update. U.S. Department of the Treasury, 20 September. Available at: https://home.treasury.gov/policy-issues/financial-sanctions/recent-actions/20180920_33 [Accessed 13 February 2024].

U.S. DoT, 2020. CAATSA-Russia Related Designations. Specially Designated Nationals List Update. U.S. Department of the Treasury, 14 December. Available at: https://home.treasury.gov/policy-issues/financial-sanctions/recent-actions/20201214_33 [Accessed 13 February 2024].

Von Soest, Ch. and Wahman, M., 2015. Are Democratic Sanctions Really Counterproductive? Democratization, 22(6), pp. 957-980.

Walker, S., 2017. The Foreign Policy Tool of Sanctions, Conflict and Ensuring Continued Access to Finance. Journal of Financial Crime, 24(3), pp. 480-490.