The BRICS summit in Durban in March 2013 may have heralded a dramatic turn in the destiny of this association of such different countries as Brazil, Russia, India, China and South Africa, which share some common problems and interests. The summit’s eThekwini Declaration and Action Plan encompass a wide range of political and socio-economic issues. It is important to remember that these documents were adopted at a time of obvious aggravation of many world problems – economic (slow recovery of the EU economies), political (North Korea), and financial (Cyprus). As a matter of fact, the five countries expressed polite criticism of the state of world affairs, including the pace of overcoming the recession: “We note policy actions in Europe, the U.S. and Japan aimed at reducing tail-risks in the world economy. Some of these actions produce negative spillover effects on other economies of the world. Significant risks remain and the performance of the global economy still falls behind our expectations.”

True, this is not yet the emergence of institutions parallel to Bretton-Woods, but certainly it is a detailed declaration of the need for improving world governance. The outlook for the development and interaction within BRICS has drawn a wide variety of comments over the past decade – from sarcasm to the expectation of miracles. But the aggravation of problems with the sustainability of global development in 2008-2013 has brought the role of those states into the limelight to show that global decisions will not be necessarily found inside Bretton-Woods institutions or the OECD. This has pushed BRICS towards intensifying consultations, academic contacts, and research into a number of common themes.

THE INEVITABILITY OF BRICS

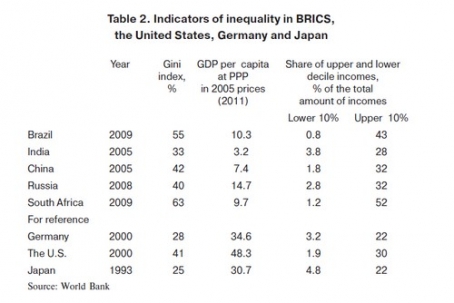

BRICS countries are at different stages of development ranging from industrialization to early post-industrialization. All show tremendous social and regional inequality. All are caught in the trap of the medium level of development. Fast breakthrough towards a stable and higher social and economic level is their common goal.

Originally, after Goldman Sachs coined the BRIC acronym in a 2001 paper, large attention to that group was riveted by virtue of forecasts of their future role in the global GDP. However, the emphasis on the GDP, calculated by means of extrapolating growth rates to a two-generation period, leads away from the gist of the problem. In case of any alignment in development (say, in keeping with Robert Solow’s theory), growth in the share of the largest countries is a natural phenomenon.

For the BRICS countries the problem of the future is not trivial GDP growth, but a trajectory of development from the relatively low, medium level with many disproportions, to a socially more stable and qualitatively higher one, similar to that of the OECD countries. It is very important what quality of life is behind the GDP and personal consumption statistics, what the state of affairs is regarding progress in science and engineering, civil society, and how democratic the system is. Over the lifetime of two generations there will occur not the complete change of the living people, but gradual transformation in the mode of behavior and standards of today’s youth. The nature of political and financial elites will be playing the determining role. Their stability, evolution and legitimacy over the lifetime of generations will determine the quality of development. This theme is not confined to the question about the maturity of the democratic system, although many tend to focus on it in the first place. The world’s configuration decades from now will depend on what institutions will emerge inside BRICS and what influence they will be causing on neighboring countries. This great responsibility against a backdrop of fast changes at home and around the world pushes the elites of the BRICS countries towards cooperation for the sake of onward movement, while retaining their own identity.

Let us imagine that as a result of the “Great Separation” of the 16th and 17th centuries China, India, Brazil and Russia spearheaded world progress (including that in social development and engineering). What would the United States, Germany and Japan have been doing now for the sake of catch-up development (Japan, in fact, had to address precisely this sort of task in the Meiji era)? Had the United States, Germany and Britain been faced with the challenge of catching up with China and India, they would have needed a bank for financing everything that they actually built (in real history) during the Great Depression (roads), World War II, and the post-war conversion that followed (the way Japan after the war had to retool its industrial plants from building planes to manufacturing motor vehicles), and the years of European state capitalism (infrastructures).

Catch-up development countries have to concentrate resources on critically important goals and to improve public institutions. BRICS countries need very much the same, but they will have to accomplish that not over a period of 200 years since the beginning of the industrial revolution, but within 30-40 years, or possibly faster. Today’s relative peace on the globe and the absence of colonizers is an advantage. On the other hand, the interests of industrialized countries as regards resources, the rules of trade and access to the markets do not always coincide with BRICS interests.

Russia is in a special situation. The country has slightly exceeded the 1989 level of the GDP, but it still falls short of the amount of capital investments of those days and has lost many of its positions in the field of technologies. It has to simultaneously address a number of problems inherited from the planned economy days, to compensate for the losses of the 1990s (and mistakes of that period), try to catch up with the industrialized countries and at the same time try not to fall behind the social structures and technologies that begin to boom as levels of economic development even up.

Naturally, it was not the 2001 Goldman Sachs paper that fermented the development of BRIC in 2005-2008, but the current political interests in the world, dominated by industrialized countries, and the international institutions and rules of the game these had established. Four BRIC states have a huge combined population (3.2 billion of the 7-billion world population) and represent two oldest civilizations in the world, one of the most important world civilizations (Russia), and the strengthening civilization of modern times. Over two decades the four growing powers and one in the process of recovery (Russia) were able to see for themselves that growing weight by no means earned them greater role in world governance.

All of them are dissatisfied with their actual position in the economic and political architecture of the modern world. In the early days of BRICS the member-countries already shared many views and agreed on a number of principles of the modern world order, including opposition to hegemony, respect for the interests of all participants and support for a multi-polar world. Excessive rigidity and inertia of the well-established developed world, the domination of “end of history” theories and the prevalence of radical neo-liberalism (in theory and in practice) caused a natural reaction. The four countries mapped out joint actions for changing the world economic order, the security situation and the political configuration. When South Africa, faced with a very similar set of problems, joined the four largest countries of Eurasia and Latin America, coordination was switched into high gear.

As experience shows, the industrialized countries are unprepared to meet the “great industrializing powers” halfway, when it comes to redistribution of roles in the world scene. The main decisions and the nature of approaches are determined by the OECD countries or the “great industrialized powers” and their Bretton-Woods institutions. But after the Great Recession of 2008-2009 the countries with relatively fast growth rates proved to be major support for the developed ones. It became clear that in the long term the weight of BRICS will be growing and in the future it will be very difficult or just impossible to maintain a stable world order without these key states demonstrating a sensible and responsible approach to world events and processes.

The general parameters of the situation are typical and were observed on many occasions in history – the dominating elite brings into being a counter-elite, which proposes its own vision of the world. The counter-elite demands its interests should be taken into account and formulates its own principles of interaction inside itself and with external actors in order to achieve a new viable and “creative” balance.

ECONOMY’S STRUCTURE AND DEVELOPMENT PHASE

The BRICS countries are working jointly to enhance their role in global politics and the economy, but that also means that time is ripe for fundamental institutionalization. Problems with the adaptation of the existing institutions and the unpreparedness of industrialized powers to make proper allowances for the new role of the booming countries in the existing financial institutions forces the latter to give thought to establishing their own development bank.

Over the past decade, the influx of foreign direct investment into the BRICS countries tripled, while their own foreign direct investments into other countries soared 20 times. BRICS countries prefer to invest into industrialized world countries (the United States and the EU), and also into nearby countries. However, mutual cooperation and investments and the sharing of assets, technologies and knowledge can yield more tangible results.

At the moment the main recipient of foreign direct investment (FDI) in the BRICS countries is the manufacturing industry – 45% in China and 34% in Brazil. But in Russia and India this key branch gets a tiny 10% and 8% respectively. Foreign investments in the health service are at a high level only in India (11% of the FDI influx), and those into the financial sector, only in Russia (47% of the investment influx), in contrast to 19% in India and 10% in Brazil. The latter factor points not so much to a shortage of national investments in Russia, as to a financial carousel phenomenon: the export of tremendous savings by the state (acquisition of bonds by the monetary authorities) and by private capital (direct investment). Portfolio investment accounts for the bulk of the money coming back into the country, and part of the direct investments coming back is nothing but Russian private capital in off-shore zones enjoying foreign status protection.

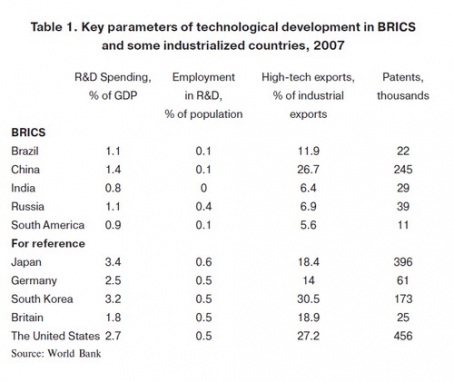

R&D spending in the BRICS countries falls behind the technologically advanced countries (Table 1) – their share in the GDP is at a level of about 1%, while in the developed world the parameter is 2% and even higher. For this reason in selecting projects the working group for the creation of a BRICS Bank should attach priority to those aimed at creating the BRICS countries’ own high technologies or mass producing technologies not yet in use.

The modernization of the economy of Russia and other countries in the group requires not just modernizing fixed assets at existing enterprises, but creating fundamentally new knowledge and technologies. For this reason it is worth suggesting as likely investment targets the priority industries of the BRICS countries in line with their national strategies. On the top of this list are products of research and development (biotechnologies, environmental protection, nuclear technologies, new materials); information technologies (software); high technologies (aircraft-building, shipbuilding, space rocket technologies); and education (grants, exchange of experience among educational establishments).

The BRICS countries demonstrate considerable internal inequality (social and regional), which is fraught with a major threat to the stability of development. Therefore, their common task is to get out of the trap of the medium development level, with a view to joining the club of advanced powers. A BRICS Development Bank might play the role of an integrating institution in some economic and political matters, conduct research into strategic issues and coordinate the financing of strategic high-tech projects.

FINANCE AS A SPARK PLUG FOR COOPERATION

The unanimity of interest is most graphically seen in the sphere of finance. A number of coordinated steps may be considered as a declaration of intent to create elements of competitive global governance. Amid the world recession the BRICS countries began to cooperate within the IMF and in the sphere of world finance: the reform of architecture, etc.

The gold and foreign exchange reserves of the BRICS countries provide the basis for this. BRICS are the largest holders of international reserves – 4.5 trillion dollars in 2012 (41% of the world reserves and 62% percent of the reserves of developing countries), with the dollar accounting for the largest share of the currency reserves (58%). Granted, nearly two-thirds of China’s reserves (over 3 trillion dollars in 2011) remain officially undisclosed in terms of their breakdown by currency, which creates some uncertainty. One thing is pretty clear, though – higher demand for dollar assets as a result of world economic growth, including that of the BRICS economies, brings about excessive accumulation of the U.S. debt and worsens world disproportions. This calls in question the long-term stability of the system. Increasing the role of other currencies as reserve assets and lowering the role of the U.S. dollar are possible ways of reforming the world financial system.

International development institutions are expected to serve as sources of liquidity for problem-riddled and developing countries. In recent years ever more developing countries, including BRICS, have become net creditors, but their role in governance is inadequate to their place in the world economy and in financing organizations. The current reform of redistributing quotas in the IMF increases the overall share of BRICS from 10.71% to 14.8%, but still it does not reflect the countries’ contribution to the development of the world economy. Many experts believe that BRICS demands for reforming the system of quotas in the IMF are not radical enough. If the share of reserves in calculating the quota goes up to 0.3 while the share of the economy’s openness decreases, the overall quota of the five countries will be up to 25.3%; and if the share of reserves is increased through reducing the share of volatility and the economy’s openness, the overall quota will be up to 25.41%.

Under both scenarios, the United States loses the ability to veto the most important decisions by the IMF, which requires an 85%-majority vote. The aggregate share of the 27 EU countries in the former case will be down from 30.01% to 22.16%, and in the latter case, to 22.8%. As the developing economies have higher growth rates than the industrialized ones, the developing countries are also interested in introducing a mechanism of automatic revision of quotas in the future in accordance with changes in their economic parameters.

Further changes in the world of finance and currencies will be related with the growing strength of the renminbi, and the problems in the euro area leave no room for expecting “counter-play” by the leading reserve currencies. In theory, China’s renminbi may become a world reserve currency in 10-15 years from now, but this will happen in case the renminbi’s foreign markets develop more actively. For now these are concentrated mostly in the countries of South and Southeast Asia. Russia, Brazil and India have been taking certain steps in an attempt to become major foreign markets for the Chinese currency in the near future. MICEX opened trading in renminbi contracts in 2010. And at the end of March 2013, just before the BRICS summit, the leaders of Brazil and China declared partial transition to their national currencies in trade between themselves and concluded an agreement on currency swaps 30 billion dollars worth.

The foreign markets of BRICS currencies may be developing on the basis of the exchange alliance incorporating the main exchanges of the five countries – Brazil’s stock exchange BM&FBOVESPA, the Moscow Exchange, India’s stock exchange BSE Ltd., the Hong Kong Exchanges and Clearing Limited, representing the interests of China, and the Johannesburg Stock Exchange (JSE Limited). The exchanges have already begun to cross-list futures contracts for the key stock market indices of the BRICS countries. In the longer term new products on the basis of these countries’ currencies are to be developed. The Durban summit confirmed the intention to speed up reforms in the IMF and changes in the countries’ quotas. Naturally, the capacity of the world’s financial markets is tremendous as compared with the financial capabilities of the BRICS countries (although their financial resources are big enough), but these capabilities will be expanding.

BRICS DEVELOPMENT BANK

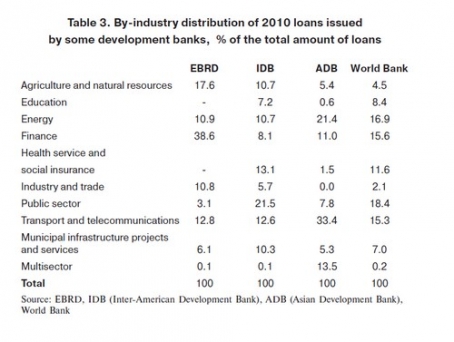

Whether or not a BRICS Development Bank would be established remained an enigma until the last day of the summit. The specific tasks and goals of the group’s countries are completing industrialization and entering the post-industrial phase against a backdrop of simultaneous cooperation and competition with the developed world. These tasks are grandiose not by the size of capital investment, but by the scale of mentality they require. True, each individual country has its own development strategy to follow, and these strategies not always match each other. In our opinion, a BRICS Development Bank in financial terms will not have the decisive importance or exceed the capacity of the national resources of its member countries or of other development banks. The BRICS countries share not so much the interest in as the need for raising the level of development above the original problems of industrialization or poverty. The issue of the day is a long stride forward in the sphere of modernization, as is seen in Russia’s national programs, plans of the other countries in the group, and resolutions by the recent congress of China’s Communist Party. The BRICS group by no means sets the task of confronting the existing banks, and the yet-to-be created Development Bank’s mission will be far from offering an alternative to the World Bank or any of the existing regional banks. However, as Table 3 indicates, these institutions have practically stopped financing industries and trade. Therefore it is of fundamental importance to address the specific set of problems other similar institutions fail to pay due attention to.

The credit ratings of the BRICS countries range from India’s BBB- to South Africa’s A and China’s AA-. India and South Africa are unable to make very large borrowings. The emergence of a BRICS Development Bank would not only promote the creation of infrastructures in the group’s participating countries, but also contribute to expanding the practice of settlements in national currencies.

“The establishment of a New Development Bank is feasible and viable. We have agreed to establish the New Development Bank. The initial contribution to the BRICS Development Bank should be substantial and sufficient for the Bank to be effective in financing infrastructure,” the BRICS leaders said in the Declaration at the summit in Durban.

The Bank is to promote transition from the medium level of development to a higher one and to ease inequality in the member-countries. Its spheres of activity may encompass efforts to overcome demographic risks and food shortages and address the problems of urbanization and management of water and land resources. Far greater attention is being paid to enhancing energy effectiveness, the technological level of the economy, infrastructure development and the promotion of human resources. Brazil’s Development Bank (BNDES) is the world’s second largest bank in this line of business as to the amount of loans extended after China’s Development Bank. It copes with national development problems quite successfully and may be regarded as a model for a BRICS Development Bank’s operating powers.

India is mostly interested in major infrastructure projects in its own territory. This field of activity is one of the high priorities at the moment. Alok Sheel, Secretary of the Department of Economic Affairs at India’s Finance Ministry, put the emphasis on the need for infrastructure project financing by a BRICS Development Bank. India’s infrastructures are below not only those of the advanced powers, but of some other countries in the group – as before, only a minority of the population has access to means of sanitation (34%) and of communication (three telephone lines per 100 people). India’s own investment in infrastructures in five years to come (2013-2017) is to reach 1.5 trillion dollars, thrice the investment in the current five-year period (542 billion dollars). The Indian government has set course towards drawing private capital and developing public-private partnerships (PPP). The BRICS Bank might provide extra resources to finance infrastructure projects. South Africa faces similar development tasks and its need for infrastructure, education and technologies is as great.

The potential benefits of such a bank for Russia are a separate question. We believe that economic and geopolitical interests of the country require it should be involved in the collective reformatting of the world economic order. Investing private and public resources into projects that raise the level of development and measures to extend assistance in the developing world are elements of this policy. However, Russia’s unilateral opportunities are limited. A BRICS Development Bank may notably raise the effectiveness of Russia’s participation and expand the country’s presence in the international scene. This concerns investment projects and, to a greater extent, joint efforts with other countries in the group to devise development strategies.

Steps to ease the level of inequality, grants for conducting research in this field and each country’s own research should enjoy priority. Infrastructure projects account for the largest share of loans issued by the existing development banks. Government-financed infrastructure projects hold first place by the number of loans received from the Inter-American Development Bank (21.5%) and the World Bank (18.4%). Projects in the sphere of transport and telecommunications technologies take first place in the Asian Development Bank (33.4%).

BRICS Development Bank activities may incorporate investment and analysis. Therefore, one should foresee the following guidelines: analysis of development problems and effective decision-making; project financing; grant giving; consultancy services; analysis of development trends and risks of world and regional growth. The BRICS group’s Development Bank would be capable of financing the member-countries’ initiatives to address complex problems of transition to a higher organizational level, specifically to reduce social inequality. It should avoid investing into undertakings that commercial or government institutions are capable of financing on their own. It would be preferable to seek planning and implementing projects yielding synergetic effects both regionally and industrially.

The purpose of BRICS Development Bank grants will be to encourage cooperation in priority fields, including research into energy efficiency, food security, and urbanization. The money will be extended directly or under partnership agreements with other financial institutions. The Development Bank is to act as a financial agent and an adviser on policy matters. The Bank’s divisions may be conducting strategic research in the interests of its founders and partners into matters related with the projects the bank is financing (infrastructure development, energy efficiency, biotechnologies, environmental protection, etc.). Ideally the teams of the Bank’s analysts will be working in cooperation with the best universities in each of the five countries.

Each of the BRICS Development Bank’s founders must have the right to participate in management proportionately to the share in the charter capital. Russia’s Deputy Finance Minister Sergei Storchak said that “the BRICS Development Bank’s corporate management may look like that of the World Bank, where there is a board of governors, a board of directors and management.” He said this does not rule out a different structure, similar to the one that operates in banks left of the Soviet Union-led Council for Mutual Economic Assistance (COMECON). The leading positions there are distributed according to quotas and the process of decision-making is based on the principle of consensus.

The registered capital may be formed with the founders’ currency reserves. The bank should be empowered to borrow on the open market. The financing of transactions may be possible through the sale of the bank’s bonds on the world financial markets, and also jointly with other institutions. For instance, in case any of the member-countries launches a major project the Bank will be able to act as a strategic agent and carry out financing together with the country concerned and other partners. In other words, the bank needs an opportunity to perform the consultant’s functions only and to hold negotiations with potential investors and interested banks, agencies and companies. Major permanent partners may be invited to participate, for instance, the existing development banks and the governments of countries outside the BRICS group.

At the initial phase full-fledged membership of the BRICS Development Bank should be restricted to the member-countries only. By analogy with other similar institutions (for instance, the Asian Development Bank) it will be possible to draw permanent investors without giving them voting rights. To ensure that the opinions of all founders on key issues are taken into account irrespective of their share in the registered capital, it might be expedient to create a two-tier system of decision-making. Decisions on strategic issues will require either consensus or a 90 percent-majority vote in the board of directors and the list of such issues must be defined pretty clearly.

The BRICS Development Bank, just as other similar institutions (the World Bank, the Asian Development Bank and the Inter-American Development Bank), may have the form of an international non-profit organization. It should be registered in the country that has the most friendly tax regimen, but various functional offices may be located in all of the five countries.

* * *

The Durban summit made an important step towards the coordination of efforts. “We aim at progressively developing BRICS into a full-fledged mechanism of current and long-term coordination on a wide range of key issues of the world economy and politics,” the eThekwini Declaration said. The question is whether the governments (elites) of the five countries are able to translate coordination and cooperation into practical steps. A Development Bank may become an important instrument not so much to finance projects, as to formulate approaches to the development of the five countries, and thus serve as a strategy think tank.