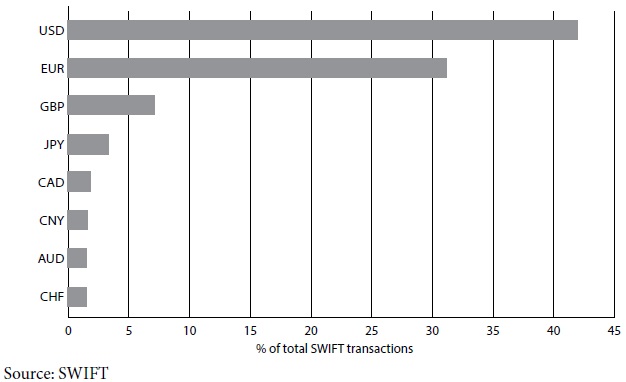

How can Russia and Japan cooperate to contribute to stability and prosperity in the Asia-Pacific region? With 48 trillion cubic meters Russia has the world’s largest natural gas reserve while Japan has the world’s largest net foreign asset of $3.2 trillion. Linking the two affluent resources creates new transactions and opportunities for the world economy. The implication will be far-reaching beyond the sphere of mere economics and will change the energy and financial world dominated by oil from the Middle East and the USD. For example, Japan imports 82% of its oil from the Middle East—Saudi Arabia (34%), UAE (25%), Qatar (8%), Kuwait (8%), and Iran (5%). On the other hand, the USD is used for 42.09% of international payments and is dominant particularly in Asia where regional currencies such as the Japanese yen (JPY) and the Chinese yuan (CNY) are used only for 3.4% and 1.68% of international payments, respectively.

Fig. 1. International payments currency, December 2016

THE PETRODOLLAR SYSTEM

In 1971, U.S. President Richard Nixon announced that his country would abandon the parity between the USD and gold. In the aftermath, the U.S. government was looking for ways to keep the USD as the most dominant reserve currency. In a series of meetings in 1974, the U.S.—represented by then U.S. Secretary of State Henry Kissinger—and the Saudi royal family made an agreement that became one of the most influential deals in the post-war period until today. The U.S. would buy Saudi oil and provide military aid and equipment. In exchange, the Saudis agreed to price all of their oil sales exclusively in the USD and invest their surplus oil proceeds in U.S. debt securities. In 1975, other OPEC members followed. This marked the beginning of the so-called petrodollar system—the most important mechanism determining the world business cycle until today.

When the U.S. economy was in recession, the Federal Reserve carried out an expansionary monetary policy, which led to depreciation of the USD. Oil price rose, oil production expanded, and the revenues were invested in U.S. debt securities closing the circle. There are two essential elements for this system to work. First, the U.S. has been the biggest oil consumer and importer throughout the second half of the 20th century until today. Second, the New York Mercantile Exchange (NYMEX), a commodity futures exchange, grew explosively after the oil crisis in the 1970s when petroleum futures were first introduced.

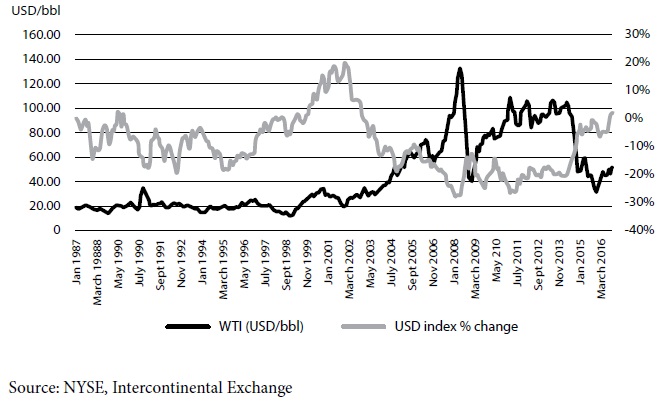

Today, 1.1 million contracts (1.1 billion barrels) of the West Texas Intermediate (WTI) futures are traded daily on NYMEX which is more than 100 times the crude oil production (8.9 million barrels per day) in 2016. Consequently, the “paper oil” has become a substitute for the USD showing a negative correlation between the oil price and the USD.

Fig. 2. Negative correlation between USD and WTI

Since the 1980s, the U.S. has increased its crude oil import and pursued an expansionary policy on both monetary and fiscal fronts. The resulting liquidity and demand have promoted globalization. But there are signs that the petrodollar system is changing.

The U.S. Energy Information Administration has reported that the U.S. will become a net energy exporter by 2026 (thanks mainly to the shale revolution). It would be the first time the U.S. will hold that status since 1953. The immediate consequence of the expansion of the U.S. energy production is that the U.S. will be less dependent on oil from the Middle East. Moreover, gas is expected to overtake oil for the primary energy demand around 2040. The weakening petrodollar recycling channel has already made the U.S. monetary policy and the USD increasingly more disconnected from the world economy.

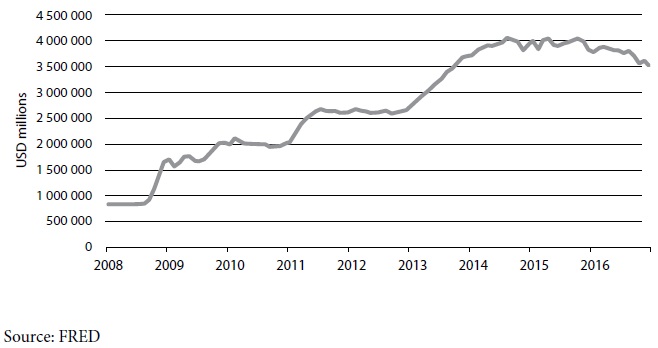

The Federal Reserve began to taper its quantitative easing policies in December 2013. The monetary base started to shrink gradually and the oil price fell sharply from its peak $112 per barrel in June to $59 per barrel in December 2014.

Fig. 3. U.S. monetary base

Moreover, Federal Reserve Chair Janet Yellen signalled further interest rate hikes this year. The U.S. monetary policy normalization will strengthen the USD and cause a liquidity crunch in the world, above all, in emerging economies with large dollar-denominated debts.

CHALLENGES TO JAPAN

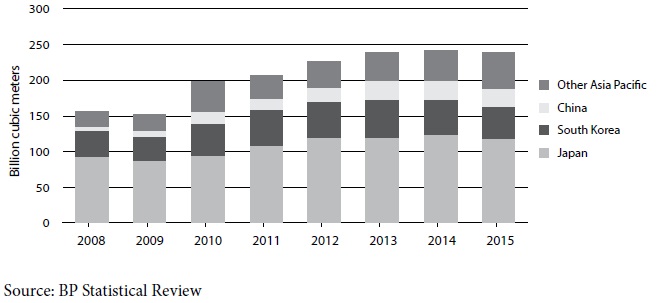

Japan has no significant natural resources. Moreover, after the Fukushima nuclear disaster in 2011, the Japanese government has suspended all but 4 of 54 nuclear power plants. To supplement its energy source, Japan has increased its import of liquefied natural gas (LNG) substantially. In 2015, Japan imported 115 billion cubic meters—more than the next four largest LNG importers combined.

Fig. 4. LNG imports

Japan’s major LNG sources were Australia (27%), Malaysia (18%), Qatar (15%), Russia (9%), and Indonesia (8%) in 2016. Nevertheless, natural gas still occupies only 23% of Japan’s primary energy mix, which is less than other liquids (42%) and even coal (27%) as of 2015.

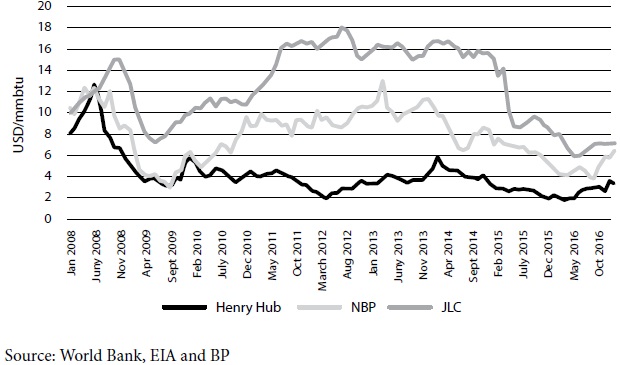

Fig. 5. Natural gas price and Japan’s import price

The LNG trade is still largely based on oil-indexed prices and long-term contracts, including the take-or-pay obligations and single destination clauses, which have isolated markets and created barriers for gas-on-gas competition. Furthermore, Japan, unlike the U.S. and Europe, has limited access to cheaper pipeline gas and lacks a secondary market to provide price competition. This has led to gas prices in Asia being substantially higher than in the U.S. and Europe—the so-called Asia premium.

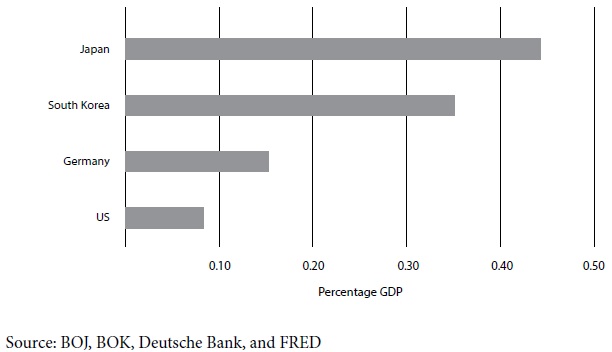

While Japan relies on natural resource import, it is capital-abundant, given the high corporate saving—a reflection of limited domestic investment opportunities. Japan can contribute to the world economy by providing liquidity and capital. This is best achieved by internationalizing the yen backed by the world’s largest net foreign asset; natural resource exporters can raise capital in yen and import Japan’s manufacturing goods.

Fig. 6. Corporate cash holding

RUSSIA’S POTENTIAL

Given its massive natural gas reserves, Russia can become a much bigger energy supplier for Japan. That will serve at least three purposes. First, Russia can balance Japan’s energy mix. Second, Russia can diversify Japan’s energy sources geographically; LNG source countries are more geographically dispersed. Third, Russia can reduce Japan’s reliance on other sources. Nuclear power had generated 30 percent of Japan’s electrical power prior to the Fukushima disaster. Restarting the nuclear power plants is politically controversial. For the environment, natural gas is cleaner, emitting less CO2 than oil and coal.

Currently, Japan’s natural gas import is around 97 percent by LNG. If the pipeline network linking the Far East, Siberia, Vladivostok, and Sakhalin can be extended to Japan, it will stabilize Japan’s energy source. In fact, the distance from the Southern tip of Sakhalin to Hokkaido is just 43km, and the pipeline can be expanded further south eventually to Tokyo covering 1,500 km. The Ministry of Economy, Trade and Industry estimates the cost to be about JPY 700 billion.

How does Russia benefit from a more comprehensive relationship with Japan? Russia’s economy needs investment to revitalize its industries and modernize its infrastructure, particularly in Siberia and the Far East. The summit meeting between Japan’s Prime Minister Shinzo Abe and Russian President Vladimir Putin last December yielded about 80 agreements between Japanese and Russian companies and state-run enterprises in energy, healthcare and other industries and, specifically, for industrial enhancement in Russia’s Far East. It is reported that Japan’s combined investments, loans and credit line will total JPY 300 billion.

Russia can secure a revenue flow from its LNG export for financing investment. Risks can be further mitigated if the revenue stream is matched with its underlying cost. This would be particularly helpful for contractors and natural gas companies that are exposed to foreign exchange risks from construction activities.

NATURAL GAS-YEN RECYCLING

The matching of interests between LNG exporters and Japan is the foundation for a new “natural gas-yen recycling.” The benefits would be far bigger if Japan had the foresight and strategic view as the U.S. did when it made the USD a global public good by creating the petrodollar system. Today, Japan is the largest natural gas importer and the largest net foreign asset holder—similar to the U.S. in the 1970s when it was the largest oil importer and the largest gold reserve holder.

During the G7 Energy Ministerial Meeting on May 1-2, 2016 in Kitakyushu City, Japan’s trade ministry announced that Japan aims to become an international trading hub for LNG by the early 2020s. To make active LNG trading possible, it plans to establish third-party access to receiving terminals, expand LNG storage facilities, connect pipeline networks, and institute a wholesale gas price.

To create a new “gas-yen system,” the LNG price index must be in the JPY as the WTI is indexed in the USD; only then, the futures market will grow and the index will be used not only for buyer/seller settlement but also for hedging against the JPY. The new regional index can exist parallel to the Henry Hub in the U.S., which is the pricing point for natural gas futures on NYMEX and will continue to be used for U.S. LNG exports.

The gas-yen system will 1) stabilize the global financial markets by promoting multi-currencies in line with more diversified energy markets; 2) solve the dilemma between the U.S. monetary tapering and liquidity needed in emerging economies short of capital and technology; 3) promote free trade when the new U.S. administration’s support for multilateral cooperation is expected to weaken.

Currency issue is a political issue as much as it is an economic one, therefore political leadership is needed. Much depends on whether Japan can cooperate with Russia as the U.S. did with Saudi Arabia. Japan would be a stable buyer of natural gas and a stable provider of capital for Russia. Utilizing affluent resources of both countries through free trade, the yen-indexed LNG market would contribute to the stability and prosperity of the region and the world.