“One Belt One Road” is not a Chinese solo, but a symphony played by all countries along the route. It is, in particular, an ensemble of China and Europe joining hands in operating on the great Eurasian market.

Wang Yiwei, 2015

A new buzzword has appeared in Russia’s international relations discourse: Povorot na Vostok (Turn to the East). A less ambitious version of it is vostochny vektor (Eastern Vector). Both phrases reflect increasing references to Russia’s “Pivot” to Asia. With a delay of three years, Russia appears to once again follow the US example and is now “pivoting” to Asia, which, in essence, means a turn to China, whose rise is changing the overall balance in the region and beyond.

However, the substance of Moscow’s pivot to Asia is quite different from Washington’s. The US essentially considers the rise of China a challenge, if not an emergent threat, which must be met with balancing efforts (plus a measure of engagement): “China represents one of the most challenging and consequential bilateral relationships the United States has ever had to manage.” This is how Hillary Clinton (as Secretary of State) justified the US pivot, which amounts to a fairly comprehensive strategic posture consisting of six elements: strengthening traditional security alliances; building new partnerships with rising powers, including (preferably, but not necessarily) China; engaging with regional multilateral institutions; expanding trade and investment; expanding the military presence beyond the established parameters; and advancing democracy and human rights. [1]

Russia, on the other hand, is evidently focused on the political and economic opportunities inherent in the tectonic shifts in that part of the world. Originally, Russia was simply attracted by the dynamic developments in Asia and China; however, since the Ukraine crisis and the deterioration of the zapadny vektor in 2014, its interest has turned into a necessity: Russia has lost alternatives. Regardless, Russia’s Asia/China pivot has become an integral part of a paradigm shift with much broader implications.

Concurrently with Russia’s turn to the East, China started marching West – through the rejuvenation of the Silk Road (“One Belt One Road”, OBOR), for example, which was inaugurated in 2013. At first glance, this move also appears to follow the example of the USA, that is, Secretary of State Hillary Clinton’s launch of a “New Silk Road” in 2011, which was primarily meant to embed Afghanistan in a Greater Central Asian network of trade and transit routes. [2] The Chinese turn to the West is clearly predicated upon US policy in the region, notably on the US Asia pivot – which is by no means devoid of anti-Chinese undertones. [3] China’s approach was first suggested by one of the country’s most prominent international relations scholars, Wang Jisi, in an article published in Global Times in October 2012, where he called for a “March West” strategy – as a means to counter the US pivot in East Asia while avoiding fruitless confrontation. Pushing forward in East Asia, his reasoning went, would inevitably lead to such confrontation, whereas the space to the west of China – that is, Central Asia and the Middle East – was not only considered free of US dominance, but in fact characterized by a withdrawal of the Americans. Thus, a turn to the West would not only facilitate a Chinese advance, but also open up prospects for cooperation, as Chinese and US interests in the region intersect nicely – particularly with regards to economic investments, non-proliferation, and regional stability. [4]

As is the case with Russia, for the Chinese, too, pushing and pulling somehow complement each other. However, while the USA plays a central role in both cases, Russia’s and China’s strategic designs and their results differ. Moreover, although Moscow and Beijing are united in their effort to rebalance the US, turning East and turning West, respectively, does not necessarily lead to a confluence of the countries’ geostrategic objectives. Rather, these turns call for a careful management of the conflict potential inherent in them.

The focus of this Paper will be on Russia. It sets out to present and analyze the various elements connected to Russia’s Asia pivot and the concurrent moves in the East. It includes four steps: first, it will address the rationale of Russia’s turn to the East; secondly, it will present the record to date; thirdly, it will assess the problems and risks; and lastly, it will provide some concluding thoughts about future prospects.

The Rationale

In principle, there is nothing wrong with turning to Asia in general and to China speci?cally – the country is currently the powerhouse of the world economy. Everybody is eyeballing China in an effort to find new market outlays, and in these economic terms, Russia has much room to improve and expand. Moreover, though it is essentially a continental power, Russia—like the US—is also an Atlantic and a Paci?c power. It is, however, much less balanced than the US: despite the fact that Russia’s access to the Paci?c is much broader than its Western shores, its center of gravity clearly resides in the western part of the country, having left the portion east of the Urals far behind—if not entirely neglected.

Rebalancing becomes an even more urgent task considering that the US has professed to build in the Asia-Paci?c what it has achieved in the transatlantic area: a “web of partnerships and institutions,” of which TPP is the most recent example. [5] And, of course, Russia shares a land border with China – which is over 4,200 km long, its largest border with a major power, and arguably the most peaceful in Russian history, as opposed to its borders with Europe or Turkey, where most military incursions of the last centuries have taken place. [6]

From the very beginning, rebalancing also meant engineering a new development push for the adjacent territories, namely Siberia and Russia’s Far East. On the one hand, this concerns the concentration of Russia’s unique natural resources in the region, the exploitation of which naturally calls for customers in geographical proximity – for the bene?t of the whole country. The same applies to the opportunity of turning the region into a bridge between the dynamic poles in the East and the West. On the other hand, it concerns a precautionary political element, that is, external threats from potentially expansionist neighbors and internal threats from separatist moods in the region, which, to some extent, gained currency during the turbulent 1990s.

However, Russia’s pivot to the East goes well beyond purely pragmatic considerations, occasionally raising fairly grandiose expectations with quite a few explicitly “geopolitical” connotations. In that vein it has been said:

“Today, the single Eurasian space – China with Southeast Asia and Russia with the Eurasian Union, plus India, the Middle East and Africa, which are also becoming increasingly Eurasia-oriented – is squeezing out the economy of the previously omnipotent trio of the United States, Europe and Japan. The United States is fiercely resisting the process in an attempt to preserve its supremacy in Eurasia, and consequently in global politics and economy.” [7]

Similarly, the admission of India and Pakistan to the Shanghai Cooperation Organization (SCO) is expected to completely change the regional and global map. With its new members, the SCO includes all leading non-Western powers of Eurasia and can therefore “be regarded as an emerging cornerstone of the multipolar world in the making, a platform offering a Eurasian alternative to Western Europe. As the Eurasian Economic Union (EEU) strives to come up with an economic alternative to the EU, the SCO could offer a political and ideological alternative.” [8]

Much of this has moved into the of?cial political foreground only in the wake of the Ukraine crisis, which clearly accelerated Russia’s turn to the East. [9] On the one hand, seeking refuge in Asia – and notably in China – was clearly a defensive move, meant to counter Western efforts of isolating Russia internationally, and intended to mitigate the adverse economic impact of Western sanctions (reinforced and superseded by falling oil prices later on). But on the other hand, these moves go beyond current concerns, following the Russian aim of doing away with US dominance and the “US-led Western-centric” world by adding substance to a multipolar international order, which Putin first alluded to at the Munich Security Conference in early 2007.

According to Dmitri Trenin, this overall goal has given rise to a substantially revised political map in the Kremlin: Putin’s original vision of a “greater Europe” from Lisbon to Vladivostok, comprising the EU and the EEU, is being replaced by a “greater Asia” from Shanghai to St. Petersburg. [10] In this sense, Eurasia, at a minimum, is considered to become the new center of economic and political gravity, where Russia and China set the tone without undue US interference.

Such a vision has familiar geopolitical undertones and – if taken as a prescription – might include far-reaching consequences, as, in the tradition of Harold Mackinder, the control of the Eurasian “heartland” is considered key to global supremacy – a proposition that has been propagated by Alexander Dugin and his, by European standards, neo-fascist Eurasian movement in Russia for years.

This confluence is one more indicator of how close the Kremlin appears to be navigating along the prescriptions of those “patriots” who ultimately detect Russia’s future in its past, white and red combined. In the wake of the Ukraine crisis, for a while, this also seemed to imply complementing the external confrontation with internal formation, thus effecting not only a turn to the East but also an imitation of what are considered the characteristics of the Chinese development model: authoritarian leadership coupled with state-led capitalism – something Dugin’s fellow traveler in the Izborsky Club and the Kremlin’s official adviser on Eurasian integration, Sergei Glazyev, has provided the intellectual blueprint for. [11]

In this sense, Russia’s turn to the East might be considered the culmination of a trend that preceded the Ukraine crisis, starting with Putin’s return to the helm of the state in 2011/2012. It implies a fairly comprehensive paradigm shift: What used to be “modernization” before became “mobilization”; what used to be “globalization” became “localization” (and “import substitution”); what used to be “democratic” became “traditional” values; and what pointed to aligning with the West became turning to the East.

The Record

Undoubtedly, Russia’s China pivot has accomplished a lot in a fairly short period of time. Whereas the “strategic partnership” between Moscow and Brussels never managed to move beyond pallid declarations, that between Moscow and Beijing has given rise to a truly preferential relationship. Putin is quite right when he states repeatedly, “As for the People’s Republic of China, the level, nature and confidence of our relations have probably reached an unprecedented level in their entire history.” [12] Notably, this was once also said about German-Russian relations, in which case, however, history proved much more tumultuous and the mutual understanding was predicated upon the limitations posed by the (widening) value gap (which prima facie constitutes another point of convergence in the case of China).

Proof of the countries’ close alignment is, for example, the fact that the Russian embassy in Beijing is second only to the embassy in Washington and that – contrary to standard practice – China boasts four inter-governmental commissions, all of which are overseen by Russian deputy prime ministers. [13] Frequent mutual visits and piles of agreements concluded and signed during these occasions complement the overall picture. The fact that China essentially sacri?ced another partner it had previously been close with – Ukraine – also testi?es to the importance Beijing attaches to its relations with Moscow. Beijing kept silent on Russia’s violation of the once upheld principle of state sovereignty and territorial integrity (as does Russia with respect to China’s territorial ambitions in the East and South China Seas, which also involve an equally close partner, Vietnam), but it has not hesitated to condemn Western sanctions, and backed Russia in its efforts at damage control.

The economic exchange between Russia and China – at least as far as trade is concerned – presents a similar picture. Since 2010, China has been Russia’s biggest trading partner with bilateral trade having reached $95 billion in 2014 (in the 1990s it hovered around a mere $5–7 billion annually). Based on this success, it became an of?cially declared objective to increase Russian–Chinese trade to $100 billion by 2015 and to $200 billion by 2020, which, in light of an average growth rate of around 30% prima facie, did not seem improbable. In 2015, however, Russian-Chinese trade could neither escape the economic downturn in both countries, nor the decline in global energy prices: it recorded a 28% decline (down to $62 billion with Chinese exports having dropped 34% and Russian exports 19%, both by and large in line with the decline in Russia’s sanctions-hit trade with the EU), rendering these ambitious goals out of reach for the time being.

Mutual investments have been much less progressive: As of the end of 2013, the total of Chinese investments in Russia approached $5 billion (of a Chinese total of around $115 billion), while Russian investments in China reached only $860 million. [14] Some have named Russia’s informal limitations on all Chinese investments in sensitive sectors such as energy, mining, and infrastructure as one reason: For the last 15 years, Chinese companies were not exactly encouraged to bid on large infrastructure projects in Russia. Moscow’s concerns allegedly included increased competition for (well-connected) local companies and a possible in?ux of Chinese migrant workers. Plans for the construction of new stations for the Moscow Metro and for a high-speed railway line from Moscow to Kazan – originally negotiated with Siemens – are the first practical signs of increased opportunities for Chinese engagement. [15]

A fairly new feature is financial cooperation, partly a response to Western sanctions, and partly driven by the aim to overcome the dominance of the US-Dollar. In 2010, the Moscow Interbank Currency Exchange launched trading in Ruble and Yuan, but sales hardly got off the ground. The situation changed drastically in October 2014, however, when the Central Bank of Russia and the People’s Bank of China signed a three-year currency swap agreement over $24.5 billion. Whereas in 2013 Ruble-Yuan settlement accounted for just 2 percent of bilateral trade, the two are now aiming at 50%. [16]

After years of protracted (price) negotiations, the first big gas deal was finally sealed in May 2014. It concerns the so-called “Eastern Corridor”. The natural gas from two remote fields east of the Baikal – the Chayandinskoye and Kovyktinskoye deposits – will be delivered via a newly built pipeline called “The power of Siberia” with a contracted final capacity of 38 bcm annually (possibly to be extended to around 60 bcm at some point in the future). The gas price has not been disclosed, but reportedly the terms and price formula are comparable to what Russia agreed on with its European customers. [17]

On 10 November 2014 Moscow and Beijing signed one more memorandum of understanding on gas supplies along the “Western Corridor”, which intends to connect fields in Western Siberia currently supplying Europe via a pipeline through the Altai Mountains with China. Theoretically this will allow Russia to switch between its customers in the East and the West for the first time, and it will be the first project to realize Gazprom’s once avowed aim of transforming the “European” gas market into a “Eurasian” market which it can randomly service. [18]

Contracts on Russian crude oil exports, such as the one between Rosneft and the Chinese National Petroleum Corporation in 2013 (on the delivery of 360 million tons of oil during 25 years), complement the picture of a belatedly emerging energy alliance between Russia and China. [19]

Certainly, the natural resource complex of Siberia and the Far East, consisting of oil, gas, coal, metals, timber, and others, as well as their proximity to Asian countries, are the most obvious – and for now Russia’s most important – assets and competitive advantage. Based on this, the region is expected to receive a more coherent and efficient development strategy than previously. There indeed exists a new “Federal Targeted Program for the Development of the Far East and the Baikal Region” for the next five years, as well as a “List of Priority Investment Projects in the Far Eastern Federal District”, approved by the Government of the Russian Federation on 3 June 2013, and, not least, Putin’s instructions to create points of economic growth in his address to the Federal Assembly of the Russian Federation on 12 December 2013. [20]

Optimism about signi?cant improvements in the region, however, is limited. The performance of the Ministry for the Development of the Russian Far East, established in 2012, for example, is assessed highly critically by Russian experts. [21] And according to Chinese complaints, the Russian state has failed to instigate even the most basic preparatory efforts for favorable investment conditions. Similarly, there exist no appropriate transport links along the border, nor has Russia managed to build its part of the 2.2 km bridge across the Amur River, a promise it made in 2007 – and reiterated again in 2014 – without much activity to follow since. Chinese critics attribute this lack of engagement to Russia’s lingering suspicion of Chinese participation in the development of Siberia and the Far East, which allegedly implies a fear of Chinese capital and the in?ux of Chinese migrant workers. [22]

Military cooperation with China, however, has intensi?ed considerably in the past few years. Military exercises such as the “Naval Interaction/Joint Sea 2014” Russian-Chinese military naval exercise (May 2014, the largest ever, though still fairly small, consisting of only 6 ships on either side), the “Peace Mission 2014” military exercises (August 2014), and the “Sea Cooperation 2015” naval exercises. [23] The next bilateral naval exercises are scheduled for 2016 in the western Paci?c.

Arms delivery and armament cooperation is another field in which previous obstacles and reservations have been overcome – again, belatedly. Whereas in the 1990s, military-technical co-operation constituted one of the pillars of mutual trade and China’s share in Russian arms export was quite sizeable, it gradually declined during the following decade. One of the reasons for that is reminiscent of Western business: Russia was concerned about the Chinese propensity to copy Russian equipment. The last large orders were reportedly placed in 2007. [24] However, considering the serious crisis between Russia and the West, well-informed observers expect a further intensification of military and military-technical cooperation, which would imply expanding the range of technology that Moscow is willing to supply to Beijing: “By all appearances, the restrictions on supplies of some of the latest technology to China will be eased.” [25]

Problems and Risks

Despite the recent increase in mutual cooperation and noticeable achievements, a good number of problems, risks and competing objectives remain between Russia and China, which might not necessarily jeopardize progress, but will certainly complicate and slow it down.

On a most basic level, China, in many respects, is terra incognita for Russia and ordinary Russians. This attitude comprises a stark contrast to Russia’s perspective of the West, where advancements were made more than twenty years sooner. A lack of experience and knowledge thus dominates Russian popular discourse about the country’s state of affairs with China. But this attitude is equally as common on the Chinese side, where very little mutual appeal and understanding exists as well. [26]

Moreover, whereas Russia’s relations with the West are often marked by an inferiority complex, the country harbors sentiments of cultural superiority vis-à-vis Asia (yet not necessarily vis-à-vis China). Conversely, whereas Russia’s “Europeanism” has always been a matter of identity, Russia’s “Asianism” is just a pragmatic choice. Considering the freeze in East-West relations, however, that Asianism appears to be moving beyond pure pragmatism; Foreign Minister Sergey Lavrov, for instance, has in early 2016 tellingly reinterpreted history, describing the period of the Mongolian invasion as “extremely important for the assertion of the Russian State’s independent role in Eurasia”, because the Golden Horde was tolerant enough to allow “the Russians’ right to have a faith of their own and to decide their fate, despite the European West’s attempts to put Russian lands under full control and to deprive Russians of their identity. I am confident that this wise and forward-looking policy is in our genes”. [27]

That being said, Russia’s alleged pragmatism remains compromised by a lingering uneasiness about China’s rise. In contrast to Western allusions to the “yellow threat”, Russia’s fears are compounded by a pertinent and peculiar concern: the (growing) economic and demographic asymmetry between China and the sparsely populated Siberia and the Far East.

Economic Asymmetries

The economic relations between Russia and China are characterized by a number of asymmetries, some of which pose challenges and others opportunities. One such asymmetry is the gradually increasing gap in the countries’ GDPs, which, according to Russian observers, constitutes “the main challenge to Russian-Chinese relations” today: Russia’s amounts to only about 20% of China’s. [28] Even more problematic is the asymmetry in the two countries’ dependency ratio: at just 1.76 per cent in 2009 and 2.15 per cent in 2013, Russia’s share in China’s foreign trade remains small, while China occupies the top rank in Russia’s foreign trade, with its share hovering well above 10%. This asymmetry has sparked concerns that “China has been diversifying its trade, while Russia has been growing increasingly dependent on the Chinese market”. [29] In addition, as trade still constitutes the overwhelming part of economic relations, the interdependence of the two countries remains extremely low.

The most signi?cant imbalances, however, are found in the structure of trade, which has undergone a very unfavorable transformation during the past ten years. In 1999, the structure of Russian imports from China was fairly balanced between processed goods (such as metals, plastic, textiles, footwear, machinery) and unprocessed goods (such as wood and vegetables). By 2013, however, these imports were clearly dominated by high added value products (notably machinery and electronic products) amounting to 48%. On the export side, just the opposite happened: In 1999, ferrous metals and machinery accounted for 39% of Russian exports to China (with fuels at a negligible 6%), but in 2013 only 4% was left of these products, as oil and other energy products reached 74%.

Of course, such large export shares of oil and gas to China imply a dependency of Russian deliveries on Chinese resource policy, and it has been argued that China, by turning to Russia, is simply seeking to minimize its risks in the sector of energy imports. At present, oil and gas imports from Russia make up just 6% and 4% respectively of all Chinese supplies of these two energy carriers. In light of this, the first Valdai report “Toward the Great Ocean” concluded that a ?xation on oil and gas pipelines exclusively for China should be avoided at all cost: “These pipelines should go to the ports of the Far East and from there on to the markets in the Paci?c and Indian oceans. The Soviet mistake of building all its gas pipelines to the West should not be repeated.” [30]

As in the case of Europe, there is growing concern that Russia might become a mere resource appendix of China. This rings all the more true considering that the countries’ ambitious goals for expanding mutual trade will allegedly only be reached if the current structure of bilateral trade is preserved: by increasing Russian (commodity) exports and Chinese (machinery) imports. [31]

Russian trade with China is an exact replication of Russia’s trade with the West, particularly with the European Union. [32] In that sense, it does not help propel structural change, but rather reinforces the status quo. Since 2014, there have certainly been exchange rate effects on the country’s foreign trade – the detrimental consequences of the Dutch disease on Russian exports might be recti?ed by the marked weakening of the Ruble in the wake of declining oil prices – but Russia’s trade pattern first and foremost re?ects structural de?ciencies. Andrei Kortunov has clearly pointed out what is at stake:

“If Russia doesn’t modernize and diversify its economy, increase its innovation potential, the ties with China will remain one-sided: Russia will export raw materials, energy resources, military equipment and, in return, receive consumer goods, car manufacturing products and so on. In order to avoid that and proceed to more complex cooperation projects, we need to restructure our economy.” [33]

In other words, economic cooperation with China alone will not help rectify Russia’s economic woes; rather, it is the other way around: China will largely bene?t from the countries’ relationship – a fact and intention that has been articulated by Chinese representatives in no uncertain terms. Consequently, it has been pointed out that, barring large energy and infrastructure projects,“companies will need to act as the agents of bilateral trade and economic cooperation” and Russia needs to “develop market mechanisms” without which “a large-scale breakthrough is unlikely to happen in trade and economic cooperation, particularly when it comes to mutual investment”. Such advice sounds very familiar and has been put forward at EU-Russia gatherings time and again (where it was increasingly perceived and criticized as undue lecturing by the Russian side). The same is true for Russian “technology clusters” which do not function properly for familiar reasons: “Unfortunately, Russia has chosen to set up technology clusters in remote regions with small populations and underdeveloped economies. As much as Russia hopes that foreign capital will develop those regions, they offer little appeal for foreign businesses.” [34]

In its turn to the East, Russia is facing the same adaptive pressures as in its time-tested relations with the West. It remains to be seen whether the “Modernization Partnership” between Moscow and Beijing will produce more tangible results than the ones it established with the EU and most of its member states around the same time. This is equally important with regard to making proper use of the opportunities presented by China’s OBOR strategy.

The Silk Road and Competing Interests

Much to Moscow’s chagrin, Europe is facing Russia as a fairly unified front. In Asia, however, the situation is completely different. Here, Russia is operating on a true minefield of competing territorial claims, historical animosities, and shifting alliances. This situation has the potential to become even more uncomfortable than the one in Europe, as Russia might be forced to take sides – in particular since China is more or less directly involved in most cases, and not necessarily in a “harmonious” way but rather in a fashion that is indicative of its cherished “rise”. This, for example, concerns relations between China and India, the latter being Russia’s time-tested partner and prime weapons customer. It also concerns the even more strained relations between China and Vietnam, where the latter has not only been the subject of a Chinese military incursion, but is also engaged in a bitter struggle over the Spratly islands in the South China Sea. And it concerns the deteriorating relations between China and Japan, with which Russia is trying to overcome the remnants of the Second World War in its – currently suspended – “two plus two” talks on what Japan calls “Northern Territories” (part of the Kurile islands). Chinese representatives have made unmistakably clear that, in spite of diverging views, Beijing expects Russia to remain at least neutral and sensitive to its interests. [35]

One area that for some time appeared in danger of open con?ict is Central Asia, where China, in its “March West,” directly interferes with Russian special interests. China’s presence in the region has expanded steadily, and received a possibly far-reaching boost in late 2013, when President Xi Jinping announced the two Silk Road proposals: the “Silk Road Economic Belt” (in Astana on 7 September) and the “21st Century Maritime Silk Road” (in Jakarta on 3 October). [36] Both initiatives, labeled “One Belt, One Road” (OBOR), are meant to establish a connection between China and Europe. This implies building necessary infrastructure, constructing “key economic industrial parks as cooperation platforms,” and removing trade and investment barriers along the Belt proper and along economic corridors that link adjacent regions to the Belt. [37]

So far, the of?cial “vision” for OBOR has been fairly vague. It is said to embrace “the trend towards a multipolar world, economic globalization, cultural diversity and greater IT application” and is designed to uphold the global free trade regime and the open world economy in the spirit of open regional cooperation.” [38] Less vague, however, has been the staggering amount of monies China plans to invest in this initiative. In 2014, a $40 billion Silk Road Fund was set up to cover the necessary investments. In addition, China announced a provision of $46 billion to finance the Chinese-Pakistani economic corridor; Prime Minister Li Keqiang is said to have committed at least $94 billion to finance speci?c projects; and China’s Development and Reform Commission has indicated that as much as $800 billion might be available for projects over the next ten years. [39]

A number of Chinese motives have been put forward as reasons for the OBOR initiative, which is currently turning into a grand strategy and a pet project of the Chinese leadership. First of all, the historical Silk Road raises largely positive connotations, representing a desire for a peaceful and mutually beneficial exchange. As such, OBOR serves as a perfect diplomatic soft-power tool to promote Xi Jinping’s “Chinese Dream” of “restoring” China’s previous and rightful place as a world power. [40] In a more mundane fashion, it reflects the Chinese desire to no longer confine itself to the East Asian region, whether to avoid confrontation with the US (the rationale of the “March West” suggestion), or to diversify relations and explore new opportunities, commensurate with China’s rise and its global ambitions. [41]

In economic terms, OBOR links up with the need for a development push in China’s western and central provinces, which are lagging seriously behind the dynamic coastal areas. It therefore complements the “Grand Western Development”, a national strategy launched back in 2000. The prime emphasis of OBOR is on connectivity, as outlined in the official “vision”: it aims to “set up all-dimensional, multi-tiered and composite connectivity networks, and realize diversified, independent, balanced and sustainable development in these countries”. Therefore, the countries along the Belt and Road should “improve the connectivity of their infrastructure construction plans and technical standard systems, jointly push forward the construction of international trunk passageways, and form an infrastructure network connecting all sub-regions in Asia and between Asia, Europe and Africa step by step”. [42]

Considering that even East and Central Asia have no shortage of institutions that are meant to foster cooperation, frustration about their performance may have also played a role in the instigation of OBOR. More specifically, these feelings concern the Shanghai Cooperation Organization (SCO), which used to be Beijing’s preferred vehicle for regional security and economic cooperation. China has pushed for a greater economic role of the SCO for years, suggesting the creation of a legal framework for a free trade zone, a business council, a regional development bank, and, in the wake of the economic crisis of 2008/2009, an anti-crisis fund. [43] These initiatives have been spoiled by Russia or by Central Asian states in various ways. [44]

OBOR signals that China is ready to embark on a much more activist, unilateral course, which certainly is not aimed at Russia, but nevertheless seriously affects Russian vested interests – particularly in the on-shore variant. For example, Russia’s favorite organization, the “Eurasian Economic Union” (EEU), is directly affected by OBOR, as some of the countries targeted by China for inclusion in the Belt are members (such as Kazakhstan and Kyrgyzstan) or potential future members (such as Tajikistan). This inevitably raises concerns about overlapping spheres of interest. In addition, OBOR may also become a competitor for Russia on infrastructure development. Originally, Russia was accorded only a peripheral role in the concept, as the main part was geared towards the region south of its border. This was vexing for Russia, as it keeps advertising its territory as the main corridor for transit between Asia and Europe, limited capacity notwithstanding.

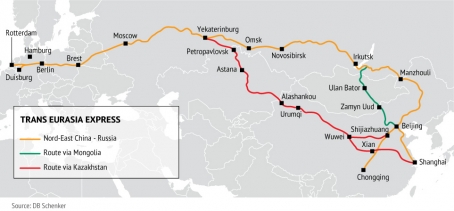

In fact, OBOR implies that various on-shore corridors be developed to transport goods from China to Europe and vice versa, all of which are considered superior and preferable to congested and time-consuming maritime freight. Of these corridors, the northern route is the longest but most established, split between the Trans-Siberian Railway and a route running south of Mongolia via Kazakhstan to Russia and on to the ports of Rotterdam and Duisburg. These connections have been used extensively, for instance by Deutsche Bahn, which, for instance between 2011 and 2012, employed nearly 200 container trains for BMW on both routes, to Chongqing and Shenyang respectively. [45] Rail freight service on the route via Kazakhstan has been operative since 1992. [46]

On the southern route that eschews Russia, various trial connections have recently been tested. These newly emerging connections have several comparative disadvantages, such as numerous custom controls, but they are being energetically expanded and could one day become a true rival to the much longer northern routes. One such trial took place between China and Teheran in early 2016 and is expected to become a regular freight service running once a month. [47] In 2015, DHL also commissioned shipping from Lianyungang in China via Kazakhstan, Azerbaijan, and Georgia, including two sea transit segments, for arrival in Istanbul within 14 days. [48]

This connection is managed by the “Coordination Committee on the Development of the Trans-Caspian International Transport Route” (TITR), initiated by Kazakh Railway and combining ports, railways and logistics businesses from Azerbaijan, Kazakhstan, Georgia, Turkey and China. [49] Recently, Ukraine has developed some interest in this Trans-Caspian connection, likely (and ostentatiously) as a means to bypass Russia: On 15 January 2016 Ukraine dispatched a 30-car container train from Illichivsk/Chornomorsk on a test journey through Georgia, Azerbaijan and Kazakhstan to China. [50]

This connection is managed by the “Coordination Committee on the Development of the Trans-Caspian International Transport Route” (TITR), initiated by Kazakh Railway and combining ports, railways and logistics businesses from Azerbaijan, Kazakhstan, Georgia, Turkey and China. [49] Recently, Ukraine has developed some interest in this Trans-Caspian connection, likely (and ostentatiously) as a means to bypass Russia: On 15 January 2016 Ukraine dispatched a 30-car container train from Illichivsk/Chornomorsk on a test journey through Georgia, Azerbaijan and Kazakhstan to China. [50]

Although the Ukrainian jump on the bandwagon might be indicative of the fact that some countries along the Belt would like to use the Russian-Chinese connectivity competition to their advantage, the real challenge for Russian interests is the predominantly bilateral nature of the OBOR initiative. The “vision” mysteriously states: “We should strengthen bilateral cooperation, and promote comprehensive development of bilateral relations through multi-level and multi-channel communication and consultation.” And it calls for the development of “a number of bilateral cooperation pilot projects” and the establishment and improvement of “bilateral joint working mechanisms”. At the same time, it also aims to “enhance” the role of multilateral cooperation mechanisms, notably the SCO, ASEAN Plus China (10+1), the Asia-Pacific Economic Cooperation (APEC), the Asia-Europe Meeting (ASEM), and even those aligned with the (Japan-dominated) Asian Development Bank, such as the Greater Mekong Sub-region (GMS) Economic Cooperation and the Central Asia Regional Economic Cooperation (CAREC). [51]

Conspicuously absent from this list is the EEU. This is all the more surprising considering that further west, since 2012, China has entered into an intensive annual dialogue with a total of 16 Central and East European countries (the so-called 16+1 cooperation format), including EU members and non-members. [52] In 2014, while speaking in reference to OBOR, Chinese Prime Minister Li Keqiang called these countries “the eastern gate to Europe” and promised material assistance for them as “express links” between China and Europe and within Europe. In concrete terms, he announced a $10 billion Chinese credit line for infrastructure development and an agreement to build a new high-speed railway link from Budapest to Belgrade – which could possibly be extended to the Greek port of Piraeus, the endpoint of the Maritime Silk Road.

In light of this it may not be surprising that it took some time and apparently “painful internal discussions” for Russia to come to terms with the Silk Road project. [53] On 9 May 2015, Putin and Xi Jinping finally signed a joint declaration “on cooperation in coordinating development of the Eurasian Economic Union and the Silk Road Economic Belt.” Moscow and Beijing con?rmed their intentions to coordinate the two projects, in order to build a “common economic space” in Eurasia, including a Free Trade Agreement between the EEU and China – which had previously been put on hold in the framework of the SCO.

So far, this is only a declaration of good intentions, however, a “Memorandum of Understanding” as generally envisioned by the Chinese authors of the Silk Road, and as signed with the EU Commission in June 2015 (which led to the creation of an “EU-China Connectivity Platform”). But the document signals that Russia and China do not want this contentious issue to escalate into open con?ict – as has happened in other cases further west. [54] Positive-sum is therefore the term most often applied to characterize the project. China is ready to accept the EEU as a negotiating partner in addition to individual member-states, even though it will hardly resort to a “Moscow-?rst” policy (which, by the way, is equally unpopular in Central Asia as it is in Central Europe). Similarly, Moscow has put its security concerns and its claim to an exclusive sphere of interest on the back burner, without, however, forfeiting its suspicions about undue foreign mingling in its backyard. This, too, is reminiscent of Russian concerns in the western part of what used to be the Soviet Union – Ukraine – but it should be noted that so far, con?ict management by the parties involved here has been vastly different from Russia’s engagement with the EU – and consequently its outcome varies as well.

This benign management of mutual concerns certainly originates from the “strategic” character of the relationship between the two countries. On top of that, the very nature of the Chinese project also helps mitigate the potential for con?ict. Contrary to European and Western approaches to regional integration, which rely on multilateral treaties, legally binding rules and standards, collective dispute settlement mechanisms, and supranational institutions, the Chinese style of economic integration is different and primarily focused on economic facilitation: “Advancement of this agenda does not require China to manage multilateral treaty negotiations or create supranational bureaucratic organizations. It merely requires China to supply leadership in the form of initiating discussion, advancing cooperation proposals, lowering information and transaction costs for cooperation partners, and providing them with material incentives such as new infrastructure, credit, investment, and trade opportunities.” [55] This particular style has also been attributed to the propensity for networks in the Chinese culture, which allows for accommodating overlaps and helps avoiding zero-sum constellations. [56] Combined with financial stimuli of unprecedented proportions, this style comprises a much greater incentive for cooperation than the European combination of regulatory demands and material parsimony.

Nevertheless, with respect to OBOR, Russian observers have noted “unacceptable delays in elaborating a common approach”. In virtually every respect – foreign investment support, arbitration, industrial cooperation, transport infrastructure – EEU members are said to have “failed to even decide on a common approach”. [57] Indeed, there exist a number of structural impediments that complicate finding a common denominator. For instance, multilateral coordination is more time-consuming than bilateral negotiations; OBOR is not equally important to all EEU member states – particularly Armenia and Belarus are hardly affected by it; and common EEU-OBOR projects are overall inconceivable insofar as the EEU is essentially a regulatory body and not (yet) a supranational entity. Finally, it is obvious that OBOR is a Sinocentric project in which Russia can only play second fiddle – a role it has never been content with. This even applies to the project level: “It seems that the vast majority of infrastructure projects within the Silk Road Economic Belt framework will be built by Chinese businesses and funded through Chinese investments.” [58]

Others are less reluctant than Russia – and this points to the potentially most important factor: The financial inducements have apparently started a race for the best place in the sun – a behavioral pattern that has been known as quite common in competitive development cooperation. This dynamic vastly plays into the hands of Chinese bilateralism. As Kazakhstan’s foreign minister, Erlan Idrissov, has stated, “Our philosophy is simple: We should get on board that train.” [59] The first visible signs of this bilateral “train ride” include the joint construction of a logistics terminal in the Chinese port of Lianyungang to facilitate the transportation of goods from Central Asia to overseas markets, and the joint project with China of a “dry port” in Khorgos at the Kazakh border, which is to become a major distribution and transshipment hub for goods bound between China and Western Europe, and has been ambitiously dubbed a “mini-Dubai”. [60]

Apart from the competition for connectivity and the pitfalls of Chinese bilateralism, Russia and China share an important common interest in Central Asia: they both seek support for political stability and the maintenance of secular regimes in power, irrespective of the (autocratic) nature of these regimes. That this confluence will eventually lead to a Russian-Chinese “condominium” in Central Asia, in which Russia will be the guarantor of security and China the largest economic player, is probably too rosy an image of the future division of labor, even if one considers the interests of the regional powers in mutual reassurance against one-sided dependencies. [61] Those engaged in propagating the accord seem to be torn between the notorious impression that Moscow’s activities in this respect are “one of the most important indicators of Russia’s comeback as a global power” and the more down-to-earth assessment that the cooperative taming of the Silk Road is “an effective instrument of trade protection for the national market” of the EEU member states. [62]

Some support and relief for Russia may be derived from the fact that in spite of the many material incentives, OBOR is regarded with quite a bit of skepticism in other parts of the world, familiar with the Chinese way of pursuing its core interests. For instance, one might fear that Central Asia could end up like Africa and Latin America – as a raw material appendix and dumping ground for Chinese excess production – in which case OBOR would almost certainly lead into a dead end. The same would apply if the creation of connectivity turned out to be no more than a job creation program for Chinese infrastructure companies, rather than an actual economic stimulant for the region.

Prospects

Contrary to skeptics of Russia and China’s relationship in Eurasia, who have described it as “public cooperation and private rivalry”, [63] Dmitri Trenin, for example, expects a fairly smooth and bene?cial evolution: “In the coming years, those relations are likely to get appreciably closer, tending toward a quasi-alliance and quasi-integration, with Beijing as the more powerful member of the relationship.” [64] Others have envisioned altogether apocalyptic scenarios, such as Robert Kagan, for example, who once warned “the coming battle will be between autocratic nations like Russia and China and the rest”. [65] A sober look at the situation, however, reveals a more nuanced picture.

First of all, Russia has to come to terms with its powerful neighbor. The history of the Sino-Soviet rivalry pays testimony to the serious risks of failing to do so – even though both countries subscribed to the same Marxist-Leninist devotion. Secondly, a close relationship needs to address and tackle obvious asymmetries. There are four interrelated Russian concerns: the prospect of being no more than the junior partner of China, the fear of ending up as a resource appendix of the dominant neighbor, the anxious expectation of an in?ux of Chinese people (and in some instances of its capital), and the risk of having the Central Asian sphere of in?uence wrestled away by the OBOR inducements. These apprehensions have been recurrent subjects in the Russian debate about its Asia pivot. The first is usually offset by Russia’s nuclear deterrent, on par with the US and well ahead of China’s, the second by the argument that having been a resource appendix of the EU proved risky but not detrimental, and the third and fourth by pointing to mutual bene?ts and the possibility of exerting control through cooperation. In any case, these concerns are reminiscent of Russia’s grievances in its relationship with the West, and have been identi?ed by many as a prime cause for its current estrangement from the West. Conversely, the current Russian-Chinese rapprochement is clearly a function of Moscow’s demarcation from the West – and thus possibly conditional and temporary. Regardless, it certainly helps mitigate Sino-Russian rivalries.

More generally, in Moscow, Russia’s Asia pivot is also considered a natural byproduct of the global power shift at the expense of the traditional West and as a building block of a new – multipolar – international order. In this regard, cooperation with China is said to “objectively strengthen Russia’s position in the international arena as an independent center of power”. [66] However, Russia’s high-pro?le offensive also carries serious risks. Acting as a battering ram not only re? ects a fairly one-sided division of labor between Moscow and Beijing, with China gently marching through the gate pushed open by Russia, washing its hands of responsibility by expounding at best “a new model of major-country relationships”. [67] It also implies overstretch and a misallocation and waste of precious and ultimately scarce resources – with a repeat of the fate of the Soviet Union looming on the horizon.

As of right now, China is not venturing to upgrade its relationship with Russia to a level of exclusivity. Rather, Beijing seems to be rejuvenating the art of triangulation between Moscow and Washington, if not opting straight for a G2 with the US as the prime source of its economic progress. So far, China and Russia seem content with assurances of mutual respect and a simulation of equality and equity – something Moscow rightly keeps complaining it failed to receive in the West. Moreover, a careful management of diverging interests and lingering con?icts of Russia and China in Central Asia, and expanding economic links as a gradual approach to economic integration could amount to something the EU can learn – and bene?t – from.

Sino-Russian economic relations only partly ?t into this positive picture, as the record is much less encouraging in this regard. Essentially, current economic relations follow an energy-driven diversi?cation strategy, which Russia needs as badly as the EU. Cutting back on its over dependence on the West – the prime destiny of its energy exports and the prime source of its value-added imports – has become even more urgent in light of the vulnerability that Russia encountered as a result of Western sanctions. However, the downside of that approach is as follows: while it expands Russia’s base of customers and suppliers, it preserves old structures; Russia is not conquering the Chinese market with new products, but rather redirecting the ?ow of its old commodities while taking in ever more imports from China. Preserving structures – political as well as economic – has always been fairly high on Putin’s conservative agenda, and it may once again prove insuf?cient.

The views and opinions expressed in this Paper are those of the author and do not represent the views of the Valdai Discussion Club, unless explicitly stated otherwise.

Valdai International Discussion Club

[1] Hillary Clinton, America’s Pacific Century, 1 October 2011, in: http://foreignpolicy.com/2011/10/11/americas-pacificcentury.This follows the logic of,“We both have much more to gain from cooperation than from conflict. But you cannot build a relationship on aspirations alone.”

[2] Its predecessor was a 1999 US assistance program with the aim (among others),“to assist in the development of the infrastructure necessary for communications, transportation, education, health, and energy and trade on an East-West axis in order to build strong international relations and commerce between those countries and the stable, democratic, and market-oriented countries of the Euro-Atlantic Community; and to support United States business interests and investments in the region” It was confined, however, to those countries that do not display a “consistent pattern of gross violations of internationally recognized human rights.” Silk Road Strategy Act of 1999, in: www.govtrack.us/congress/ bills/106/hr1152/text.

[3] Building a regional energy market for Central Asia has been presented as “a centerpiece of the U.S. strategy”. This primarily concerns the Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline, which could not only provide economic dividends to Afghanistan, but would also allow Turkmenistan “to diversify its exports away from China” by delivering energy to India and Pakistan. However, just as in the case of the aborted “Nabucco” project, investors are in short supply. James McBride, Building the New Silk Road, 25 May 2015, in: www.cfr.org/asia-and-pacific/building-new-silkroad/p36573.

[4] See, for instance, Yun Sun, March West: China’s Response to the U.S. Rebalancing, 31 January 31, 2013, in: www. brookings.edu/blogs/up-front/posts/2013/01/31-china-us-sun. In a skeptical side note she also refers to a strategic postulate by Mao Zedong: “Where the enemy advances, we retreat. Where the enemy retreats, we pursue.”

[5] Clinton, op. cit.

[6] In the East Russia used to be the expansionist power – right up until the “unequal” treaties with China, such as the Treaty of Aigun 1858 and the Beijing Convention of 1860 which granted Russia quite big territories (Amurskaja Oblast, Khabarovskiy Kray, Primorskiy Kray).

[7] Gleb Ivashentsov, Toward a Peaceful Eurasia, 14 May 2015, in: http://russiancouncil.ru/en/inner/?id_4=5918#top-content.

[8] Alexander Lukin, Shanghai Cooperation Organization: Looking for a New Role, Valdai Discussion Club, Special Issue. Allegedly, this also implies a clear break with the SCO’s past, as Russia originally intended the SCO simply as an ideological symbol of a multipolar world: “It adopted declarations expressing a non-Western, multipolar view of the world and non-Western values, but did not undertake any serious organizational work.” The Chinese concept of the SCO, however, points into another, economic-minded direction.

[9] According to Alexander Lukin the rapprochement between Russia and China implies a broader meaning and dates back to the late Brezhnev era: “The drawing together of Russia and China began long before the Ukraine crisis and has continued already for more than 30 years. The causes are much more fundamental than most observers acknowledge and consist of gradually recognizing the similarity and even overlap of their core interests in the international system and their geopolitical situation.” (Alexander Lukin, Russia, China and the Emerging Greater Eurasia, 18 August 2015, in: www. theasanforum.org/russia-china-and-the-emerging-greater-eurasia). However, he also acknowledges “complexities” in the Russian-Chinese relationship, which, under different circumstances, would have led Moscow to act “more cautiously,” since “in the Russian leadership and elite, there have always existed different approaches to China and the West”. That is to say, in the end it was “the antagonistic policies of the West” that “do not leave an alternative. […] Moscow is left with no choice but to turn to Asia, first of all China”.

[10] Dmitri Trenin, From Greater Europe to Greater Asia? The Sino-Russian Entente, 9 April 2015, in: http://carnegie. ru/2015/04/09/from-greater-europe-to-greater-asia-sino-russian-entente/i64a#.

[11] See, among many others of his numerous publications, Sergey Glazyev, Moment istiny: Rossiya i sanktsii zapada (The Moment of Truth: Russia and the Sanctions of the West) 24 June.2014, in: www.dynacon.ru/content/articles/3397.

[12] Plenary session of the 19th St Petersburg International Economic Forum, 19 June 2015, in: http://en.kremlin.ru/events/president/news/49733.

[13] See Alexander Gabuev, Russia’s Policy towards China: Key Players and the Decision-making Process, 5 March 2015, in: http://carnegie.ru/2015/03/05/russia-s-policy-towards-china-key-players-and-decision-making-process/i4ek.

[14] Mikhail Titarenko et al., Development of Russian–Chinese Trade, Economic, Financial and Cross-Border Relations, RIAC Working Paper 20/2015, p.4.

[15] See Alexander Gabuev, A “Soft Alliance”? Russia-China Relations After the Ukraine Crisis, European Council on Foreign Relations, February 2015. Nevertheless, Chinese investment in Siberia and in agriculture remains a highly charged subject of discussion: When the news appeared that Russia’s Zabaikalsky region would grant 115,000 hectares of land to a Chinese company, many protests ensued. See Alexander Gabuev Should Russians Fear Chinese Colonization? 30 June 2015, in: www.themoscowtimes.com/opinion/article/should-russians-fear-chinese-colonization/524739.html.

[16] Gabuev, A “Soft Alliance”? op.cit.

[17] See on this Alexey Grivach, What Are the Gains for Russia from Its Gas Contract with China? Russia in Global Affairs, No. 3, 2014, in: http://eng.globalaffairs.ru/print/number/A-Window-to-Asia-16999. A skeptical assessment has been put forward by Vladimir Milov, Russia’s New Energy Alliances: Mythology versus Reality, Paris (Russie, NEI, Visions No. 86), July 2015, pp. 7-9.

[18] See on this “Europe and Eurasia: towards a new model of energy security. The natural gas aspect”, Valdai Discussion Club, Position paper for the Berlin conference, 13 April 2015. The first memorandum of that kind was actually signed back in 2006 and since then not much progress has been registered. Similarly, a third project that was much publicized as well, a joint LNG terminal in Vladivostok, seems to have stalled, too.

[19] Add to this the stakes which Chinese companies recently acquired in Russian natural resource companies and deposits, see, e.g.,“The US and Russia in the Asia-Pacific”, Report jointly prepared by the IISS and IMEMO, 2016, p.10.

[20] Titarenko et al., op. cit., pp. 4-5.

[21] “So far, it has not performed its main function of making the region attractive for businesses as well as for the people. There is still no clear understanding on which country the Far East should focus its cooperation, and the investment climate remains unwelcoming for foreign investors” (Titarenko et al., op. cit., p. 19).

[22] Luzyanin/Huasheng et al., op. cit., p. 16.

[23] Ibid., p. 4.

[24] Alexander Gabuev, Russia’s Policy Towards China: Key Players and the Decision-making Process, 5 March 2015, http://carnegie.ru/2015/03/05/russia-s-policy-towards-china-key-players-and-decision-making-process/i4ek.

[25] Sergey Luzyanin, Zhao Huasheng et al., Russian-Chinese Dialogue: The 2015 Model, RIAC Report 18/2015, p.9. Some even advocate cooperation between both military industrial complexes the future locomotive of economic cooperation (not least because both are equally affected by Western sanctions and since “Chinese defense industry companies can serve as a bridge to reach out to China’s high-tech civilian enterprises”), see Vasily Kashin, Industrial Cooperation: Path to Confluence of Russian and Chinese Economies, Moscow (Valdai Papers, No. 44), March 2016, p.10.

[26] Even at the last Petersburg Economic Forum in 2015, hampered by Western neglect, Chinese attendees were seriously underrepresented. A Chinese participant complained: “I am not so sure that your businesspeople are ready to make use of the advantages the Chinese market offers. Just take a look around. How many Chinese are there here in the audience? I feel quite alone here on the stage. How many Russians are there in China? I don’t even know. Talking to my Russian friends about all of this over the last couple of days, I came to the conclusion that people here still see Asia as a place they would like to get hold of, but they are not ready to go and commit themselves economically there.” Plenary session of the 19th St Petersburg International Economic Forum, 19 June 2015, in: http://en.kremlin.ru/events/president/news/49733.

[27] Sergey Lavrov’s article “Russia’s Foreign Policy: Historical Background” for “Russia in Global Affairs” magazine, 3 March 2016 (408-03-03-2016), in: www.mid.ru/en/foreign_policy/news/-/asset_publisher/cKNonkJE02Bw/content/ id/2124391.

[28] Titarenko et al., p. 8.

[29] Ibid., p. 10.

[30] “Toward the Great Ocean, or the New Globalization of Russia”, Valdai Discussion Club, Analytical Report, Moscow, July, 2012, p. 64.

[31] Luzyanin/Huasheng et al, op. cit., p. 26. Others point to the urgent need to expand the transport capacity, see Titarenko et al., op. cit., p. 19.

[32] With reservations as China – contrary to the EU from which Russia used to import most of its machinery – has not really shown a propensity to share its technology with others, nor does it dispose of the appropriate technological potential or appears willing to seriously invest into the Russian economy. See on this, e.g.,“Russia and China: Towards a Bright Future?” 9 June 2015, in: http://russiancouncil.ru/en/inner/?id_4=6095&active_id_11=37#top-content.

[33] Ksenia Zubacheva, Pivotal questions about Russia’s China pivot, 3 June 2015, in: www.russia-direct.org/debates/pivotal-questions-about-russias-china-pivot

[34] Luzyanin/Huasheng, et al., op. cit., pp. 15, 21.

[35] Ibid., pp. 24, in careful diplomatic wording: “In the framework of this trust-based partnership, Russia and China should approach certain sensitive topics in their domestic and foreign policies with patience and understanding. Those topics are Taiwan, the South China Sea, the East China Sea, and Tibet for China, and they are Ukraine and the Crimea, the spread of Orthodoxy in China, and other topics for Russia.” (p. 25)

[36] See the proposals in greater detail at “Vision and Actions on Jointly Building Silk Road Economic Belt and 21stCentury Maritime Silk Road”. Issued by the National Development and Reform Commission. Ministry of Foreign Affairs and Ministry of Commerce of the People’s Republic of China. March 2015, in: http://en.ndrc.gov.cn/newsrelease/201503/ t20150330_669367.html.

[37] Vision and Actions on Jointly Building Silk Road Economic Belt and 21st-Century Maritime Silk Road”. Issued by the National Development and Reform Commission, Ministry of Foreign Affairs and Ministry of Commerce of the People’s Republic of China, March 2015, in: http://en.ndrc.gov.cn/newsrelease/201503/t20150330_669367.html.

[38] Vision and Actions…, op. cit.

[39] David Arase, China’s Two Silk Roads: Implications for Southeast Asia (Amended Version), ISEAS Perspective, No. 2, 2015, Singapore, 22 January 2015, in: www.iseas.edu.sg/images/pdf/ISEAS_Perspective_2015_2.pdf. Not to forget the Chinese sponsored “Asian Infrastructure Investment Bank” (AIIB) endowed with a capital of $100 billion.

[40] See on this Margot Schüller, Tam Nguyen, Vision einer maritimen Seidenstraße: China und Südostasien, GIGA-Focus No. 7, 2015.

[41] In this respect it has been argued that OBOR reflected the Chinese drive to “gain more control over regional agreements and institutions and progressively position itself vis-à-vis the US, as well as Japan, as the uncontested regional leader” (Alice Ekman, China: setting the agenda(s)? European Union Institute for Security Studies, Brief 4, March 2015).

[42] Vision and Actions…., op cit.

[43] Alexander Cooley,“Tending the Eurasian Garden: Russia, China and the Dynamics of Regional Integration and Order”, Paper prepared for ICCEES, Makuhari, Revised Draft, 1 July 2015. He also made the puzzling observation that as a result of this frustration,“Beijing has adopted the curious position of going ahead with a range of bilateral economic initiatives, but referring to them post hoc as SCO projects”.

[44] This, for instance, concerns Chinese proposals for the anti-crisis fund, or, a little later, the SCO Development Bank, which Beijing proposed in 2012, expecting them to provide loans for specific projects (in the tune of $10 billion). The bank’s authorized capital was intended to be based on proportional contributions by each participating state, depending on the size of its respective GDP, which would also determine voting rights. Russia turned a blind eye to the proposal and instead suggested to expand its Eurasian Development Bank, established in 2006 and largely controlled by Moscow and Astana. Other financial instruments of which both China and Russia are members – on a more equitable basis – include the BRICS “New Development Bank”, expected to allocate an equal share of the $50 billion startup capital that will be expanded to $100 billion (the bank’s board had its inaugural meeting on 7 July 2015, and the BRICS “Contingency Reserve Arrangement” with commitments of $100 billion of which China provides the lion’s share of $41 billion. These two not only mirror the Western-dominated IFIs, but would also perform the task originally set for the SCO Development Bank. See Alexander Gabuev, Taming the Dragon: How Can Russia Benefit From China’s Financial Ambitions in the SCO? 19 March 2015, in: http://carnegie.ru/2015/03/19/taming-dragon-how-can-russia-benefit-from-china-s-financialambitions-in-sco/i4sd.

[45] www.deutschebahn.com/de/konzern/im_blickpunkt/2504358/db_schenker_chinazug_20120511.html.

[46] Zhang Xiaotong, Marlen Belgibayev, China’s Eurasian Pivot, The Asan Forum, January-February 2016, Vol. 4, No. 1, in:/ www.theasanforum.org/chinas-eurasian-pivot.

[47] Güterzug von China in den Iran Die neue Seidenstraße lebt, 16 February 2016, in: www.faz.net/aktuell/wirtschaft/ttip-und-freihandel/gueterzug-von-china-in-den-iran-die-neue-seidenstrasse-lebt-14073293.html.

[48] DHL lays tracks for new Silk Road with China-Turkey rail corridor, in: www.dpdhl.com/en/media_relations/press_releases/2015/dhl_lays_tracks_silk_road_china-turkey_rail_corridor.html.

[49] Erste Containerzugverbindung von China zum Seehafen Baku transformiert den Handel zwischen Europa und Asien, 4 August 2015, in: www.presseportal.de/pm/117845/3088555.

[50] John C. K. Daly, Bypassing Russia, Ukraine Becomes Another “Silk Road” Terminus, Eurasia Daily Monitor, Vol. 13, No. 18, 27 January 2016, in: www.jamestown.org/single/tx_ttnews[tt_news]=45028&tx_ttnews[backPid]=7#.Vt6t1uYSySB.

[51] Vision and Actions…., op cit.

[52] Alice Ekman, China’s multilateralism: higher ambitions, European Union Institute for Security Studies, Alert No. 2, 2016.

[53] Alexander Gabuev, Eurasian Silk Road Union: Towards a Russia-China Consensus? 5 June 2015, in: http://carnegie.ru/2015/06/05/eurasian-silk-road-union-towards-russia-china-consensus/i9kt.

[54] As a first step, on 8 May the Eurasian Economic Commission was mandated by Russia, Kazakhstan, Belarus and Armenia to start negotiations on a trade and investment agreement with China.

[55] David Arase, China’s Two Silk Roads: Implications for Southeast Asia (Amended Version), ISEAS Perspective, No. 2, 2015, Singapore, 22 January 2015, in: www.iseas.edu.sg/images/pdf/ISEAS_Perspective_2015_2.pdf.

[56] See on this Nadine Godehardt, Chinas Vision einer globalen Seidenstraße, in: Volker Perthes (ed.), Ausblick 2016: Begriffe und Realitäten internationaler Politik, SWP-Ausblick, Berlin, Januar 2016.

[57] Timofei Bordachev, Not-So-United Europe and Greater Eurasia, in: http://valdaiclub.com/news/not-so-united-europe-and-greater-eurasia.

[58] Ivan Zuenko, Connecting the Eurasian Economic Union and the Silk Road Economic Belt: Current Problems and Challenges for Russia, 30 October 2015 China in Central Asia (Blog), in: http://chinaincentralasia. com/2015/10/30/connecting-the-eurasian-economic-union-and-the-silk-road-economic-belt-current-problemsand-challenges-for-russia.

[59] Quoted in Simon Denyer, In Central Asia, Chinese inroads in Russia’s back yard, Washington Post, 27 December 2015, in: www.washingtonpost.com/world/asia_pacific/chinas-advance-into-central-asia-ruffles-russian-feathers/2015/12/27/ cfedeb22-61ff-11e5-8475-781cc9851652_story.html.

[60] Ibid.; Tian Shaohui, Chronology of China’s Belt and Road Initiative28 March 2015, in: In addition Kazakhstan obviously considers OBOR to jump start its own “Nurly Zhol” development program which President Nazarbayev expects to become a driver of growth during the coming years: “200,000 new jobs will be created by the construction of roads alone, creating a multiplier effect in other economic sectors: production of cement, metal, machinery, bitumen, equipment, and related services” (Nursultan A. Nazarbayev, Nurly Zhol, Bright Path to the Future, https://www.thebusinessyear.com/ kazakhstan-2015/nurly-zhol-bright-path-to-the-future/inside-perspective).

[61] That is what Alexander Gabuev expects (Russia-China Talks: Silk Road Leads to Eurasia, 15 May 2015, in: http://carnegie.ru/2015/05/15/russia-china-talks-silk-road-leads-to-eurasia/i8vo).

[62] “Toward the Great Ocean-3. Creating Central Eurasia: The Silk Road Economic Belt and the priorities of the Eurasian states’ joint development”, Valdai Discussion Club Analytical Report, Moscow, June 2015, pp.8, 15.

[63] Alexander Cooley,“Tending the Eurasian Garden: Russia, China and the Dynamics of Regional Integration and Order”, Paper prepared for ICCEES, Makuhari, Revised Draft, 1 July 2015.

[64] Dmitri Trenin, From Greater Europe to Greater Asia? The Sino-Russian Entente, 9 April 2015, in: http://carnegie. ru/2015/04/09/from-greater-europe-to-greater-asia-sino-russian-entente/i64a#.

[65] Robert Kagan, Forget the Islamic threat, the coming battle will be between autocratic nations like Russia and China and the rest, in: timesonline.co.uk, 2. September 2007. See also his book: Robert Kagan, The Return of History and the End of Dreams, New York (Knopf) 2008.Around the same time as Kagan, Sergei Karaganov observed “an unfolding struggle between two models of development – the liberal-democratic capitalism of the traditional West and authoritarian capitalism” which he attributed to Russia and China (Sergei Karaganov, Nastupaet novaya epocha, in: Rossiyskaya Gazeta 6 July 2007).

[66] Lukin, Russia, China…, op. cit.

[67] See on this Fu Ying, How China Sees Russia. Beijing and Moscow Are Close, but Not Allies, in: Foreign Affairs, Vol. 95, No.1, 2016, p. 103. One need not go as far as Wang Jisi who considers it “virtually impossible to distinguish China’s friends from its foes” (Wang Jisi, China’s Search for a Grand Strategy. A Rising Great Power Finds Its Way, Foreign Affairs, March/April 2011 Issue, in: https://www.foreignaffairs.com/articles/china/2011-02-20/chinassearch-grand-strategy).