“Today, as in the past, when economic and financial problems worsen, they upset the social balance, undermine democracy, weaken trust in institutions, and can degenerate into war, civil or foreign…”

Dominique Strauss-Kahn, IMF Managing Director, December 8, 2010

In the 1990s the International Monetary Fund, acting on a tip from the United States, strongly recommended that countries with economies in transition should peg their exchange rates to strong and stable world currencies – in fact, the U.S. dollar. Fixed exchange rates minimized the currency risks of foreign investors and thus promoted the influx of foreign capital, especially into the countries of Southeast Asia.

In the middle of the decade, though, the U.S. raised rates to fight inflation. In order to keep the fixed rates, the developing countries were forced to do so, too. Their currencies grew more expensive, which slowed down exports and increased foreign debts. In 1997, against the backdrop of the collapse of the Thai baht, the Indonesian rupiah, the Philippine peso and the Malaysian ringgit Southeast Asia was left at the mercy of the strongest financial crisis.

Those damages were actually the price the countries in the region had to pay for the one-sided adjustment to Washington’s monetary policy. Now, fifteen years later, the threat of unilateral adjustment is looming over the United States. The huge imbalance in external current accounts, especially those with China, makes the Americans dependent on the renminbi. For the first time in modern history the world’s dominant currency issuer is fighting for an independent economic policy. Until just recently this right belonged to it unconditionally and completely.

THE FRONTLINE

When the acute phase of the crisis was over, the question that took center stage was who will pay for the restoration of economic growth. The means of payment had been determined well in advance – unemployment and falling living standards.

According to official figures, the U.S. recession ended in the middle of 2009. In the fourth quarter of 2009 and in the first quarter of 2010, the GDP was growing at a rate of 4-5 percent per annum. But in the second and third quarters, when the fiscal incentives were canceled, the rate fell to annualized 2 percent. And this is clearly insufficient for easing unemployment, which during the crisis more than doubled – from 5 to 10 percent of the workforce. Of the 8.4 million jobs lost by the end of 2009, over the next three quarters only 900 thousand were restored.

In early November, the Federal Reserve announced the second stage of quantitative easing: by the end of the second quarter of 2011 treasury bonds totaling 600 billion dollars are to be bought up. Federal Reserve Chairman Ben Bernanke, speaking in Frankfurt-am-Main on November 19, explained the decision in these words: “On its current economic trajectory the United States runs the risk of seeing millions of workers unemployed or underemployed for many years. As a society, we should find that outcome unacceptable.”

According to the position of the Federal Reserve, support for economic growth in the U.S. contributes to the overall global economic growth, and increases the stability of the dollar, which plays a key role in the international monetary and financial system.

The Fed does not mention, however, that the continued inflation of dollar liquidity facilitates depreciation of the dollar in the long term, and that additional emission always leads to inflation, and only a country with the dominant currency in the world can afford what French economist Jacques Rueff once cutely described as “deficit without tears.” The Fed routinely relies on the expectation a new portion of excessive dollar supply would spread evenly all over the world, and therefore it will not cause a hike in prices in the United States. That is, in its monetary policies Washington continues to act as the strongest player: it protects the national interests and does not worry too much about the interests of its partners.

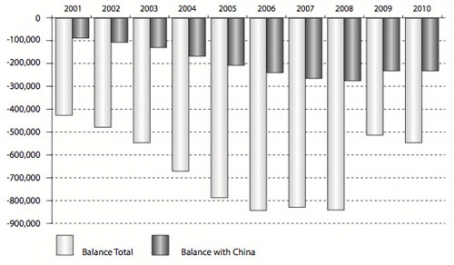

But there is an area where this independence is already upset. It is the chronic imbalance of the U.S. current account transactions, including a significant excess of imports over exports (Fig. 1). In 2008 the trade deficit exceeded 800 billion dollars, showing a 100-percent increase since 2001. Over the same period, the deficit in trade with China grew by 3.2 times, and the share of China in this indicator rose from 20 to 32 percent. Back in 2004-2005, the United States began to feel serious concerns over the problem of the undervalued renminbi, and it started to demand Beijing should revalue it. The American position gained support of G7 finance ministers. As a result of this campaign the People’s Bank of China (PBC) officially shifted from a fixed exchange rate of the renminbi to its managed float.

In July 2005, the exchange rate, which had been at around 8.28 renminbi to one dollar for many years, rose to 8.11. Over the next three years it grew gradually, and in September 2008 it reached 6.82 renminbi per dollar. In all, during this period the renminbi rose by 20percent. Next, there erupted the global crisis. Investors began to flee from the currencies of developing countries for dollars, considered as the most reliable investment. Although the U.S. was in the midst of the crisis, the dollar experienced an upward, rather than a downward, pressure from the markets – solely by virtue of its status of the world’s dominant currency. Accordingly, the renminbi’s strengthening against the dollar stopped, but, unlike many other currencies of the developing countries, the renminbi did not depreciate. For about six months the rate stayed unchanged, and in the summer of 2010 there happened another, very cautious increase.

In 2009, the United States significantly reduced imports – from 2.1 to 1.6 trillion dollars, which allowed for a 40-percent reduction in the trade deficit – from 840 billion dollars to 500 billion dollars. In trade with China, the success was minimal, and as a result it accounted for slightly less than half of the U.S. foreign trade balance. The statistics for January-October 2010 look a little better, but they do not change the overall picture. The U.S. authorities could now see for themselves that they can reduce the deficit on external accounts, but not with China. WTO rules do not allow a rise in duties on Chinese goods or restrictions on their import. There remains only one solution – to force Beijing to revalue the renminbi. To do this, Washington needs broad international support, especially from the IMF and the G20.

Fig. 1. U.S. commodity trade balance in 2001-2010, bln dollars

Note: 2010 – statistics for January-October

Source: U.S. Census Bureau, Foreign Trade Division

At the latest summit of the G20 on November 11-12, 2010 in Seoul, paramount importance was attached to exchange rate issues. On top of the joint action plan there were measures called “to ensure ongoing recovery and sustainable growth and enhance the stability of financial markets, in particular moving toward more market-determined exchange rate systems, enhancing exchange rate flexibility.” The summit participants expressed the desire to refrain from “competitive devaluation of currencies.” The advanced economies, including those with reserve currencies, were advised to be “vigilant against excess volatility and disorderly movements in exchange rates.”

The summit highlighted two points of view on what is happening in the world monetary system – of the developed and developing countries. The former (mainly, the United States) were angry with the undervalued renminbi and with the devaluation of some other currencies of rapidly growing economies. The latter were concerned by the strong fluctuations of the dollar and the euro, as well as Washington’s monetary policies – “irresponsible” in their view. And both found currency exchange rates worrisome for a common reason – these rates became the stumbling block in search for a global strategy to resume economic growth. In other words, there is a question which countries at the exit from the crisis will be guided solely by their national interests, and which will have to adjust themselves to the policies of stronger players. What really counts is not exchange rates as such, but who will be able to dictate its will to the partners and make them pay for the recovery of the global economy.

Beijing, as every one could expect, totally rejects U.S. charges of an undervalued renminbi. According to an official statement of June 19, 2010, the People’s Bank of China shifted to a more flexible exchange rate regime. Also, it began a campaign for making Chinese enterprises and banks better ready for more frequent and significant fluctuations in the renminbi rate. Exporters were advised to switch from labor- and resource-intensive industries to producing technologically sophisticated products, and also to investing into the services segment, which is believed to increase the capacity of the domestic market, ease dependence on the external markets and create many jobs.

Deputy governor of the People’s Bank of China, Hu Xiaolian, in a statement issued on July 30, 2010, declared that the main objectives of the country’s economic policies were economic growth, full employment, price stability and the PBC’s balance of payments. Hu said, “the reform of exchange rate regime has demonstrated to the international community China’s commitment to promote global economic balance, providing a more facilitating international environment.” Moreover, “a floating renminbi exchange rate shows that China is dedicated to promoting global economic balance and that China is a responsible member in the international community.” Such phrases as “currency war” are absent from official PBC documents for obvious reasons.

Xiao Gang, Chairman of the Board of Directors of the Bank of China Limited, one of the largest commercial (until recently state-owned) banks in the country, speaks his mind far more freely and expressively. His two-page article “No Winner in a Currency War”, published on November 12, 2010, produces the impression of a foreign policy ultimatum. Its first paragraph is as snappy as a gunshot: “Shifting public debt to other countries, blocking Chinese investments and limiting exports will affect global recovery.”

The Federal Reserve System of the United States is expressly called “the biggest force undermining the dollar,” and “a second round of quantitative easing or QE2” is slammed as “dangerous.” “With the dollar’s interest rates at nearly zero, the country is printing more money and pumping it into the U.S. markets, from where it flows to the rest of the world. As a result, the dollar has tumbled; inflation expectations have increased; asset and commodities prices have hit new peaks. Even worse, the dollar’s depreciation has negatively affected other economies and currencies, forcing them to act, either by imposing capital controls or intervening in their exchange rates.” According to Xiao, the United States pursues a “beggar-my-neighbor policy,” trying to internationalize the national debt, formed as a result of the nationalization of private debts in times of crisis.

Especially significant is the following phrase (ostensibly casual, although there is not a single random word in this manifesto): “Shifting the accumulated debt burden across the world by softening the dollar will force other countries to take action to protect their currencies, and will ultimately isolate the dollar and its users. Therefore, the U.S. needs to refrain from the QE2 policy” [italics is mine – O.B.]. In fact, Xiao told Washington – on Beijing’s behalf – that the era of the dollar is not infinite, and that its future depends on the goodwill of millions of ordinary market players who will not succumb to anyone’s attempts to make them use a particular currency for their transactions. What will happen to the dollar, if China begins to diversify its official reserves, which are reaching 2.6 trillion dollars, is anyone’s guess.

BEHIND THE GREAT WALL OF CHINA

China’s officially announced exchange rate regime is a managed floating arrangement, but the IMF identifies it as a stabilized arrangement – proceeding from the actual flexibility of the exchange rate. The question arises: Why doesn’t China shift to free float, that is, a rate that would be entirely determined by supply and demand on the foreign exchange market? An answer may look as follows.

In the financial sector any country is faced with the “magic triad” (“impossible trinity”): a fixed exchange rate, the autonomy of monetary policies, and the liberal movement of capital. Of the three conditions one is allowed to choose only two, while a third must be sacrificed. Whenever a central bank raises or lowers the rate of refinancing (or the discount rate), this leads to a corresponding increase or decrease in all other interest rates in the economy and, at the same time – in the yields of securities with a floating interest rate. For foreign investors it becomes more or less profitable than before to invest in the local currency. With the growth of the interest rate their demand for currency climbs, and with its fall it drops. An inflow or flight of capital pushes the local currency up or down. When the movement of capital is free, interest policies have a direct effect on the exchange rate.

In practice, this results in three possible schemes. The first option is a fixed rate plus an independent monetary policy and minus the free movement of capital. This is precisely the scheme China employs today. The second option suggests a fixed rate plus the free movement of capital and minus an independent monetary policy. This combination is most vulnerable, because the monetary authorities lack the opportunity to conduct anti-cyclical management of the economy. In times of crisis, they must maintain the exchange rate at all costs, sacrificing the interests of the real sector. This is what happened in 2008-2009 to the Baltic countries, whose national currencies were pegged to the euro within the Exchange Rate Mechanism-II (ERM-II). It was not accidental that Estonia on January 1, 2011 hastened to accept the euro to finally free the national economy from currency pressures. Thirdly, there is a floating rate plus an independent monetary policy and the free movement of capital. It is followed by all industrialized countries and, of course, the issuers of reserve currencies.

Exchange rate arrangements are many (currency board, fixed rate, managed float and free float), but the main battle is revolving around the choice between the fixed rate and the floating rate. American economist Milton Friedman was one of the first to describe their influence on macroeconomic policies. In the early 1950s, he pointed to the inconsistency of the Bretton Woods system of fixed exchange rates. Friedman’s calculations meant the free movement of capital, but up to the beginning of the 1990s almost all countries had maintained restrictions on capital movements, and the technical capabilities of cross-border payment systems remained very modest. The growth of information technologies, the transition of the socialist and developing countries to open market economies, as well as the widespread abolition of foreign exchange and capital controls have radically changed the situation on financial markets.

The first alarm bell was rung in 1992-1993, when the pound sterling, the Italian lira, the Swedish krone and several other European currencies were devalued under the impact of speculators. The trading band within which they were pegged to the ECU (officially it was called joint float), proved an unreliable shelter in the context of developed and brisk financial markets. The economists came up with a forecast to the effect partial solutions in the exchange rate policies were coming to an end. This merely strengthened the resolve of the EU countries to move towards a single currency, shortly before that declared in the Treaty of Maastricht. After the crises in Southeast Asia and Russia in 1997-1998, the question whether there should be a fixed or a floating rate finally made its way from economic theory manuals to the trading floors and government offices.

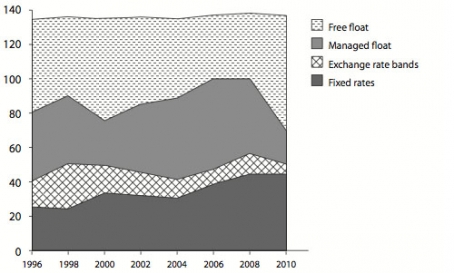

From that moment on, the middle of the global structure of foreign exchange regimes began eroding. Fig. 2 shows changes in the number of countries practicing different exchange rate regimes. For correct comparison the statistics were cleared of 34 countries with a population of under one million (29 of which have fixed rates), and 14 states of the West African Economic and Monetary Union and Central African Economic and Monetary Community (WAEMU and CAEMC). According to the IMF, of the remaining nearly 140 countries in 1996, 26 had a de facto fixed exchange rate, and in 2010, as many as 45. The number of countries with a free float rate increased during the specified period from 53 to 66. One should remember, though, that in 2009 the IMF changed the methodology of classifying exchange rate regimes, which added points for this category. The number of states that have mixed regimes (exchange rate bands and managed float) has decreased by half or even more – from 55 to 25.

Fig. 2. Exchange rate regimes of IMF countries with populations over 1 mln in 1996–2010

Note. The IMF publishes statistics about de facto rather than de jure exchange rate arrangements. The group of countries with fixed rates includes countries with currency board arrangements and no separate legal tender. Fourteen WAEMU and CAEMC states were excluded from statistics.

Source: IMF Annual Report for respective years

It is evident that today’s global practices do not give a clear answer in favor of free float. True, it is used in all industrialized countries and in many countries with emerging markets, including Mexico, Argentina, Colombia, Chile, Indonesia, the Philippines, Thailand, Turkey, Hungary and Poland. Nevertheless, the number of countries that consider it necessary to protect their businesses and their people from currency fluctuations has been rising steadily. Alongside China, this group in 2010 included, for example, Hong Kong, Bangladesh, Iraq, Sri Lanka, Vietnam, Saudi Arabia, the UAE, Oman, Qatar, Bahrain, Jordan, Kuwait, Libya, Morocco, Namibia, Syria, Tunisia, Bolivia, Venezuela, Denmark, Bulgaria, Latvia, Lithuania and Estonia. The list includes not only such a major financial center as Hong Kong but also rich oil exporters, as well as members of the European Union.

Although international institutions generally tend to promote a liberal regime for the movement of capital, its costs are acknowledged. The latest Global Financial Stability Report, published by the IMF in April 2010, states that the inflow of capital into a country expands the base for financing the economy, particularly so in countries with inadequate savings, and contributes to the development of financial markets. If the real sector is unable to accommodate significant amounts of incoming investments, this leads to inadequate expansion of domestic demand, an overheating of the economy, inflation and a soaring exchange rate of the national currency. A mass capital inflow “may also lead to asset price bubbles and increase systemic risk in the financial sector, even sometimes in the case of a generally effective prudential supervisory and regulatory system.” Furthermore, the IMF experts honestly admit the longer controls over capital movements operate, the greater their effectiveness is. In other words, having removed restrictions once, one cannot reintroduce them with the same net effect.

This means that a fixed exchange rate of the renminbi, coupled with restrictions on the movement of capital, is crucial to China in order to ensure the manageability of the national economy. One can easily imagine how important it is for a country with a huge population, low living standards and an unemployment rate not amenable to counting (according to various estimates, it ranges from 30 million to 150 million). Should it change the paradigm, Beijing will improve conditions for the United States to exit from the crisis, but will leave its own economy with no brakes at all. Maybe, in several years’ time the circumstances will change, and the country will effect the full liberalization of the currency sphere. But now the price of such a transition would be unreasonably high.

PEACE NEGOTIATIONS

Everybody agrees the international financial architecture needs radical restructuring. Experts are even mulling the possibility of a third Bretton Woods. It is implied that the system that has been in action since 1971 will be replaced with something radically different. The guidelines for the reform are well known: changing the rules of the IMF and its policy of regulating current balances, improving oversight of financial markets and of the use of new tools, taking into account the increased role of the developing countries in world finance, and linking actions by the IMF and WTO in order to prevent any growth of protectionism.

The movement towards this new system will take several years, possibly a decade or more. In the meantime, the issue of competitive devaluations is to be addressed now. What tools are available for this?

One must say that the question of “the right and proper” exchange rate is one of the most enigmatic in the modern economy. It is argued that as long as coins made of precious metals were in circulation, their exchange was not an issue at all. This is not true. The first coins appeared in the 6th century BC, and as early as the 3rd-2nd centuries BC the internal circulation of money in Rome was separated from the external one. Within the state there was the denarii, and also heavy bronze cast coins – aes grave. To meet the needs of foreign trade, coins of silver and light copper were minted, having no official status within the metropolis. In the second half of the 19th century, most countries switched from the silver standard to the gold one. International trade relied exclusively on gold, and later – on bills denominated in pounds sterling. Whatever the case, up to the collapse of the Bretton Woods system the exchange rates were based on the gold content of currencies.

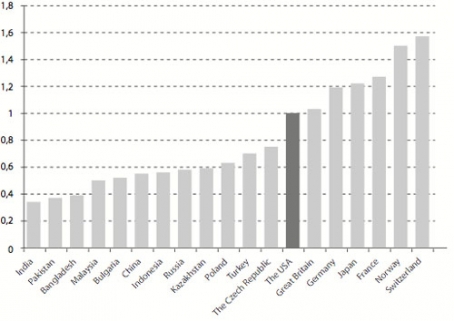

When in 1971 this standard was gone, the concept of purchasing power parity (PPP), developed far back in the 1920s by Swedish economist Gustav Kassel, was brought to the forefront. According to it, the exchange rate equalizes the amount of goods and services that are available for this currency in the issuer country and in another country after conversion. However, in practice the PPP is almost never enforced. It is common knowledge that in India one dollar can buy far more goods than in Switzerland. Domestic prices are highly dependent on the prices of local raw materials, fuel and labor. And for the simple reason less than one-third of all of the world’s goods and services get into international trade, the exchange rate cannot and should not reflect the overall ratio of prices between countries. As a rule, the exchange rates of developing countries deviate from the PPP downwards, and those of the developed ones – upwards (Fig. 3).

According to the IMF, in 2009 the current exchange rate of the renminbi stood at 55 percent of the PPP, which was on a par with that of other developing countries in Asia. In Russia, the rate is 58 percent of the PPP, and in Poland – 63 percent of the PPP. These figures do not allow one to say that the renminbi is now undervalued. Accordingly, one cannot regard as overvalued the Norwegian krone and the Swiss franc, although they are 50 percent above the PPP. It is appropriate to recall the devaluation of the ruble in August 1998. The crisis hit at a time when the rate had been up to 70 percent of the PPP. According to many analysts, for Russia – a country with an economy in transition – this level was too high and in glaring discrepancy with the market realities. That the exchange rate of the ruble is now at a lower point in relation to the PPP merely strengthens the empirical support for this statement.

Fig. 3. The ratio of the nominal exchange rate of national currencies to the purchasing power parity in 2009

Source: World Economic Outlook Database, IMF

Alongside the PPP, there are several other models of the exchange rate equilibrium. Their function is to help calculate at what exchange rate the economy will be in a state of internal and external equilibrium – zero or minimal current account deficit, low inflation, minimal unemployment and sustainable growth. Although these models enable one to find out what level of the exchange rate best meets the objectives of the country’s economic development, they are no good for international comparisons. Still less they are suitable for measuring the “fairness” of exchange relations.

It is hard to imagine how the international community might go about the business of settling a currency conflict between the U.S. and China, should it develop into the acute phase. The value of the required rate is unknown, and the leverage to influence the participants in the duel is extremely limited. True, the G20 recommended all countries with current accounts surpluses to encourage domestic demand, and all countries with deficits, to increase savings and boost exports. No one will be eager to go first, of course. Most probably, both sides will make some small shifts, not detrimental to their current interests. China, for example, has repeatedly raised the discount rate and the rate of minimum reserves.

Decisions by the G20 are not binding, and translating them into life depends on the participants’ commitment to shared goals. The IMF does have means of coercion, but only when a particular country turns to it for a loan. Initially the Fund was created to help the developing and poor countries in case their balance of foreign payments deficit leads to a sharp devaluation of the national currency. The IMF’s mechanisms are not tooled to making a country with the leading world currency restore the balance of foreign payments or terminate its credit expansion. Likewise, the Fund has no authority to act in case of an undervalued currency at a time when there is a large trade surplus. To put it in a nutshell, the conflict between the United States and China goes beyond the mandate of the IMF. The WTO has still less intention to meddle, and it will certainly not intervene, although some are inclined to interpret the competitive devaluations as unjustified advantages for national exporters.

Another widely discussed way out is a return (partial or full) to the gold standard. With the onset of the crisis the issue gained worldwide popularity, and many in Russia began to recall with nostalgia the gold chervonets of the New Economic Policy period (1921-1928). On November 8, 2010, newswires in many countries reported that World Bank President Robert Zoellick had suggested tying the currencies of the world’s leading economies to gold. A professional economist could have never uttered anything like that, of course. Literally, Zoellick said the following:

“The G20 should complement this growth recovery program with a plan to build a co-operative monetary system that reflects emerging economic conditions. This new system is likely to need to involve the dollar, the euro, the yen, the pound and the renminbi. […] It should also consider employing gold as an international reference point of market expectations about inflation, deflation, and future currency values.”

In fact, a return to gold will be impossible, because in this way there stand some insurmountable obstacles.

First, there is not enough gold to meet the growing needs of the global economy. If the exchange rate is rigidly pegged to gold, the issue of each new bill should be accompanied by a new portion of the metal deposited in the state vault. From 2004 to March 2010 the amount of gold in the reserves of the IMF countries declined from 898 million ounces to 871 million ounces (approximately from 28,000 tons to 27,000 tons). The annual world production of gold has been kept in recent years at 2,500 tons, and it is not growing, although prices are. Almost half of the mentioned amount is produced by five countries: China, Australia, South Africa, the U.S. and Russia (the author expresses special thanks to the user of old-pferd.livejournal.com for discussion and for advice on gold production issues).

The ratio of production to reserves stands at 9 percent, while the annual growth in money supply is no less than 6-8 percent (based on a 4-5 percent increase in the GDP, and a 2-3 percent inflation). In other words, should it peg all the existing currencies to gold today, the world will soon face a shortage of it for a normal cash flow. This will be so even if all produced gold goes to the vaults of central banks.

Another reason is rooted in the above-shown relationship of the monetary and exchange rate policies. At a rate tied to gold countries will manage to maintain the free movement of capital – but only if they give up independent monetary policies. In other words, a return to the gold standard would mean that all countries must shift to the currency board regime, which would strip central banks of a chance to effectively carry out counter-cyclical policies. What the gold standard will do to interbank rates is hard to imagine. It is not excluded that the money markets may quietly wither away.

The third reason is this: gold is not just a financial item, but also an ordinary good, a commodity. It is in great demand from the jewelry industry, as well as from electrical engineering, electronics, aerospace and advanced instrument making. That is, in case of a hypothetical peg of money to gold the purposes of monetary policies would be in conflict with the development of high technologies, which would be very undesirable indeed.

The general conclusions that the international community, including Russia, should make are the following:

- Transformation of the world monetary system towards multipolarity, which began with the introduction in 1999 of the European single currency, is slowly gaining momentum. Participation in the currency conflict of the world’s first and third largest country (in terms of the GDP) adds geopolitical significance to the ongoing developments.

- The conflict has once again highlighted the problems facing the industrialized countries in view of increasing globalization. Over the past decade they supported economic growth and living standards largely by increasing the public debt. Now this source is close to exhaustion, and the contradiction between the economic centers with different labor costs and the different systems of social security is acquiring new forms.

- Russia should be as cautious as possible about any further liberalization of its foreign exchange regime and the regime of the movement of capital. It is not excluded that in the near future individual countries will begin to strengthen control over this sphere, particularly if the quantitative easing policy in the U.S. aggravates the volatility of major currencies and the mobility of speculative capital.

- The tools available to the world community to try to resolve the currency dispute between the United States and China are very limited. Under a favorable scenario the conflict will remain latent. And under the worst it will result in the overall growth of protectionism. Much will depend on how well Western countries can reduce the level of public debt. At the second turn of the debt crisis it will go geopolitical.